Welcome to CENFACS’ Online Diary!

24 April 2024

Post No. 349

The Week’s Contents

• FACS Issue No. 83 of Spring 2024 Titled as Charity Trade, Investment and Poverty Reduction in Africa

• Burundi’s Flood Victims Ask for Your Aid

• Financial Resilience Programme for Households – In Focus for Wednesday 24/04/2024: Households’ Liquid Assets

…And much more!

Key Messages

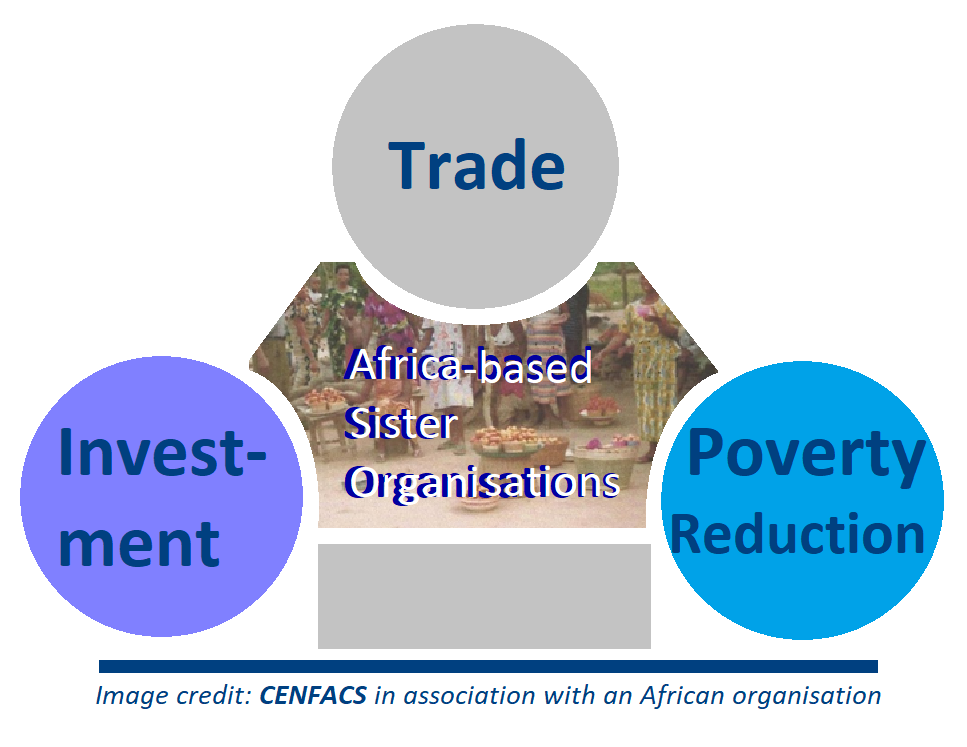

• FACS Issue No. 83 of Spring 2024 Titled as Charity Trade, Investment and Poverty Reduction in Africa

The 83rd Issue of FACS is about trade and investment run by Africa-based Sister Charitable Organisations to help reduce poverty and hardships amongst those in need. It also includes trading activities carried out by the members or beneficiaries of these organisations, who are engaged in trade to reduce poverty or simply to make ends meet. Amongst these people are those poor who cross borders on a daily basis to sell goods and services to make ends meet. The 83rd Issue of FACS focus on these organisations and individuals selling goods and services for the purpose of coming out poverty.

The 83rd Issue of FACS inspects contemporary theories of trade and the space they provide to explain trade in the charitable and voluntary sector, particularly in Africa. Far from being a simple theoretical account of these theories or models, the 83rd Issue of FACS aims at providing the justifications or cases for trade within the charitable and voluntary worlds. One of these justifications comes from International Trade Council (1) which argues that

“Economic growth spurred by international trade can directly contribute to poverty reduction. As countries export goods and services, they not only generate income but also create employment opportunities, which can uplift people out of poverty”.

The 83rd Issue of FACS deals with intra-regional trade carried out by Africa’s charities and how this trade is helping to reduce poverty. As a treaty of intra-regional trade, the 83rd Issue of FACS envisages cases of trade within the region of Africa and the space given by African Continental Free Trade Area with all the advantages and disadvantages that area contains. In doing so, the 83rd Issue of FACS does not undermine the value of trade conducted beyond Africa’s borders.

The 83rd Issue of FACS is a story of trade creation, rather than trade diversion, in order to reduce poverty and enhance sustainable development. From this perspective, the 83rd Issue of FACS is an illustration of how Africa-based Trade Charitable Organisations are trying to capture the window of opportunities provided by a free trade regime to reduce poverty in various sectors of human empowerment.

In practical terms, the 83rd Issue of FACS is a handy piece of work explaining how poor and vulnerable beneficiaries are trying to create usable means to live off and push poverty away. To push poverty away via trade, these beneficiaries need trade skills. So, investing in these beneficiaries to acquire or improve these skills has been dealt within the 83rd Issue of FACS, just as the transmission and sharing of trade skills.

Key summaries and highlights of the 83rd Issue of FACS are given under the Main Development section of this post.

• Burundi’s Flood Victims Ask for Your Aid

This is an appeal to light a blaze of hope for those who have been affected by El Niño in Burundi. Indeed, El Niño has severely impacted the Lake Tanganyika with landslides, heavy rains, and violent winds, according to the information received from Burundian local sources.

In addition to this information, ‘reliefweb.int’ (2) explains that

“Since 13 March 2024, the water level of Lake Tanganyika has risen by 776.76 meters, exceeding the normal level by 1.76 meters, making the most severe increase in sixty years. The rising waters of Lake Tanganyika have impacted 10 communes across 4 provinces affecting all households in the vicinity”.

The website ‘relief.int’ also presents the following list of damages as a result of El Niño:

∝ Nearly 1, 344 houses have been flooded

∝ 300 houses have been threatened with 34 households displaced

∝ More than 300 Ha of fields in Bujumbura have been damaged

∝ 65 Ha of fields have been damaged around the disaster

∝ Road from Bujumbura to the Democratic Republic of Congo has been damaged.

The cartography of the damages is also given by the local people and the victims themselves who argue the following:

∝ 200,000 people have been affected by the effects of El Niño phenomenon

∝ 20, 000 people have been left homeless

∝ 40,000 hectares of crops have been washed away

∝ 29,000 class rooms have been severely damaged in towns bordering the Lake Tanganyika.

As a result of these damages, there are many threats like of spread of epidemics, hunger, malnutrition, poor sanitation, lack of safe drinking water, etc.

Yet, it is possible to help limit the life-threatening and -destroying damages of the El Niño phenomenon on the Burundians. It is practically feasible to mitigate the adverse impacts of bad weather and natural catastrophes (like rising lake level) caused by El Niño.

