Welcome to CENFACS’ Online Diary!

14 February 2024

Post No. 339

The Week’s Contents

• Africa Not-for-profit Investment 2024 – In Focus: Impact Investing in Africa-based Sister Charitable Organisations and Causes Specialised in Home and Land Ownerships

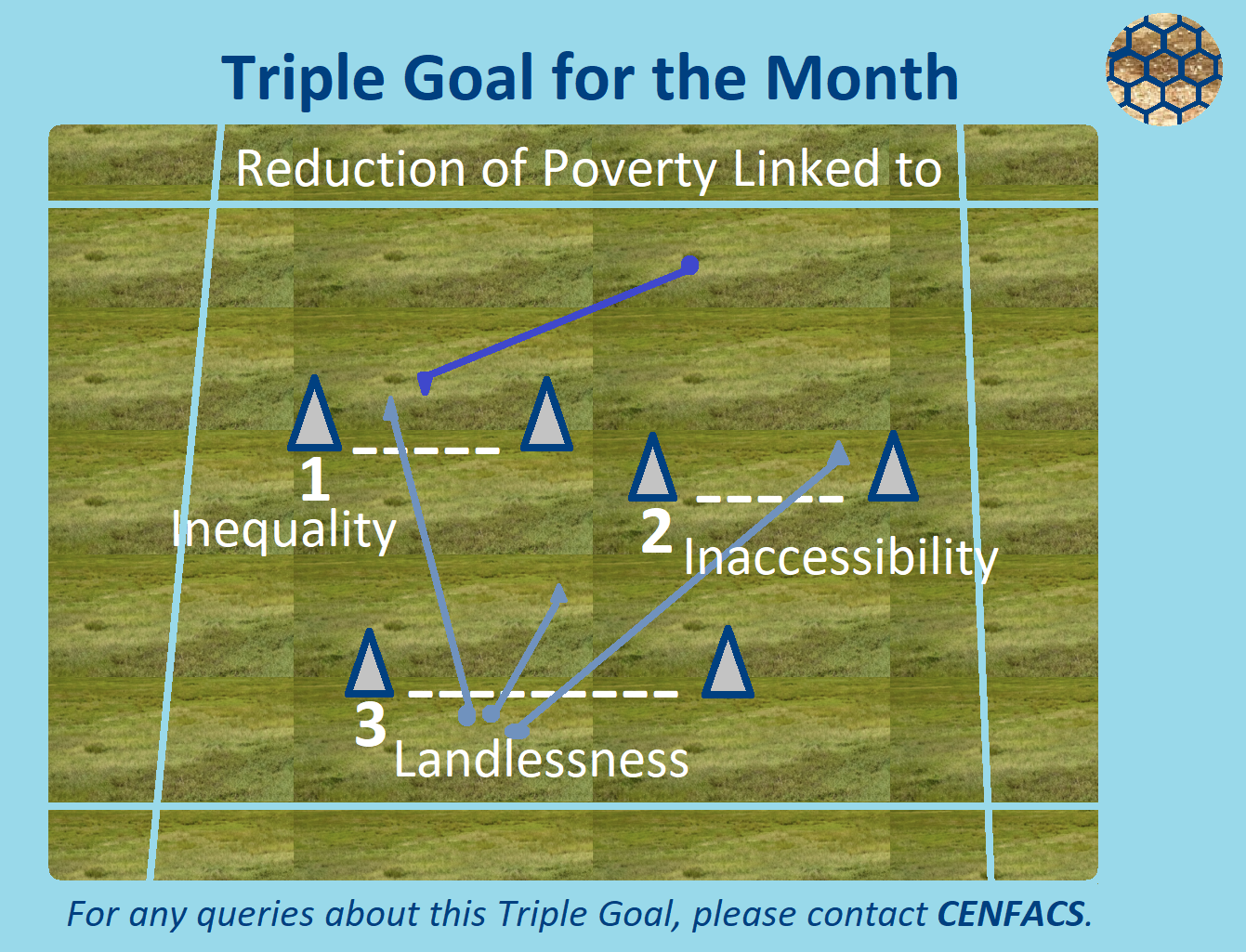

• Reduction of Unequal or Lack of Access to Basic Services to Empower the Poor and Vulnerable Households

• Lighting a Blaze of Hope for the Rain-Hit and Food Insecure in Chad, Congo and the Democratic Republic of Congo

… And much more!

Key Messages

• Africa Not-for-profit Investment 2024 – In Focus: Impact Investing in Africa-based Sister Charitable Organisations and Causes Specialised in Home and Land Ownerships

Africa is currently the world’s fastest growing region in terms of population. Yet, Africa is also a place with low level of homeownership and high level of insecure land tenure. The low level of homeownership can be partly justified by the affordability of homes.

For example, ‘statista.com’ (1) notes that

“At least 95 percent of urban households in over 17 of the countries in Africa were unable to buy the cheapest newly built house in 2021”.

Another example is from ‘housingfinance.org’ (2), which provides housing data for many cities in Africa. The ‘housingfinance.org’ explains that

“In Kinshasa, a modern house built in a serviced residential area costs up to FC 588.5 million (US $250 000). These prices are beyond the reach of most of the population: up to 80% cannot afford the costs, with unemployment at 23%. The housing backlog stands at 4 million units a year while approximately 265 000 housing units are built each year”.

This situation provides a window of opportunities to invest in Africa, particularly to those who would like to impact investing in home and land ownerships to reduce poverty.

Africa Not-for-profit Investment 2024 (AN4PI2024) deals with these home and land matters. Particularly, it focusses on Africa-based Sister Charitable Organisations and Causes (ASCOCs) that work with their locals, mostly those who would like to become home and/or land owners, to find suitable, affordable and accessible home or land, while reducing poverty and enhancing sustainable development amongst them.

These ASCOCs need support of all kinds, including foreign direct investment. In this respect, AN4PI2024 aims at those impact investors who would like or are looking to impact invest in Africa’s charitable organisations and causes that deal with homes, lands, homeownership and land ownership matters.

AN4PI2024 is also about ASCOCs that work or help to reduce or end poverty through the allocation of power on home and land to those in need in their communities or sister communities so that these needy people can improve their health, hygiene, education opportunities, etc. They can as well have access to clean water, safe toilet, electricity and respite via sustainable homeownership and secure land tenure. Given that AN4PI2024 is about ASCOCs working to reduce poverty, it focusses on the lower end of housing market in Africa.

Like for the previous issues of Africa Not-for-Profit Investment, AN4PI2024 has to be understood as an extension of CENFACS’ Guidance Programme for those who would like to not-for-profit invest for impact in Africa. The AN4PI2024 does not, however, replace the Guidance for Investing in Africa. It just adds value to it. Because of its unique contribution to the not-for-profit investment sector, AN4PI2024 presents the information that not-for-profit investors may want in simple yet concise format. In particular, it provides the mission/objects/speciality and types of services ASCOCs offer in the areas of home and land ownerships.

More on Africa Not-for-profit Investment 2024 can be found under the Main Development section of this post.

• Reduction of Unequal or Lack of Access to Basic Services to Empower the Poor and Vulnerable Households (Note 2 of Sustainable Development Month on 14/02/2024)

To deliver this note, let us try to understand basic services and their access.

• • Understanding Basic Services

Our understanding of basic services comes from Manisha Shrestha (3) who argues that

“Basic services are the provision of fundamental needs such as water, food, electricity, and energy, shelter, sanitation and health, and education to improve people’s live”.

The poor and vulnerable households need to access these services to empower and free themselves.

• • Explaining Access to Basic Services

The website ‘onsecrethunt.com’ (4) explains that

“Access to basic services includes basic access to drinking water, basic sanitation facilities, essential health services (including mental health care, reproductive health and vaccination) and education (as a minimum primary school education)”.

Manisha Shrestha (op. cit.) adds that access to basic services becomes limited when there is high unemployment, poverty, and less awareness among people. Things become even worse when there is a lack of access or inequality in access. In which case, there is a need to reduce or end unequal or lack of access to basic services.

• • Reducing or Ending Unequal or Lack of Access to Basic Services

Reducing or ending unequal or the lack of access to basic services is about improving access for all, and reducing or ending inequalities in access. It involves many players including governments, businesses, charities, etc. It also requires partnerships between different players and a multi-stakeholder approach.

However, what we are interested in is not only what others can do or are doing to reduce or end unequal or the lack of access to basic services. What we are interested in is what CENFACS can do in order to empower user households members of its community experiencing inequalities in access to basic services.

• • Empowering or Working with CENFACS’ Households Members Facing Inequalities in Access to Basic Services

CENFACS can work with its members in a number of ways to help reduce or end unequal or the lack of access to basic services. These ways of working together with them include the following:

√ Promoting equality to improve access

√ Mobilising resources to reduce the lack of resources

√ Identifying access problem with beneficiaries

√ Working with agencies responsible for access to basic services

√ Help beneficiaries to access basic services

√ Providing useful tips and resources on access to basic services

√ Discussing with beneficiaries’ journey in accessing basic services

√ Inviting users to share their experience (e.g., discrimination, social exclusion, lack of diversity, etc.) in accessing basic services

√ Working with beneficiaries to find equality support services when accessing basic services

√ Helping them to find information about access to basic services

√ Working on factors (like communication and language barriers or enablers) that influence beneficiaries’ ability to access basic services

√ Providing inclusion and integration skills (like literacy, numeracy and digital skills) to access basic services

√ Translating and interpreting documents and other materials from beneficiaries to facilitate access to basic services

√ Signposting beneficiaries to access hubs, clubs and event organisers

√ Working with beneficiaries’ networks (family, community and social) to sustain access to basic services, etc.

For those members of our community who may be interested in matter relating to Access to Basic Services, they are free to contact CENFACS.

For any other queries or enquiries about Sustainable Development Month and the Reduction of Unequal Rights, of the Lack of Access to Basic Service and of Landlessness; please also contact CENFACS.