You can support the Flood Victims of Burundi who Need Lighting a Blaze of Hope.

You can Light up a Blaze of Hope for them.

You can also donate £5 or more since the needs are urgent and pressing. Through this appeal and your support, CENFACS aims to reach the Flood Victims in Burundi.

You support will help

√ alleviate the suffering of the El Niño-affected communities

√ reduce the side effects of the chaos brought by El Niño

√ respond to the flood victims’ need of food, shelter, safe drinking water, clean sanitation, health and education.

These flood victims need your life-saving humanitarian response right now.

To donate or light a blaze of hope, please get in touch with CENFACS.

• Financial Resilience Programme for Households – In Focus for Wednesday 24/04/2024: Households’ Liquid Assets

This week, we are carrying on the work on financial asset holdings of households or economic resources that households possess to help them stay resilient against shocks, like financial crisis that affect financial assets and other values.

To start this second theme of our Financial Resilience Programme for Households (FRPHs), theme which is Households’ Liquid Assets, we are going to briefly explain the meanings of households’ liquid assets.

Since one of the objectives of this programme is to help reduce liquid asset poverty, we are going to elucidate what this type of poverty means. Then, we will illustrate how households’ liquid assets can contribute to their financial resilience, and how CENFACS can work with them regarding liquid assets matter.

• • What Are Household Liquid Assets?

To understand household liquid assets, one may need to first know the meaning of asset.

The definition of asset used here comes from Ford in 2004, quoted by Caroline Moser (3). This definition is:

“An asset is identified as a stock of financial, human, natural or social resources that can be acquired, developed, improved and transferred across generations. It generates flows or consumption, as well as additional stock”. (p. 5)

The concept of asset can include tangible and intangible ones. Assets can also be aspirational, psychological, productive, political, environmental, etc. However, what we are interested in is liquid assets. What are liquid assets?

According to ‘sapling.com’ (4),

“Household liquid assets are its cash and equity assets. These assets include the cash that you have on hand in the household, plus any bank accounts, retirement accounts, certificates of deposit, and saving bonds or other bonds you own. Equity assets also include the cash value of any life insurance you own”.

Focussing on the conversion and speed properties of these assets, the website ’embracehomeloans.com’ (5) speaks about their ease of conversion into cash and the speed at which they can be sold or traded without any significant loss of values. For this website, liquid assets – which are equal fast, easy access to cash – include: savings accounts, stocks, bonds, and shares of company which can be easily sold (liquidated) and converted into cash, annual tax refund.

The understanding of these assets provides the basis for dealing with poverty linked to them. In other words, households that do not have these assets can be considered as liquid asset poor.

• • What Is Asset-based Poverty?

There are many ways of defining it. Using the definition given Carlotta Balestra (6),

“A household/individual is asset-poor whenever their wealth holdings are not sufficient to secure them a given standard of living for a certain, usually short, period of time”.

The study conducted by Carlotta Balestra under the auspices of the Organisation for Economic Cooperation and Development differentiates income from assets, as well as distinguishes asset-based poverty from net worth poverty.

The definition of asset-based poverty and what it measures will help in studying the household net worth of CENFACS’ members, as well as to work out the percentage of these households or individuals in our community experiencing income and/or liquid asset poverty.

• • Contributions of Liquid Assets to Households’ Financial Resilience

Liquid assets like cash, savings, accounts deposits, money market funds, government bonds, etc. can contribute to households’ financial resilience in time of financial crisis or income shock. Unfortunately, many low income families or households may not be able to have enough or lack liquid assets to face these crises or shocks. For many of them, what they earn or receive as income from one hand goes away to the other hand as expenses, without having the possibility to retain some of this income as liquid asset. They end up with nothing to keep as liquid assets.

This is why it is important to work with them on liquid assets as part of FRPHs and the Month of Protection within CENFACS, so that they can understand how it is life-saving to have liquid assets for your financial resilience and what can be done to create liquid assets.

• • Working with Households on Liquid Assets

Working with household on liquid assets is about operationalising the above-mentioned definitions. It is also about using an asset-based approach to poverty reduction by focussing on assets vulnerabilities, capabilities and endowments. It is further about developing policies (including advice, information, guidance services, etc.) to address the impacts of shocks by focussing on the assets and entitlements of these households.

For example, if liquid asset poverty is high for a particular household making our community, we can work with this household to address this issue so that when a crisis or shock appears this household could be ready to face it. In this process of working this household, we can as well discuss their reserve target/policy.

The above is the second theme of our FRPHs .

Those households that are struggling to have liquid assets in order to stay resilient, they can work with CENFACS.

For any queries and/or enquiries about the theme of Liquid Assets for Households as well as Financial Resilience Programme for Households (including how to access this programme), please do not hesitate to contact CENFACS.

Extra Messages

• Protection Key Note 4 for Week Beginning 22/04/2024: Consumer Protection

• Supporting Networking and Protection against Poverty in 2024

• All-year Round Projects Cycle (Triple Value Initiatives Cycle) – Step/Workshop 10: Terminating Your Play, Run and Vote Projects

• Protection Key Note 4 for Week Beginning 22/04/2024: Consumer Protection

The last key note of our approach to protection from the perspective of spending/expenses/expenditures is on Consumer Protection. To compose this note, let us explain consumer protection and how CENFACS can work with its community on this matter. Since this is the last note, we shall as well deliver our final thought on theme of Spending Protection, theme of the Month of Protection.

• • What Is Consumer Protection?

To explain it, let us refer to what ‘aseanconsumer.org’ (7) argues about it, which is

“Consumer protection safeguards the well-being and interests of consumers through education, mobilization, and representation. Consumer protection ensures that consumers make well-informed decision about their choices and have access to effective redress mechanism”.

From the perspective of this note, consumer protection will be approached from the consumer side rather than from what consumer laws tell businesses what are their customer rights. From our point of view, it means working with the members of our community (here made by consumers) on their consumer protection or rights.

• • Working with the CENFACS Community Members on Consumer Protection

It is about making sure that consumer protection system designed for them work for them. It means that they too can play their part in the system.

Therefore, working with them includes:

√ ensuring that they are informed about their rights

√ accepting to play the rule of the game as an informed consumer

√ informing them about consumer associations that can help them

√ playing their part in consumer protection system

√ guiding them to areas of consumer policies, laws and regulations so that they do not loose money through their spending because of the lack of protection

√ explaining them the guarantee that businesses provide regarding the quality of their products and services

√ discussing with them the tools protecting their consumption

√ enhancing their knowledge in the areas of consumer protection

√ securing redress actions with them if required

etc.

The above are just some of ways CENFACS could support the community regarding consumer protection. These support services or products make up our financial guidance service relating to consumer protection.