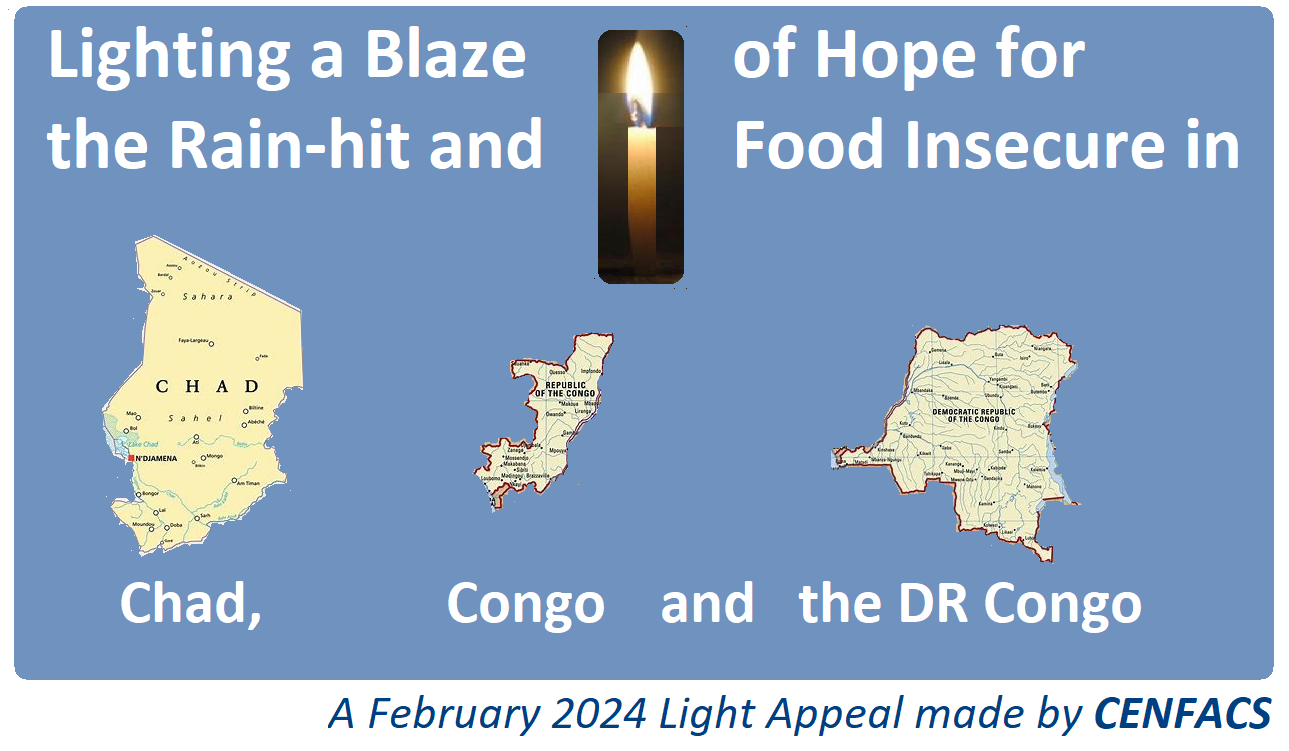

• Lighting a Blaze of Hope for the Rain-Hit and Food Insecure in Chad, Congo and the Democratic Republic of Congo

This is an appeal to light a blaze of hope for those who have been hit by torrential rains and cyclones that led food insecurity in Chad, Congo and the Democratic Republic of Congo (DRC). The appeal is also for the victims of these natural disasters who continue to suffer from their legacies.

The data and news about this appeal speak for these torrential rain-hit and food insecure people in Chad, Congo and the Democratic Republic of Congo. For example, the website ‘crisisresponse.iom.int’ (5) states that

“In 2023, flooding in the rainy season hit 19 out of 23 provinces [of Chad], affecting 1.3 million people, damaging over 350,000 hectares of agricultural land, killing 20,000 head of livestock, and destroying 80,000 homes, as well as a large number of schools, health centres, and public infrastructure, according to OCHA”.

Likewise, the ‘reliefweb.int’ (6) highlights heavy rainfall affected the eastern and southern areas of the Democratic Republic of Congo (DRC). These floods caused fatalities in Kasai-Central province, Bukavu City and Burhinyi village and damaged 1,400 houses. There is also rising of the Congo River water level which affected both Congo and the DRC.

Additionally, the ‘globalhungerindex.org’ (7) points out that

“In the 2023 Global Hunger Index, Chad ranks 119th out of the 125 countries with sufficient data to calculate 2023 GHI scores. With a score of 34.6 in the 2023 Global Hunger Index, Chad has a level of hunger that is serious…The Republic of Congo ranks 107th out of the 125 countries with sufficient data to calculate 2023 GHI series. With a score of 28.0 in the 2023 Global Hunger Index, the Republic of Congo has a level of hunger that is serious… The DRC ranks 122nd out of 125 with sufficient data to calculate 2023 GHI scores. With a score of 35.7 in the 2023 Global Hunger Index, the DRC has a level of hunger that is alarming“.

The above-mentioned data tells a bit of story about the flood-hit and food insecure in these three countries and why they need your help.

You can support the victims of floods and food insecure in Chad, Congo and the DRC.

You can Light up a Blaze of Hope for the Rain-Hit and Food Insecure in Chad, Congo and the Democratic Republic of Congo.

You can now donate £5 or more since the needs are urgent and pressing. Through this appeal and your support, CENFACS aims to reach the victims of floods and food insecure in Chad, Congo and the DRC.

These victims need your life-saving humanitarian response right now.

To donate, please get in touch with CENFACS.

Extra Messages

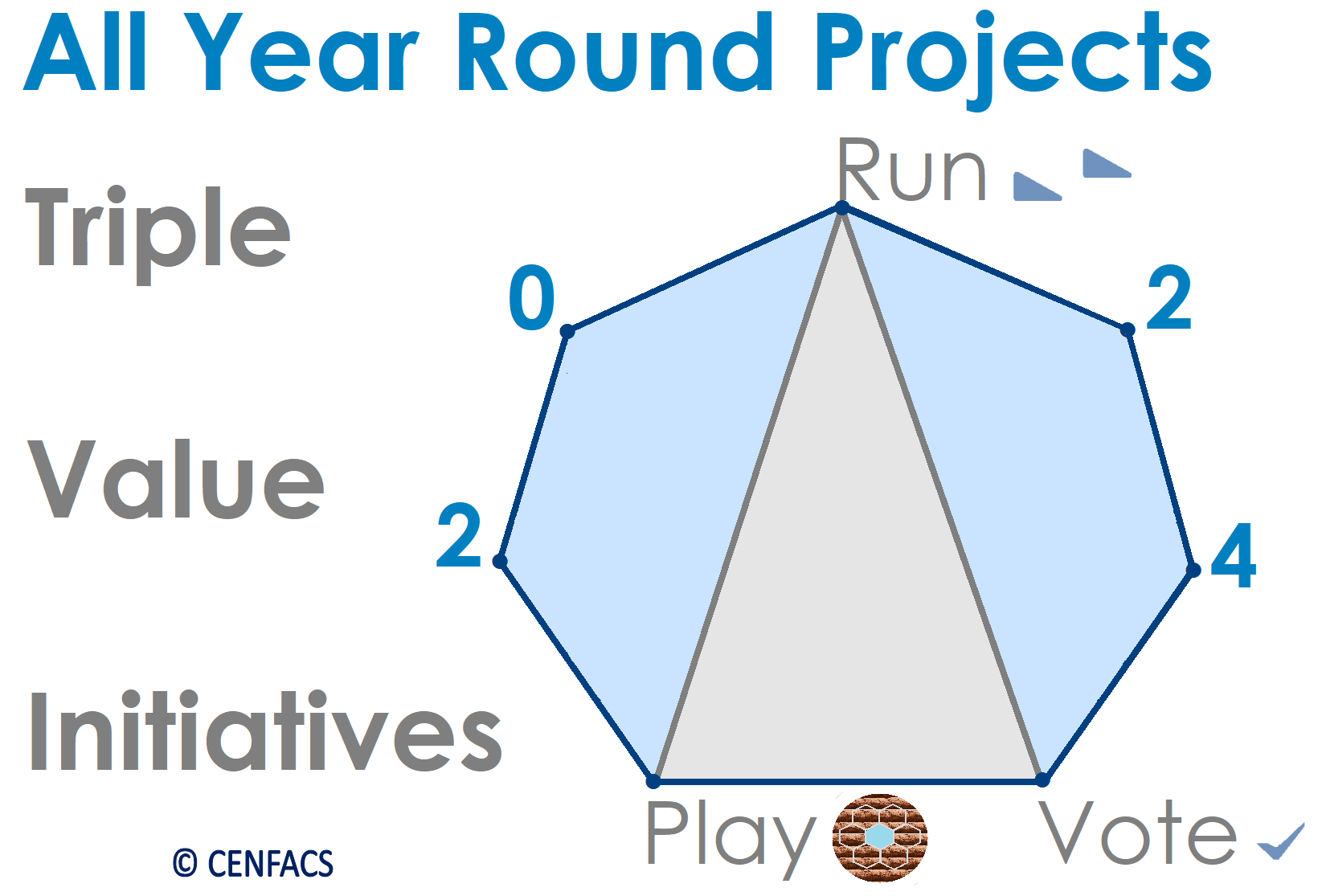

• Project Planning/Start Up Service for the Users of Triple Value Initiatives (or All Year-round Projects)

• Financial Controls 2024 for Households

• Impact Monitoring, Evaluation, Learning, Development and Action Plan about Structured Finance Activities or Micro-projects under Financial Capacity and Capability Building Programme or Scheme

• Project Planning/Start Up Service for the Users of Triple Value Initiatives (or All Year-round Projects)

In order to support those who have decided or may decide to engage with All-year Round Projects or Triple Value Initiatives, we are running start up sessions for each of them (i.e. Run, Play and Vote projects). What do we mean by running start up sessions for Run, Play and Vote projects?

• • Start up for Run, Play and Vote Projects

Start up for these projects is about working with whoever decides to execute the above mentioned projects to set the tone of their projects and expectations for themselves. It is also about setting realistic goals and working out the right methodology from the beginning to the end in their project journey. It includes better planning and management.

• • Phases of Project Planning and Management

We are going to deal with different phases of project planning or start up from the idea (of running or playing or voting) to the initiative implementation, impact monitoring and evaluation.

Whether you want to run or play or vote; you need to undertake a basic project planning in terms of the way you want to do it. This basic project planning/start-up will include things like the following:

σ Aims (changes you plan to achieve)

σ Impact (a longer-term effects of your project)

σ Inputs (resources you will put into your initiative)

σ Monitoring (regularly and systematically collecting and recording information)

σ Outcomes (changes and effects that may happen from your initiative)

σ Indicators (measures or metrics that show you have achieved your planned outcomes)

σ Budget (income and expenses for your initiative)

σ Reporting (sharing your actions and results)

Etc.

• • All-year Round Projects Cycle

Project planning will include the different steps of project cycle (as shown by the All-year Round Projects Cycle above), which are: Identification, preparation, feasibility study, appraisal, negotiations and agreement, start, implementation, monitoring, reviews, termination, evaluation and impact evaluation.

These steps will be approached in a simple and practical way to make everybody (especially those members of our community who are not familiar with them) to understand what they mean and how to use them in the context of Triple Value Initiatives.

As we all know, not everybody can understand these different steps they need to navigate in order to make their initiative or project a success story. That is why we are offering this opportunity to those who would like to engage with the Triple Value Initiatives (Run, Play and Vote projects) to first talk to CENFACS so that we can together soften some of the hurdles they may encounter in their preparation and delivery.

For those who are interested in this service, they can contact CENFACS by phoning, texting, e-mailing and completing the contact form on this website. We can together discuss in detail your/their proposals about either your/their Run or Play or Vote projects.

For those who would like to discuss with CENFACS their Triple-value-initiative plans or proposals, they are welcome to contact CENFACS.

• Financial Controls 2024 for Households

As explained in our previous posts, Financial Controls are conducted with Financial Stability Campaign. During our previous work on Financial Controls with households, we focussed on Year-in-review Accounts as they are part of Financial Controls project or exercise, which also includes income boost and other financial tools making our Campaign to reduce and end poverty, particularly income poverty.

Before we start Financial Controls 2024, we would like to inform our beneficiaries that we are still working on 2023 Year-end Financial Controls as stocking and charge taking tools for poverty reduction. We are doing it until the 31st of March 2024 or until the end of the financial year, the 6th of April 2024. For those who need support for the Year-end 2023 Accounts, they should not hesitate to contact CENFACS.

• • Financial Controls 2024

To conduct Financial Controls 2024, we have planned five weekly sessions starting from this week. The five sessions match the five essential financial controls given by ‘eftsure.com’ (8), which are:

a) Segregation of duties

b) Internal auditing

c) Budgeting and forecasting

d) Reconciliation

e) Cash management.

Let us start with the first control, which is segregation of duties.

• • In Focus from 14/02/2024: Segregation of Duties

Before releasing the note for Segregation of Duties, let us remind our audiences the meaning of financial controls. The definition used here of financial controls comes from ‘corporatefinanceinstitute.com’ (9) which explains that

“Financial controls are the procedures, policies, and means by which an organisation monitors and controls the direction, allocation, and usage of its financial resources. Financial controls are at the very core of resource management and operational efficiency in any organisation”.

Financial controls has components which include monitoring cash flow projections, analysis of balance sheets and income statements, reconciliation of accounts payable and receivable records, and ensuring compliance with regulatory requirements.