• • Final Thought on Spending Production

Dealing with poverty as basic expenditure insufficiency or poverty linked to the lack of spending protection is more than just resolving the problem of transferring consumption or purchasing power to those in need at a particular time of the history. It is mostly about restoring and sustaining the human right relating to essential spending. It means removing all the barriers stepping in the way of these people and their future generations so that they can enjoy freedom from poor or the lack of basic consumption.

Those who need help and support about financial guidance on spending protection and/or for any of the matters listed above falling within our capacity or relating to the Protection Month, they can contact CENFACS.

• Supporting Networking and Protection against Poverty in 2024

The Month of Protection within CENFACS is also a giving one towards protection. It is the month of supporting CENFACS’ Networking and Protection Project. To support this project, one may need to understand it.

• • What Is CENFACS’ Networking and Protection Project?

It is a child poverty reduction initiative designed to help and support the vulnerably poor children from HARMS, THREATS and RISKS from any forms of exploitation, neglect and abuse in Africa. The project helps and supports them through the improvement of the flow of information, knowledge development, self-help activities, the increase and diversification of opportunities and chances together with and on behalf of these children.

One can back this project by Supporting Networking and Protection against Poverty in 2024.

• • What Supporting Networking and Protection against Poverty in 2024 Is about

It is about the following:

√ Improving the flow of information with and amongst the vulnerable people and communities for poverty relief

√ Preventing and responding to any forms of vulnerability threats and risks coming from close and global environments by using protection tools at our disposal

√ Re-empowering the vulnerable by increasing and diversifying opportunities and strengths amongst them.

• • What Your Support Can Achieve

It will help

√ To raise awareness and improve the circulation and dissemination of information for poverty reduction and vulnerability relief

√ To prevent human exploitation (particularly child exploitation) and respond to child protection and safeguarding issues

√ To re-empower and re-strengthen poor people and communities’ capacities and capabilities to protect young generations

√ To widen and diversify opportunities to the vulnerable to escape from poverty

√ To develop a well-informed base to reduce information gap and other types of vulnerabilities linked to the lack of networking, interconnectedness and protection.

• • How to Support Networking and Protection against Poverty in 2024

You can DONATE, PLEDGE AND MAKE A GIFT AID DECLARATION of any amount as a way of supporting Networking and Protection against Poverty in 2024.

To donate, gift aid and or support differently, please contact CENFACS.

You can donate

*over phone

*via email

*through text

*by filling the contact form on this site.

On receipt of your intent to donate or donation, CENFACS will contact you. However, should you wish your support to remain anonymous; we will respect your wish.

• All-year Round Projects Cycle (Triple Value Initiatives Cycle) – Step/Workshop 10: Terminating Your Play, Run and Vote Projects

There are various reasons that can lead to project termination. ‘Taskmanagementguide.com’ (8) states that

“Failure and success are two basic reasons for terminating projects”.

The same ‘taskmanagementguide.com’ explains that success happens when project goals and objectives are accomplished on time and under budget, while failure occurs when project requirements are not met.

The above reasons for project termination can be related to the types of project termination to a certain degree; types which could be termination by addition or by integration or by starvation. In the end, what is project termination?

• • Defining Project Termination

There are similarities in the definition of project termination. To simplify the matter, let us refer to the definition of ‘taskmanagementguide.com’, which is

“Project termination is a situation when a given project is supposed to be closed or finalised because there’s no more need or sense for further continuation”.

Similarly, Project Management Institute (9) argues that

“Projects by definition are time bound, and must terminate”.

However, to effectively finalise a project, one needs to follow project closure procedures.

Let us follow project closure procedures to close out one of our all-year-round projects.

• • Example of Terminating Your All-year Round Projects: Case of Play Project

Realistically speaking, any of your All-year Round Projects close out just a week before 23/12/2024. As explained above, there is a procedure for terminating them. This procedure can be simple or complex depending on project.

Let say, you want to finalise your Play Project. To do that, we are going to use a 8-step model of terminating a project as provided by ‘taskmanagementguide.com’ (op. cit.)

• • • Terminating Your Play All-year Round Project

To terminate your Play Project, you need proceed with the following:

a) Close any agreements you made with any third parties

(e.g., if you borrow materials from the library to research on poverty reduction performance of African countries, you need to close the given borrowing agreement by returning the materials, which can be a book, video, tape, etc.)

b) Handover responsibilities and accountabilities

(i.e., transfer assignments to your play mates)

c) If you have been playing with friends and family members, you will dismiss them

d) Release the resources used

(e.g., returning books to the lending library)

e) If you open a project book to record your results and accounts, you need to close it

f) Record and report your lessons learnt and experiences

g) Accept or reject your result which in this case should be the best African Country Poverty Reducer of 2024

h) Share your result with the community and CENFACS by 23/12/2024.

The above is one of the possible ways of terminating your All-year Round Projects.

For those who would like to dive deeper into Terminating their Play or Run or Vote project, they should not hesitate to contact CENFACS.

Message in French (Message en français)

• Programme de Résilience Financière des Ménages – Gros plan du mercredi 24/04/2024 : Les Liquidités des Ménages

Cette semaine, nous poursuivons nos travaux sur les actifs financiers détenus par les ménages ou sur les ressources économiques dont disposent les ménages pour les aider à rester résilients face aux chocs, comme les crises financières qui affectent les actifs financiers et d’autres valeurs.

Pour débuter ce deuxième thème de notre Programme de Résilience Financière des Ménages (PRFM), qui est les Liquidités des Ménages, nous allons vous expliquer brièvement la signification des Liquidités des Ménages. Étant donné que l’un des objectifs de ce programme est de contribuer à réduire la pauvreté en liquidités, nous allons élucider ce que cela signifie. Ensuite, nous montrerons comment les liquidités des ménages peuvent contribuer à leur résilience financière, et comment le CENFACS peut travailler avec eux sur les actifs liquides.

• • Qu’est-ce qu’un actif liquide pour les ménages?

Pour comprendre les liquidités des ménages, il faut peut-être d’abord connaître la signification du mot « actif ».

Caroline Moser (3) cite Ford qui affirmait en 2004 que

« Un actif est identifié comme un stock de ressources financières, humaines, naturelles ou sociales qui peuvent être acquises, développées, améliorées et transmises d’une génération à l’autre. Elle génère des flux ou des consommations, ainsi que des stocks supplémentaires ». » (p. 5)

La notion d’actif peut inclure des actifs tangibles et immatériels. Les actifs peuvent également être ambitieux, psychologiques, productifs, politiques, environnementaux, etc. Cependant, ce qui nous intéresse, ce sont les actifs liquides.

Les liquidités des ménages sont, selon le « sapling.com (4),

« Leurs liquidités et capitaux propres. Ces actifs comprennent l’argent que vous avez en main dans le ménage, ainsi que les comptes bancaires, les comptes de retraite, les certificats de dépôt et les obligations d’épargne ou autres obligations que vous possédez.