• • • Segregation of Duties as Financial Control by Households

Like any organisation, households can segregate their duties. Separating their household responsibilities from each other means assigning different tasks to those making their household and sharing control while catching errors in the running of their households.

To implement their segregated duties, they need to proceed with the following:

σ Identifying key financial processes and associated tasks forming their households

σ Assigning duties to different members of their households

(Even children when they learn since they are little what duties they can have in their family; there assigned duties can contribute to the effectiveness of financial controls in their family. For instance, children whose duty is to save resources not to waste them can contribute to the financial well-being and wealth of their family)

σ Ensuring that financial control is shared within the household, not only a matter of one person only

σ Regularly reviewing and updating your segregation of duties.

The above is the first financial control we wanted to share with our users or beneficiaries.

If anyone of our members need support regarding their financial controls and in particular Segregation of Duties within their household, they should not hesitate to contact CENFACS.

• Impact Monitoring, Evaluation, Learning, Development and Action Plan about Structured Finance Activities or Micro-projects under Financial Capacity and Capability Building Programme or Scheme

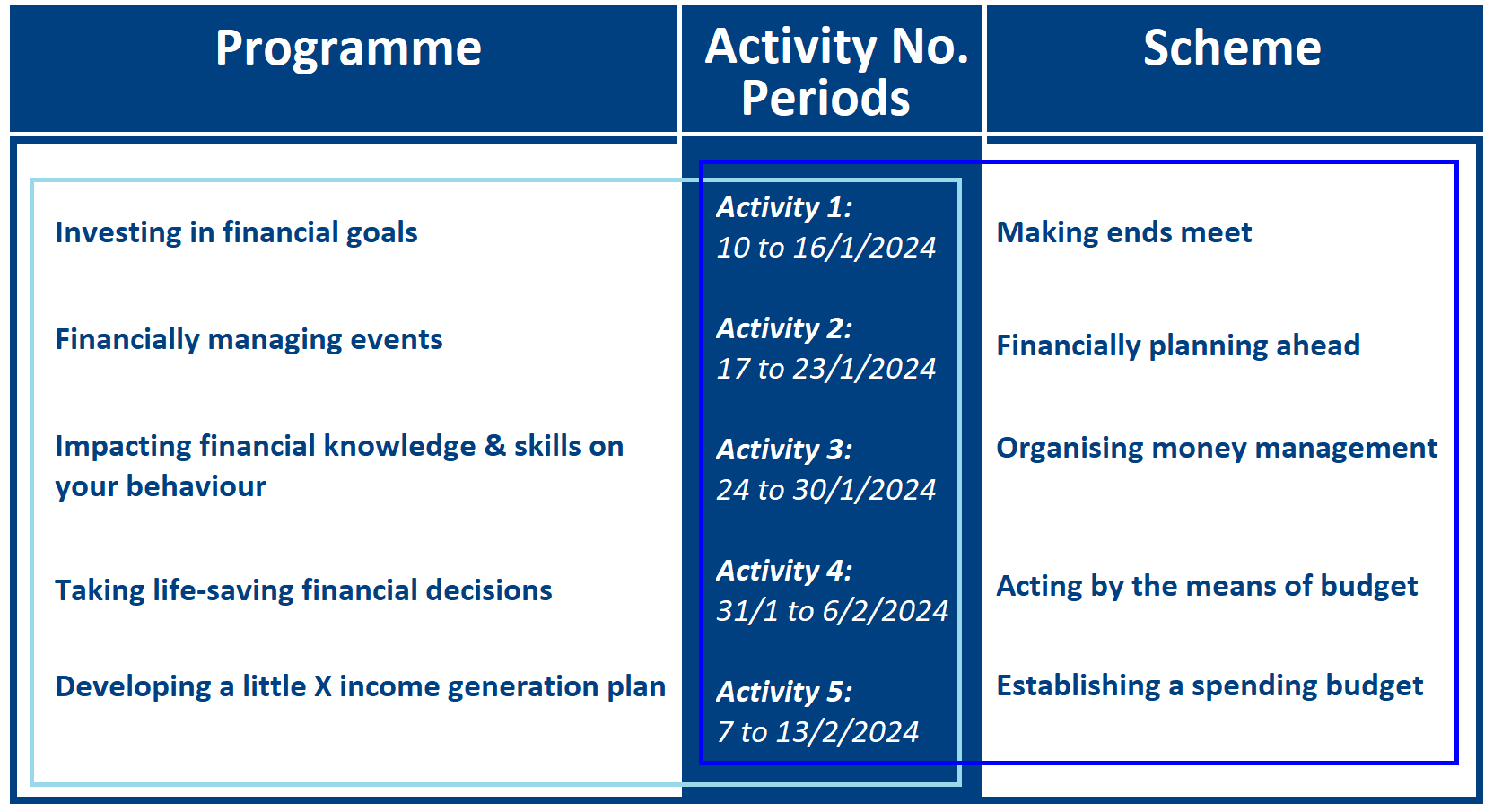

From 10/01/2024 to 13/02/2024, we have focused on Structured Finance Activities or Micro-projects under Financial Capacity and Capability Building Programme or Scheme, in particular we carried out the following working plan:

In order to know the progress and achievements made as well as the to examine our performance against objectives, we are carrying out two exercises:

a) Impact Monitoring and Evaluation

b) Learning Development and Action Plan.

Let us explain what these two exercises are about.

• • Impact Monitoring and Evaluation of Structured Finance Activities or Micro-projects under Financial Capacity and Capability Building Programme or Scheme

We are now carrying on with the systematic process of observation, recording, collection and analysis of information regarding the five Structured Finance Activities or Micro-projects conducted under on Financial Capacity and Capability Building Programme or Scheme in order to get its impact or at least its output. This routine process will help to examine the activities developed and identify bottlenecks during the process to see if they are in line with objectives we defined.

Also, we are undertaking the sporadic activity to draw conclusion regarding the relevance and effectiveness of the activities or microprojects presented. This activity will contribute to the determination of the value judgement regarding the performance level and attainment of defined objectives for Financial Capacity and Capability Building Programme or Scheme within the community.

The findings from this Impact Monitoring and Evaluation will help to figure out what has been achieved through this work and give us some flavour about the future direction of Financial Capacity and Capability Building Programme or Scheme.

As part of this Impact Monitoring and Evaluation exercise, we would like to ask to those who have been working with us throughout the last five weeks to share with us their feelings and thoughts about these three areas:

(a) The overall “Structured Finance Activities or Micro-projects conducted under on Financial Capacity and Capability Building Programme or Scheme”

(b) Any of the activities or microprojects they have been interested in or used in the context of running their household

(c) The relevancy or suitability of these activities or microprojects in terms of dealing with their financial matters.

You can share your feelings, thoughts, takeaways and insights with us by:

∝ Phoning

∝ Texting

∝ E-mailing

∝ Completing the contact form with your feelings and thoughts.

• • Learning Development and Action Plan for Structured Finance Activities or Micro-projects conducted under on Financial Capacity and Capability Building Programme or Scheme

As part of keeping the culture of continuous learning and professional development within CENFACS, we are examining what the running of Structured Finance Activities or Micro-projects conducted under on Financial Capacity and Capability Building Programme or Scheme have brought and indicated to us. We are particularly looking at the learning and development priorities and initiatives. In this exercise, we are considering the action points and plan we may need to make in order to improve or better change the way in which we deliver our services and work with users.

For those who have been following the running of these activities or microprojects with us, this is the time or opportunity they can add their inputs to our learning and development experience so that we can know the financial skills gap that need to be filled up in the future. They can as well have their own action plans on how they would like to take forward the contents of these activities or microprojects month. And if they have a plan and want us to look at it, we are willing to do so.

The plan could be on the above-mentioned activities or microprojects presented throughout this month. In particular, we can look at how any household making our community wants to make a plan for them or would like CENFACS to work with them on their chosen area of finances.

Those who have some difficulties in drawing such a plan, they can speak to CENFACS.

Message in French (Message en français)

• Suivi, évaluation, apprentissage, développement et plan d’action sur les activités et les microprojets de financement structuré dans le cadre du programme/processus de renforcement des capacités et aptitudes financières

Afin de connaître les progrès et les réalisations faites ainsi que d’examiner nos performances par rapport aux objectifs, nous effectuons deux exercices :

a) Suivi et évaluation de l’impact

b) Développement de l’apprentissage et plan d’action.

Laissez-nous vous expliquer en quoi consistent ces deux exercices. Avant de les expliquer, il est mieux de rappeler les activités dont on parle.

Les cinq activités liées au programme sont les suivantes: investir dans des objectifs financiers, la gestion financière des investissements, impacter vos connaissances et compétences sur votre comportement, prendre des décisions financières qui sauvent, et élaborer un plan pour générer de revenus supplémentaires.

Les cinq activités relatives au processus sont ci-après: joindre les deux bouts du mois, planifier financièrement à l’avance, gérer de l’argent, agir à travers le budget, et établir le budget de dépenses.

• • Suivi et évaluation de l’impact des activités de financement structuré ou des microprojets dans le cadre d’un programme ou d’un processus de renforcement des capacités et aptitudes financières

Nous poursuivons actuellement le processus systématique d’observation, d’enregistrement, de collecte et d’analyse des informations concernant les cinq activités de financement structuré ou microprojets menés dans le cadre du programme ou du processus de renforcement des capacités et aptitudes financières afin d’en obtenir l’impact ou au moins les résultats. Cette procedure d’usage permettra d’examiner les activités développées et d’identifier les goulots d’étranglement au cours du processus pour voir s’ils sont conformes aux objectifs que nous avons définis.

De plus, nous entreprenons des activités sporadiques pour tirer des conclusions quant à la pertinence et à l’efficacité des activités ou des microprojets présentés. Cette activité contribuera à la détermination du jugement de valeur concernant le niveau de performance et la réalisation des objectifs définis pour le programme ou le processus de renforcement des capacités et aptitudes financières au sein de la communauté.

Les résultats de ce suivi et de cette évaluation de l’impact aideront à déterminer ce qui a été accompli grâce à ce travail et nous donneront une idée de l’orientation future du programme ou du processus de renforcement des capacités et aptitudes financières.

Dans le cadre de cet exercice de suivi et d’évaluation de l’impact, nous aimerions demander à ceux ou celles qui ont travaillé avec nous au cours des cinq dernières semaines de nous faire part de leurs sentiments et de leurs réflexions sur ces trois domaines:

a) L’ensemble des « activités de financement structuré ou microprojets menés dans le cadre du programme ou du processus de renforcement des capacités et aptitudes financières »

b) Toutes les activités ou microprojets qui l’intéressent ou qui l’utilisent dans le cadre de la gestion de leur ménage

c) La pertinence ou l’adéquation de ces activités ou microprojets en ce qui concerne le traitement de leurs questions financières.

Vous pouvez nous faire part de vos sentiments, de vos pensées, de vos points à retenir et de vos idées en :

∝ téléphonant

∝ envoyant des textos

∝ utilisant une messagerie électronique

∝ remplissant le formulaire de contact avec vos impressions et vos pensées.

• • Plan d’action et de développement de l’apprentissage pour les activités de financement structuré ou les microprojets menés dans le cadre du programme ou du process de renforcement des capacités et aptitudes financières

Dans le cadre du maintien de la culture de l’apprentissage continu et du développement professionnel au sein du CENFACS, nous examinons ce que la gestion d’activités de financement structuré ou de micro-projets menés dans le cadre du programme ou du processus de renforcement des capacités et aptitudes financières nous a apporté et nous a indiqué. Nous nous penchons particulièrement sur les priorités et les initiatives en matière d’apprentissage et de perfectionnement. Dans le cadre de cet exercice, nous examinons les points d’action et le plan que nous pourrions avoir besoin de mettre en place afin d’améliorer ou de mieux changer la façon dont nous fournissons nos services et travaillons avec les bénéficiaires.