Les capitaux propres comprennent également la valeur de rachat de toute assurance-vie que vous détenez.

En se concentrant sur les propriétés de conversion et de rapidité de ces actifs, le site Web « embracehomeloans.com » (5) parle de leur facilité de conversion en espèces et de la rapidité avec laquelle ils peuvent être vendus ou échangés sans perte de valeur significative. Pour ce site, les actifs liquides – qui sont synonymes d’un accès rapide et facile à l’argent liquide – comprennent : les comptes d’épargne, les actions, les obligations et les actions de la société qui peuvent être facilement vendues (liquidé) et converti en espèces, remboursement d’impôt annuel.

La compréhension de ces actifs constitue la base pour faire face à la pauvreté qui y est liée. En d’autres termes, les ménages qui ne disposent pas de ces actifs peuvent être considérés comme pauvres en liquidités.

• • Qu’est-ce que la pauvreté fondée sur les actifs?

Il existe de nombreuses façons de le définir. En reprenant la définition donnée par Carlotta Balestra (6),

« Un ménage ou un individu est pauvre en actifs lorsque son patrimoine n’est pas suffisant pour lui assurer un niveau de vie donné pendant une certaine période, généralement courte. »

L’étude menée par Carlotta Balestra sous les auspices de l’Organisation de Coopération et de Développement Economique (OCDE) établit une distinction entre le revenu et le patrimoine, ainsi que la pauvreté fondée sur le patrimoine de la pauvreté liée à la valeur nette.

La définition de la pauvreté fondée sur les actifs et ce qu’elle mesure aideront à étudier la valeur nette des ménages de nos membres, ainsi qu’à déterminer le pourcentage de ces ménages ou personnes de notre communauté qui vivent dans une pauvreté en matière de revenu et/ou d’actifs liquides.

• • Contribution des liquidités à la résilience financière des ménages

Les actifs liquides tels que les liquidités, l’épargne, les dépôts sur les comptes, les fonds du marché monétaire, les obligations d’État, etc. peuvent contribuer à la résilience financière des ménages en cas de crise financière ou de choc des revenus. Malheureusement, de nombreuses familles ou ménages à faible revenu peuvent ne pas avoir suffisamment d’actifs liquides ou manquer de liquidités pour faire face à ces crises ou à ces chocs. Pour beaucoup d’entre eux, ce qu’ils gagnent ou reçoivent comme revenu d’une part, part de l’autre part en tant que dépenses. Ils se retrouvent sans rien à conserver en tant qu’actifs liquides.

C’est pourquoi il est important de travailler avec eux sur les actifs liquides dans le cadre des PRFM et du Mois de la Protection au sein du CENFACS afin qu’ils puissent comprendre pourquoi il est vital d’avoir des actifs liquides pour leur résilience financière et ce qui peut être fait pour créer des actifs liquides.

• • Travailler avec les ménages sur les actifs liquides

Travailler avec les ménages sur les actifs liquides, c’est opérationnaliser les définitions mentionnées ci-dessus. Il s’agit également d’utiliser une approche de réduction de la pauvreté fondée sur les actifs, en mettant l’accent sur les vulnérabilités, les capacités et les dotations des actifs. Il s’agit en outre d’élaborer des politiques (y compris des services des conseils, de l’information, des orientations, etc.) pour faire face aux impacts des chocs en mettant l’accent sur les actifs et les droits de ces ménages.

Par exemple, si la pauvreté en liquidités est élevée pour un ménage particulier qui fait partie de notre communauté, nous pouvons travailler avec ce ménage pour résoudre ce problème afin qu’en cas de crise ou de choc, ce ménage puisse être prêt à faire face. Dans ce processus de travail avec ce ménage, nous pouvons également discuter de leur politique de réserve.

Ce qui précède est le deuxième thème de notre PRFM.

Les ménages qui ont du mal à avoir des liquidités pour rester résilients peuvent travailler avec le CENFACS.

Pour toute question et/ou demande de renseignements sur le thème des Liquidités pour les Ménages ainsi que sur le Programme de Résilience Financière pour les Ménages (y compris comment accéder à ce programme), n’hésitez pas à contacter le CENFACS.

Main Development

• FACS Issue No. 83 of Spring 2024 Titled as Charity Trade, Investment and Poverty Reduction in Africa

The contents and key summaries of the 83rd Issue of FACS are given below.

• • Contents and Pages

I. Key Terms Relating to the 83rd Issue of FACS (Page 2)

II. Members of CENFACS Who May Be Interested in the News about Charity Trade and Investment (Page 2)

III. Relationship between Charity Trade and Poverty Reduction, between Charity Investment and Poverty Reduction (Page 3)

IV. Relationship between Trade and Conflict Reduction (Page 3)

V. Tackling Skills Gap in Trade in Africa (Page 4)

VI. Informal Sector Trade Skills Development in Africa (Page 4)

VII. Protection et aide à la prise en compte de la dimension de genre du commerce effectué par les commerçantes pauvres en Afrique (Page 5)

VIII. L’entrepreneuriat féminin et la réduction de la pauvreté intergénérationnelle en Afrique (Page 5)

IX. Les petites et moyennes activités des femmes pour sortir de la pauvreté (Page 6)

X. Les femmes aident les organisations sœurs de la CENFACS basées en Afrique par le biais de micro-activités commerciales (Page 6)

XI. Survey, Testing Hypotheses, E-questionnaire and E-discussion on Charity Trade and Investment (Page 7)

XII. Support, Tool and Metrics, Information and Guidance on Trade and Investment (Page 8)

XIII. Workshop, Focus Group and Booster Activity about Charity Trading, Investment and Poverty Reduction (Page 9)

XIV. Giving and Project (Page 10)

• • Key Summaries

Please find below the key summaries of the 83rd Issue of FACS from page 2 to page 10.

• • • Key Terms Relating to the 83rd Issue of FACS (Page 2)

There are three terms used in the context of this Issue of FACS. These terms are charity trading, charity investment and poverty reduction. Let us briefly explain these key terms.

• • • • Charity Trading

To explain this term, we are referring to what the Scottish Charity Regular says about trading. According the Scottish Charity Regular (10),

“Trading usually involves the sale of goods or services for the purpose of making a profit. Trading can be carried out directly by the charity, if it has the power in its governing document. In some cases, it is advisable that any trading is carried out by a trading subsidiary”.

From the point of view of the same Scottish Charity Regular, trading can be primary or ancillary or non-primary. Primary purpose trading helps advance the charity’s purpose (e.g., providing residential accommodation in return for fees). Ancillary purpose trading compliments charitable purposes (e.g., sale of drinks and foods at charity events). Non-primary purpose trading provides an income to support charitable activity (e.g., selling calendars to raise funds for the charity).