Pour ceux ou celles qui ont suivi la mise en œuvre de ces activités ou microprojets avec nous, c’est le moment ou l’occasion d’ajouter vos contributions à notre expérience d’apprentissage et de développement afin que nous puissions connaître le déficit de compétences financières qui doit être comblé à l’avenir. Vous peuvez également avoir vos propres plans d’action sur la façon dont vous souhaitez faire avancer le contenu de ces activités ou de ces semaines de microprojets. Et si vous avez un plan et veulez que nous l’examinions, nous sommes prêts à le faire.

Le plan pourrait porter sur les activités ou les microprojets mentionnés ci-dessus présentés tout au long de cinq dernières semaines. En particulier, nous pouvons examiner comment les ménages de notre communauté veulent faire un plan pour eux ou aimeraient que le CENFACS travaille avec eux sur le domaine financier qu’ils ont choisi.

Ceux ou celles qui ont des difficultés à élaborer un tel plan, ils/elles peuvent s’adresser au CENFACS.

Main Development

• Africa Not-for-profit Investment 2024 –

In Focus: Impact Investing in Africa-based Sister Charitable Organisations and Causes Specialised in Home and Land Ownerships

Our coverage of Africa Not-for-profit Investment 2024 includes four items:

σ What Your Need to Know about Africa Not-for-profit Investment 2024

σ Impact Investing in Africa-based Sister Charitable Organisations and Causes

σ Mission/Objects/Speciality and Services of Africa-based Sister Charitable Organisations to Not-for-profit Invest with Impact

σ Guidance for Not-for-profit Investors about Organisations to Not-for-profit Invest for Impact in Africa.

Let us highlight each of these items.

• • What Your Need to Know about Africa Not-for-profit Investment 2024

As its focus says, Africa Not-for-profit Investment 2024 deals with Africa-based Sister Charitable Organisations and Causes Specialised in Home and Land Ownerships, and Impact Investors who would like to put their money or other assets into these organisations.

Africa Not-for-profit Investment 2024 highlights essential information about the mission/objects/speciality and services of these organisations. What they provide could be interesting for potential not-for-profit investors.

Africa Not-for-profit Investment 2024 is a mini-guide for those who would like to not-for-profit invest with impact in Africa and in these organisations. This mini-guide is therefore for those investors who are new to impact investing and those who want to know where and into what organisation to not-for-profit invest in Africa.

• • Impact Investing in Africa-based Sister Charitable Organisations and Causes

African Sister Charitable Organisations and Causes (ASCOCs) can be an alternative route for investing in Africa for those investors having other motives than only making profit. Investing in this sort of organisations and causes is a way of thinking differently and approaching poverty from a different and new perspective.

Indeed, there is a difference between investing in organisations that consider poverty reduction as a residual or appended or negligible aspect of their main trading activity compared to those organisations or causes that take poverty reduction as their main or core mission or activity. So, if one wants to see real improvements in reduction of poverty in quality and quantity; then putting their money and assets into ASCOCs that take poverty reduction as their core mission could be a viable option. However, one needs also to know these organisations in which they want to invest.

In the context of Africa Not-for-profit Investment 2024, the knowledge of these organisations is on their mission/objects/speciality and matching services they offer. They are those working in the fields of home and land ownerships.

• • Mission/Objects/Speciality and Services of Africa-based Sister Charitable Organisations and Causes to Not-for-profit Invest with Impact

Although Africa Not-for-profit Investment 2024 is not a sort of classified entries that list organisations with their names and contact details, it nevertheless provides the brief mission or objects or speciality and matching services of the Africa-based Sister Charitable Organisations and Causes working in the areas of home and land ownerships, and needing investment to continue to their work of poverty reduction in Africa.

The following are the possible mission/objects/speciality and matching services of these organisations, which potential not-for-profit investors can look into and decide whether or not there is an opportunity to invest in them. Organisation’s mission/objects are abbreviated as OMO and Related Organisation’s Service are shortened as ROS.

——————

OMO1: help potential homeowners to access affordable housing financing solutions

ROS1: homeownership counselling on suitable financial products to find their homeownership project

——————

OMO2: homeownership and land tenure

ROS2: development of housing supply for poor households and assistance to access low-cost housing opportunities

——————

OMO3: women and land matters

ROS3: dealing with change customs and traditional practices that prevent women from inheriting or acquiring ownership of land and other properties, micro-finance for women

——————

OMO4: gender equity and land equality

ROS4: work on the removal of cultural restrictions linked to land inheritance and improving women’s ability in other areas (e.g., documenting land rights for women), indigenous and rural communities

——————

OMO5: secure tenure rights to land

ROS5: protection of land against risks and crises such as armed conflicts and natural disasters that lead people to becoming landless and homeless

——————

OMO6: land and home/property rights against land grabbing (e.g., mining/forestry exploitation projects)

ROS6: advocacy and campaign for restoration of land rights to the dispossessed land/homeowners, for direct financial compensation and adequate wage for labour

——————

OMO7: general access and affordability of homes

ROS7: intergenerational wealth transfers through home access for the poor

——————

OMO8: residential and social mobility

ROS8: advice, information and guidance to support people to match job opportunities and residential mobility

——————

OMO9: sustainable homeownership for all and sustainable solutions to shelter poverty

ROS9: home finding service for all and access to housing ladder

——————

OMO10: skills development, learning and wellbeing in homeownership

ROS10: information and knowledge about housing poverty, development of homeownership, improvement of the quality of life through better housing and perception of land tenure

——————

OMO11: traditional purchase or sale of a residential building/dwelling

ROS11: residential property buying and selling service

——————

OMO12: newly constructed building with the builders’ intent to occupy the dwelling

ROS12: property development and finance

——————

OMO13: inherited residential dwelling to stem homeownership from one generation to the next

ROS13: inheritance and micro-finance

——————

The above is the essential mission/objects/speciality and main services of Africa-based Sister Charitable Organisations working in home and land ownerships. It is the highlight of the prospect for not-for-profit investing in Africa’s housing sector. It is part of a series of contents for advice and tips planned for 2024 to work with potential not-for-profit investors.