So, by following charity trading regulatory rules, trading is possible for charities. Charity trade can help to back charities’ mission and charity objects like the reduction of poverty. For example, according to ‘charityretail.org.uk’ (11),

“Profit contribution of charity retail to parent charities was £387 million between 2022 and 2023. Social value generated by UK charity shops was £75.3 billion between January and December 2022”.

• • • • Charity Investment

Again, according to the Scottish Charity Regular (12),

“An investment is intended to generate a return – to give something back to the person or organisation that owns it. In a charity context, investments are charity assets used to help the charity deliver its charitable purposes”.

Investments can bring the following: financial return (income), capital growth, social or environmental return, and so on. It is not a surprise if Charities Aid Foundation (13) argues that

“Investing can make the most of your long-term funds and protect your charity’s money against the impact of inflation. Investments may generate better returns than holding cash in the bank, so there is potential to grow your money and expand in the future”.

As the ‘charityintelligence.co.uk’ (14) explains in its ‘The Charity Intelligence Investment Fund Quarterly Review’, charities can have capital return and earn income from their investment in terms of mixed assets funds, UK equity funds, global equity funds, fixed interest funds, property and cash funds.

Briefly speaking, charities can trade and invest under charity laws, which need to be followed and complied with. In other words, a charity that would like to trade and/or invest needs to first check what the charity laws say in its area of operation.

• • • • Poverty Reduction

To understand poverty reduction, there could be a need to know poverty. John Scott and Gordon Marshall (15) sociologically explain that

“Poverty is a state in which resources, usually material but sometimes cultural, are lacking” (p. 588).

Poverty reduction is thus any measure or effort to decrease this state in which resources are lacking.

Looking at poverty reduction from the monetary perspective, Y. A. Bununu (16) thinks that

“Poverty reduction can be considered as the improvement of an individual’s or group’s monetary expenditure to an amount above the poverty line while improving access to education, healthcare, information, economic opportunities, security of land-tenure, all the other deprivations associated with it”.

Taking a historical and intertemporal view of poverty reduction, the website ‘borgenproject.org’ (17) argues that poverty reduction is evolving concept. It evolves from a simple to complex concept throughout the time to mean the following:

σ financial contributions to governments of poverty-stricken nations

σ achieving the goal of lifting as many people above the poverty line as possible

σ the extended relief programmes and education programmes focusing on sustainability in target communities.

The goalposts of poverty reduction keep moving depending on the types of hardship people face at a particular time of the history.

The above-named definitions shape the contents of the 83rd Issue of FACS. They also provide some indication about the types of audiences the contents of this Issue may be interested in.

• • • Members of CENFACS Who May Be Interested in the News about Charity Trade and Investment (Page 2)

Among the people with whom CENFACS work and who may be interested in charity trading and/or investing in our noble and beautiful cause of reducing poverty include the following:

√ Those who would like to feed their families through trade

√ Those wanting to make ends meet or reduce poverty via trade

√ Those who would like to raise funds for CENFACS‘ noble and beautiful cause via trading

√ Africa-based Sister Organisations engaged in or planning to trade and invest to help reduce poverty in Africa

√ Those seeking trade skills to reduce poverty

√ Those who see trade as a potential way of reducing conflicts that adversely affect poor people

√ Investment and fund managers of Africa’s charities

√ Those planning to impact invest in the poor people’s idea to trade

√ Those aiming at tackling skills gap in trade for good causes

√ Those looking to reduce gender gaps in trade and investment

√ Project beneficiaries engaged or planning to trade for CENFACS‘ noble and beautiful cause of poverty reduction

Etc.

All the above-mentioned persons (physical or moral) can find some interesting information in the 83rd Issue regarding their trading and investment plans or projects. They may also want to know if there is any relationship between charity and poverty reduction, between charity investment and poverty reduction.

• • • Relationship between Charity Trade and Poverty Reduction, between Charity Investment and Poverty Reduction (Page 3)

The findings from many studies conducted on these relationship issues tend to suggest that there could be a link between charity trade and poverty reduction, an association between charity investment and poverty reduction.

For example, the World Economic Forum (18) argues that

“Open trade is particularly beneficial to the poor, because it reduces the cost of what they buy and raises the price of what they sell”.

This can be true for charity trade as well.

Equally, the British International Investment (19), which provides some studies on the relationship between investment and the rate of poverty reduction, states that

“Higher rates of private investment are associated with faster poverty reduction”.

Private investment in charities can have similar effects.

However, to prove that there is a positive relationship between charity trade and poverty reduction, or charity investment and poverty reduction, one may need to statistically conduct a correlation test with data in hands. Statements are not enough to prove this sort of relationships.

• • • Relationship between Trade and Conflict Reduction (Page 3)

Trade can help to reduce conflicts between people, between neighbours.

For example, if young unemployed people learn to trade and engage in trade, there could be chance that they would not be recruited into armed movements (like what is happening in the East of the Democratic Republic of Congo) and criminal gangs or being candidates for illicit activities such as natural resources trafficking which could exacerbate poverty where these resources are illicitly taken.

In this respect, trade can help reduce the possibility of conflicts and wars in Africa, which can decrease the probability of increased poverty. Again, one needs statistical evidence with data to back whatever they are saying.

• • • Tackling Skills Gap in Trade in Africa (Page 4)

Many poor beneficiaries can succeed or manage to set up income-generating activity to feed their nuclear family and the rest of their extended family. However, there is still a challenge as many of them lack certain critical skills to scape up their trade to deliver poverty reduction on a large scale. Many of them fail to develop scalable economies in their trading models.

Special attention can be paid to both soft and hard skills like marketing, communication, digital skills, etc. to tackle skills gap in trade in Africa. Tackling them can help enhance poverty reduction in Africa. There is a number of skills that poor traders need in order to improve their trading capacity and capability. Amongst these skills are the ones we have just mentioned above plus the following ones: analytical, market research, marketing, focus, record keeping, communication skills, etc.

• • • Informal Sector Trade Skills Development in Africa (Page 4)

In 2014, ‘adeanet.org’ (20) found that

“In Africa, the majority of workers in micro and small enterprises learn their trade on the job in the informal sector rather than in the formal technical and vocational education and training (TVET) sector”.

Yet, providing the entire spectrum of skills training in the form technical and vocational skills development for sustainable trade profession to those engaged in trade can increase and improve the way they trade.

Although, what ‘adeanet.org’ found was 10 years ago, it is still happening today in Africa. Knowing the large size of the informal sector in Africa, there is a great need to train these workers who would like to engage in trade if one wants to further reduce poverty in Africa.

• • • Protection et aide à la prise en compte de la dimension de genre du commerce effectué par les commerçantes pauvres en Afrique (Page 5)

Dans les zones d’opération de nos organisations sœurs basées en Afrique, on remarque qu’il y a beaucoup de femmes qui font du commerce pour joindre les deux bouts. Mais, elles rencontrent de nombreux défis et problèmes. Bien qu’il soit difficile de saisir l’ampleur des flux de commerce informel (à la fois intrafrontalier et transfrontalier), il est possible de protéger et d’aider ces femmes. Pour les protéger et les aider, il peut s’agir de:

√ Les aider à participer efficacement aux négociations commerciales

√ Leur donner les moyens d’analyser les questions liées au commerce (comme les programmes de financement pour passer à l’échelle)

√ Les accompagner dans la diversification de leur modèle commercial

√ Éliminer les obstacles qui empêchent les femmes de participer au commerce

√ Améliorer leur capacité à commercer

√ Lutter contre la violence fondée sur le genre dans le commerce

√ Leur fournir une infrastructure pour qu’ils puissent commercer comme des étals sur une place de marché

√ Mettre fin à toute forme de harcèlement, y compris de la part des agents du fisc ou des policiers.

√ Améliorer brièvement les conditions et le statut de ces femmes commerçantes.

Ce qui précède n’est que quelques exemples de moyens de protéger et d’aider ces femmes à s’engager dans le commerce. et si l’on veut prendre en compte de la dimension de genre du commerce effectué par les commerçantes pauvres.

• • • L’entrepreneuriat féminin et la réduction de la pauvreté intergénérationnelle en Afrique (Page 5)

L’entreprenariat féminin en Afrique est souhaité et désiré par les femmes elles-mêmes. Il est également soutenu par ONU Femmes (21) à travers ses activités de réforme et de diffusion des lois qui sont bénéfiques pour l’entrepreneuriat féminin. Cela est particulièrement vrai pour les femmes issues de milieux pauvres qui s’engagent dans des activités génératrices de revenus pour subvenir aux besoins de leur famille.

Ces opérations et activités leur permettront de sortir du secteur informel et de la pauvreté. Cela profitera non seulement à ces femmes, mais aussi à leurs familles et à leur progéniture. Cette sortie peut également avoir des effets bénéfiques en termes de réduction de la pauvreté intergénérationnelle.

Car l’histoire regorge d’exemples où le commerce passe des parents à leurs enfants et petits-enfants. Si le transfert est bien assuré et réussi, il peut éviter une histoire de pauvreté intergénérationnelle.

• • • Les petites et moyennes activités des femmes pour sortir de la pauvreté (Page 6)

Ces activités comprennent les activités maraîchères itinérantes, la vente de pain, la gestion de petits commerces ou de petits dépôts, la vente de braises, la vente de poissons et de produits alimentaires, etc. Ces activités se trouvent dans la plupart des endroits où nos organisations sœurs basées en Afrique opèrent. Ces activités ont un impact sur la pauvreté.

Ces activités contribuent à assurer leur vie existentielle et sociale. Elles aident d’une manière ou d’une autre à autonomiser ces femmes et à les libérer de la pauvreté. Cependant, ces femmes, marchandes et commerçantes entreprenantes ont besoin d’être guidées et soutenues.

Il y a des organisations africaines de soutien au commerce qui peuvent leur apporter secours dans plusieurs matières (telles que le développement des produits and des parts de marché, le renforcenent des capacités à faire du commerce, etc.). Parmi ces organisations, on peut citer les suivantes:

∝ Africa Trade Foundation (https://www.africatradefoundation.org)

∝ Africa Trade Fund (https://www.africatradefund.org)

∝ African Trade Policy Centre (https://www.uneca.org/african-trade-policy-centre)

Etc.

• • • Les femmes aident les organisations sœurs de la CENFACS basées en Afrique par le biais de micro-activités commerciales (Page 6)

Il y a un certain nombre de nos organisations sœurs basées en Afrique qui ont été aidées par des femmes locales et des bénéficiaires de projets dans de nombreux domaines tels que le volontariat, le commerce, la collecte de fonds, etc.

En nous concentrant sur le commerce, partageons ceci. Selon les zones où les organisations sœurs basées en Afrique opèrent, certaines de ces organisations sont engagées dans la fourniture de biens et de services. Il y en a qui le font avec l’aide de sympathisants locaux. Parmi ces habitants, il y a des femmes qui aident à vendre, par exemple, des biens (tels que les savons, les aliments et les vêtements faits à la maison) fabriqués par elles-mêmes afin de collecter des fonds localement pour soutenir leur cause.

Ces activités commerciales apportent une certaine contribution aux organisations caritatives pour répondre aux besoins locaux tels que la santé, l’éducation, le développement local et d’autres besoins locaux. Ces activtités leur permettront de sortir de la pauvreté.

• • • Survey, Testing Hypotheses, E-questionnaire and E-discussion on Charity Trade and Investment (Page 7)

• • • • Survey on charity trade

Trading can provide to charities extra income to achieve their mission.

The purpose of this survey is to collect information from a sample of our users and community members regarding their perception of charity trading.

Participation to this survey is voluntary.

As part of the survey, we are running a questionnaire which contains some questions. One of these questions is:

Q: Charity trading can contribute more to the relief of poverty than charity donation?

You can respond and directly send your answer to CENFACS.

• • • • Testing hypotheses about charity investments to poverty reduction

According to the Scottish Charity Regular (op. cit.),

“Charity’s investments can involve a range of assets, such as a building from which you receive rental income, cash placed on deposit which generated interest, a portfolio of stocks, shares and other assets, or a right to income from other asset, for example royalty income arising from owning the copyright to a book”.

Considering this spectrum of investments, one can conduct the following test:

∝ Null Hypothesis (Ho): There is a correlation between charity’s return on investments and its contribution to its cause.

∝ Alternative Hypothesis (H1): There is not a correlation between charity’s return on investments and its contribution to its cause.

The above test is for those of our members who would like to dive deep into charity’s investments and their impact on its cause. In order to conduct these tests, one needs data on charity’s return on investments and to know the charity cause they are talking about.

• • • • E-question on your view about charity trading

Any of our readers and users can answer the following question:

Q: Is trading the right option for charities since trading involves the sale of goods and services for the purpose of making profit?

You can provide your answer directly to CENFACS.

For those answering any of this question and needing first to discuss charity trading, they can contact CENFACS.

• • • • E-discussion on resilience via trading and/or investment

Many of our members have their own view about what helps to stay resilient against global shocks. Some think that trading can help. Others do not agree as they believe that trading could be itself a transmission channel of global shocks, which impacts the people in need. Others more argue that diversifying your risk through a good investment policy on your assets will shield you from global shocks.

For those who may have any views or thoughts or even experience to share with regard to this matter, they can join our e-discussion to exchange their views or thoughts or experience with others.

To e-discuss with us and others, please contact CENFACS.