For those not-for-profit investors who are interested in a particular mission/object/speciality and matching service, and who would like to dive deeper into this matter, they are free to contact CENFACS.

• • Guidance for Not-for-profit Investors about Organisations and Causes to Not-for-profit Invest for Impact in Africa

Those potential not-for-profit investors who need customised guidance about how to not-for-profit invest in Africa, they can contact us so that we can conduct needs assessment with them and search their ideal Africa-based organisation to invest in. We run a Matching Organisation-Investor Programme to that effect.

• • • What Is a Matching Organisation-Investor Programme?

Matching programme is a term used in various settings. In the context of CENFACS, Matching Organisation-Investor Programme is the process by which organisations (here Africa-based Sister Organisations) are matched against not-for-profit (n-f-p) investors. The programme uses n-f-p investors’ description of their requirements to fit organisations’ needs via a fit test.

• • • The Aim of Matching Organisation-Investor Programme

The aim of this programme is to reduce poverty amongst the people in need in Africa; poverty due to the lack of best match or fit between ASOs’ needs and not-for-profit investors’ interests. Where the needs of the ASOs best meet or match the vested interests of not-for-profit investors, there could be high probability to reduce poverty amongst the beneficiaries of ASOs. The match probability could be high or average or low depending on how much ASOs’ needs meet investors’ interests.

• • • How Can Africa-based Sister Organisations and Not-for-profit Investors Be Matched?

The matching happens through the two main components of this programme, which are Impact Advice to ASOs and Guidance to Not-for-profit Investors for Impact.

• • • • What Is Impact Advice to ASOs?

It is an approach to or methodology of working with ASOs that uses a theory of change to measure impact following advice given on project planning.

Impact Advice to ASOs is about

√ Working with ASOs to overcome their project planning problems

√ Helping them to improve their project planning processes, knowledge, skills and capabilities

√ Making sure that project planning benefits the users and communities they serve, particularly those living in poverty

√ Ensuring that project planning tackles the root causes of poverty and hardships

Etc.

Impact Advice uses impact measuring tools and frontline metrics to track results and outcomes.

• • • • Guidance to Not-for-profit Investors for Impact

This is a service we offer to those n-f-p investors who would like to not-for-profit invest for impact in Africa’s not-for-profit organisations and charitable causes. To understand this service, one needs to know “What is a Not-for-profit Investment?” (10)

A Not-for-profit Investment is a sum of money puts into a not-for-profit organisation in order to help this organisation achieve its not-for-profit mission. Not-for-profit means that the organisation is not engaged in the activity of realising a greater difference between its sales revenue and total costs. Instead, the organisation aims at providing services without making profit, services that benefit its members or the community as specified in its governing document.

This not-for-profit investment can be in the physical or financial form. Therefore, there are two types of investment that not-for-profit investors can choose in order to engage in, which are: physical or real investment and financial investment.

This guidance is based on not-for-profit investment and impact investing. What is impact investing?

According to ‘evpa.ngo’ (11),

“Investing for impact is an impact strategy followed by investors that adopt the venture philanthropy approach to support social purpose organisations maximising their social impact. Investors for impact support innovative solutions to pressing societal issues, providing in-depth non-financial support and taking on risks that most of other actors in the market cannot – or are not willing to take”.

Briefly, Africa-based Sister Organisations and Not-for-profit Investors can be matched via Impact Advice on project planning for the former and Guidance on Impact Investing for the latter. To realise a successful match, some guidelines need to be followed.

Those who have any queries and/or enquiries about this guidance, they can communicate with CENFACS.

If a potential investor cannot find the above-mentioned types of mission/objects/speciality and matching services they want, they can contact CENFACS. They can join CENFACS’ Guidance Programme for those who would like to not-for-profit invest in Africa.

_________

• References

(1) https://www.statista.com/statistics/613846/urban-households-who-can-afford-the-cheapest-new-houses-africa-by-country/ (accessed in January 2024)

(2) https://housingfinance.org/app/uploads/2023/10/2023-CAHF-Yb_Compressed-14.11.2023.pdf (accessed in February 2024)

(3) Shrestha, M. (2021), Access to Basic Services and Its Linkage with Ending Poverty. In: Leal Filho, W., Azul, A. M., Brandli, L., Lange Salvia, A., Ozuyar, P. G., Wall, T. (eds) No Poverty. Encyclopedia of the UN Sustainable Development Goals, Springer, Chana. https://doi.org/10.1007/978-3-319-69625-6_1-1 (accessed in February 2024)

(4) https://www.onsecrethunt.com/what-is-the-definition-of-lack-basic-services/ (accessed in February 2024)

(5) https://crisisresponse.iom.int/sites/g/files/tmzbdl1481/files/appeal/pdf/2024_Chad_Crisis_Response_Plan_2024.pdf (accessed in February 2024)

(6) https://reliefweb.int/disaster/fl-2024-000009-cod (accessed in February 2024)

(7) https://www.globalhungerindex.org (accessed in February 2024)

(8) https://eftsure.com/blog/processes/five-essential-financial-financial-controls-every-financial-leader-must-implement/# (accessed in February 2024)

(9) https://corporatefinanceinstitute.com/resources/career-map/sell-side/risk-management/financial-controls/ (accessed in February 2024)

(10) cenfacs.org.uk/2023/02/08/africa-not-for-profit-investment-outlook-2023/ (accessed in November 2023)

(11) https://www.evpa.ngo/impact-glossary (Accessed in March 2023)

_________

• Help CENFACS Keep the Poverty Relief Work Going this Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE AND BEAUTIFUL CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2024 and beyond.

With many thanks.