• • • Support, Tool and Metrics, Information and Guidance on Trade and Investment (Page 8)

• • • • Ask CENFACS for Guidance regarding the reduction of poverty via trade and investment

Trade and investment can be a means to reduce and possibly end poverty.

For those members of our community who would like find out how trading and investing can help them to reduce or come out of poverty, they can contact CENFACS.

CENFACS can work with them to explore ways of trading and investing.

We can work with them under our Advice-, Guidance- and Information-giving Service. We can as well signpost them to organisations working on trading and investing issues.

If you are a member of our community, you can ask us for guidance on trading and investing to reduce poverty.

• • • • Tools and metrics of the 83rd Issue of FACS

The 83rd Issue of FACS is concerned with four types of tools or metrics which are: return on investment, surplus margin, earned income and poverty gap ratio.

Let us briefly explain these tools or metrics.

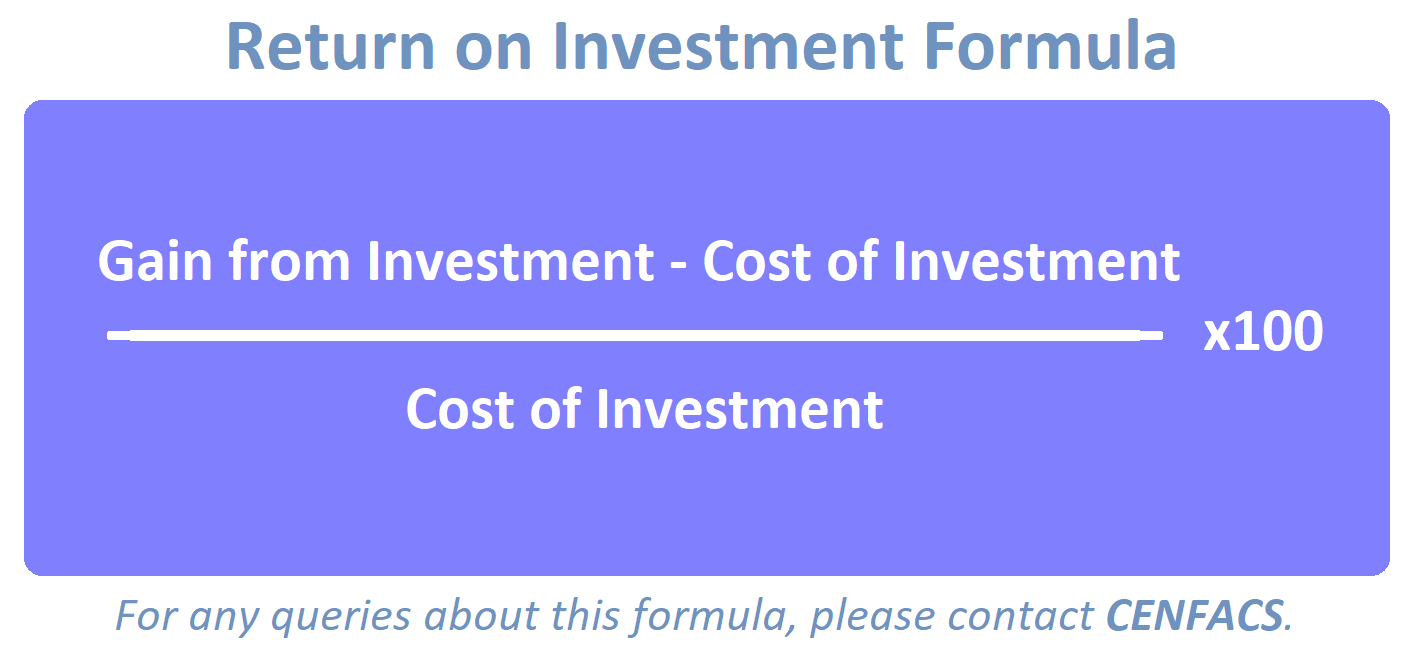

• • • • • Investment tool and metrics: Return on Investment

The 83rd Issue utilises as tool Return on Investment. This return on investment (ROI) does not necessarily to be financial (income). It can be capital growth, social or environmental return, happiness and so on.

If one chooses financial ROI, then they need to explain what it means and how to measure it. Definitions of ROI tend to overlap.

For example, ‘corporatefinanceinstitute.com’ (22) defines ROI as

“A performance measure used to evaluate the returns of an investment or to compare the relative efficiency of different investments”.

Another definition comes from ‘forbes.com’ (23) that states

“ROI is a metric used to understand the profitability of an investment”.

There is also online ROI calculator for those who will be interested in it.

Because charities exist to delivery public benefit not profit, the 83rd Issue is also interested in non-financial ROI. Furthermore, the 83rd Issue considers the impact of your investments on poverty reduction. In other words, it deals with impact investing.

• • • • • Surplus margin

The second metrics that the 83rd Issue uses is Surplus Margin. What is it?

It is the following measure:

(Net income/Total income) x 100

The website ‘cranfieldtrust.org’ (24) explains that

“Generating a surplus allows a charity to invest in the improvement/expansion of charitable activities. If the surplus marginal overall is positive, you have made a surplus and your reserves will be boosted”.

For example, this measure can be used to find out the surplus margin of African charitable trade organisations investors and their investment portfolios.

Additionally, one could consider the number of charitable trade organisations that are investors and the types of their investments. Do they invest in mixed assets funds or national equity funds or global equity funds or fixed interest funds or property and cash funds or green bonds? What do their investment portfolios look like? Do they achieve a surplus margin? What is the profile of their margins?

• • • • • Earned to unearned income ratio

The 83rd Issue also employs the ratio of earned to unearned income. This ratio can be written as follows:

Earned Income / Unearned Income

The website ‘cranfieldtrust.org’ (op. cit.) argues that

“The ratio of earned to unearned income helps to show that the charity has developed diversified income as it has evolved. It is useful for donors and funders”.

For example, our ASOs that would like to trade can utilise this ratio to compare income earn from trading to incomes from unearned sources.

• • • • • Poverty gap ratio

This is an interesting metrics of poverty as it measures the intensity of poverty.

The online ‘marketbusinessnews.com’ (25) explains that

“The poverty gap ratio or poverty gap index is the average of the ratio of the poverty gap to the poverty line. Economists and statisticians express it as a percentage of the poverty line for a region or whole country…The poverty gap ratio considers how far, on the average, poor people are from poverty line”.

The above tools and metrics can be used in dealing with charity trading, investment and poverty reduction in Africa. For example, one can use the poverty gap ratio to measure the average shortfall of the income of the poor women traders in Africa from the poverty line.

• • • • Information and guidance on charity trading, investment and poverty reduction

Information and Guidance include two types areas of support via CENFACS, which are:

a) Information and guidance on charity trading and poverty reduction

b) Signposts to improve Users’ Experience about impact investing and poverty reduction.

• • • • • Information and guidance on charity trading and poverty reduction

Those Africa-based Sister Organisations (ASOs) that are looking for information and guidance on charity trading and that do not know what to do, CENFACS can work with them (via needs assessment conducted under CENFACS’ International Advice Service) or provide them with leads about other organisations, institutions and services that can help them.

• • • • • Signposts to improve Users’ Experience about impact investing and poverty reduction

For those who are looking for whereabout to find help about impact investing queries, we can direct them to the relevant services and organisations.

More tips and hints relating to the matter can be obtained from CENFACS‘ Advice-giving Service and Sessions.

Additionally, you can request from CENFACS a list of organisations and services providing help and support in the area of charity trading and investment, although the Issue 83 does not list them. Before making any request, one needs to specify the kind of organisations they are looking for.

To make your request, just contact CENFACS with your name and contact details.

• • • Workshop, Focus Group and Booster Activity about Charity Trading, Investment and Poverty Reduction (Page 9)

• • • • Mini themed workshop on trade skills to reduce poverty

Boost your knowledge and skills about the reduction of poverty via trade skills with CENFACS.

The workshop aims at supporting those without or with less information and knowledge about trade skills and knowledge while improving the quality of their lives. The workshop will provide recommendations for actions with options and opportunities for the participants.

To enquire about the boost, please contact CENFACS.

• • • • Focus group on impact investing

The focus group will deal with how to invest not only to realise a good return on your investment, but also to create a lasting impact. Impact investing will be approached from the perspective of win-win.

To take part in the focus group, group that will use deliberative practice strategies, please contact CENFACS.

• • • • Spring activity: Becoming Charity Impact Investors

This user involvement activity revolves around the answers to the following question:

Q: What steps do you need to take to become a charity impact investor?

Those who would like to answer these questions and participate to our Becoming Charity-Impact-Investors Activity, they are welcome.

To take part in this activity, please contact CENFACS.

• • • Giving and Project (Page 10)

• • • • Readers’ giving

You can support FACS, CENFACS bilingual newsletter, which explains what is happening within and around CENFACS.

FACS also provides a wealth of information, tips, tricks and hacks on how to reduce poverty and enhance sustainable development.

You can help to continue its publication and to reward efforts made in producing it.

To support, just contact CENFACS on this site.

• • • • Basic Trade Skills Development (deBASICTS) Project

deBASICTS is an initiative that helps to reduce poverty by providing new skills or reskilling or skilling up those who are looking forward to trade to make ends meet or to improve their enterprising model in the African context.

deBASICTS will be achieved through the development of trade capacity and capability to trade and reduce poverty. As it stands, the project is not only about developing trade skills, but also reducing poverty through the skills acquired or at least putting project beneficiaries in the right direction to reduce poverty.

To support or contribute to deBASICTS, please contact CENFACS.

For further details including the implementation plan of the deBASICTS, please contact CENFACS.

The full copy of the 83rd Issue of FACS is available on request.

For any queries and comments about this Issue, please do not hesitate to contact CENFACS.

_________

• References

(1) https://tradecouncil.org/exploring-the-relationship-between-international-trade-and-poverty-reduction/# (accessed in April 2024)

(2) https://reliefweb.int/report/burundi/burundi-floods-and-landslides-dref-operation-ndeg-mdrbio20-update (accessed in April 2024)

(3) Moser, C. O. N. (2006), Asset-based Approaches to Poverty Reduction in a Globalized Context: An introduction to asset accumulation policy and summary of workshop findings, The Brookings Institutions, Global Economy and Development Working Paper#01, Washington, DC, doi: 10.2139/ssrn. 1011176 (accessed in April 2024)

(4) https://www.sapling.com/7817240/household-assets (accessed in April 2024)

(5) https://blog.embracehomeloans.com/liquid-assets-vs-fixed-assets-understand-the-differences/ (accessed in April 2024)

(6) Balestra, C. (2018), OECD Statistics and Data Directorate, Social Situation Monitor Research Seminar, Brussels, March 2018

(7) https://www.aseanconsumer.org/cterms-consumer-protection (accessed in April 2024)

(8) www.taskmanagementguide.com/glossary/what-is-project-termination-.php (Accessed in April 2023)

(9) https://www.pmi.org/learning/library/project-termination-delay-1931 (Accessed in April 2023 )

(10) https://www.oscr.org.uk/guidance-and-forms/charities-and-trading-guide/1-types-of-charity/# (accessed in April 2024)

(11) https://www.charityretail.org.uk/key-statistics/ (accessed in March 2024)

(12) https://www.oscr.org.uk/guidance-and-forms/charity-investments-guidance-and-good-practice/2-what-is-an-investment/# (accessed in April 2024)

(13) https://www.cafonline.org/charities/investment/getting-started-with-charity-investment (accessed in April 2024)

(14) https://www.charityintelligence.co.uk/media/139/2023-06-charity-intelligence-investment-performance-fund-quarterly-reviewpdf (accessed in April 2023)

(15) Scott, J. & Marshall, G. (2009), Oxford Dictionary of Sociology, Oxford University Press, Oxford New York

(16) Bununu, Y. A. (2020). Poverty Reduction: Concept, Approaches, and Case Studies. In: Leal Filho, W., Azul, A., Brandli, L., Özuyar, P., Wall, T. (eds) Decent Work and Economic Growth. Encyclopedia of the UN Sustainable Development Goals. Springer. Cham. https://doi.org/10.1007/978-3-319-71058-7_31-1 (accessed in April 2024)

(17) https://borgenproject.org/what-is-poverty-reduction/ (accessed in April 2024)

(18) https://www.weforum.org/agenda/2019/03/poverty-reduction-rests-on-trade (accessed in April 2024)

(19) https://www.bii.co.uk/en/news-insight/insight/articles/whats-the-expected-impact-of-investment-on-poverty-reduction (accessed in April 2024),

(20) https://www.adeanet.org/en/blogs/skilling-africa-the-paradigm-shift-to-technical-and-vocational-skills-development (accessed in April 2024)

(21) https://www.unwomen.org/fr/about-un-women (accessed in April 2024)

(22) https://corporatefinanceinstitute.com/resources/accouting/what-is-return-on-investment-roi/ (accessed in April 2024)

(23) https://www.forbes.com/advisor/investing/roi-on-investment/ (accessed in April 2024)

(24) https://www.cranfieldtrust.org/articles/top-10-financial-ratios-forcharities (accessed in April 2024)

(25) https://marketbusinessnews.com/information-on-credit/gap-ratio–definition-meaning (accessed in August 2023)

_________

• Help CENFACS Keep the Poverty Relief Work Going this Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE AND BEAUTIFUL CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2024 and beyond.

With many thanks.