Welcome to CENFACS’ Online Diary!

16 August 2023

Post No. 313

The Week’s Contents

• Financial Updates – In Focus for 2023 Edition: Financial History – How to build your financial past for poverty reduction

• Following the Direction of Poverty Reduction this Summer via Marine and Coastal Ecosystem Services, Trending Topic in Focus from Wednesday 16/08/2023: Cultural Services

• Happiness and Healthiness Journal 2023, Creative Activity No. 4: Create Your Journal of Real Disposable Income

…And much more!

Key Messages

• Financial Updates – In Focus for 2023 Edition: Financial History

How to build your financial past for poverty reduction

Too many crises (like the coronavirus disaster, the cost-of-living crisis, food crisis, energy crisis, nature crisis, climate crisis, debt crisis, geo-economic crisis, etc.) can make people, especially those living on ordinary means, find their financial history in threat or destruction. Yet, financial history is important especially in the process of recovering and rebuilding from crises.

The 2023 Edition of Summer Financial Updates (SFU) focuses on information about income, finances, assets, salaries and wages, monetary incentives, insurance, financial transactions, credit worthiness, and debts that our users may need to prove or produce in order to justify their financial past.

In this year’s edition of SFU, we have provided guidance, tips and hints about ways of building forward financial history. In this respect, the 2023 Edition of SFU will help our users

√ to apply money, financial and banking knowledge in their daily life

√ to identify the causes of financial crisis (e.g., debt crisis or distress) through which some of our members may have gone or face

√ to reconstruct their financial history

√ to identify and learn from past financial mistakes

√ to reflect on their financial wellbeing and record keeping and tracking

√ to have a historiographical view of their finances

√ to improve the relationship between their financial history and financial poverty reduction

√ to make better financial projections from their financial past

etc.

In brief, the 2023 Edition of SFU is not only about learning your financial past and background, but also avoiding financial mistakes of the past in the future; mistakes that could have led some to financial poverty. In this respect, this edition will help to find way of achieving the goal of financial poverty reduction.

We have provided key highlights about the 2023 Edition of SFU under the Main Development section of this post.

• Following the Direction of Poverty Reduction this Summer via Marine and Coastal Ecosystem Services, Trending Topic in Focus from Wednesday 16/08/2023: Cultural Services

This week, we are continuing to follow the direction of poverty reduction via Marine and Coastal Ecosystem Services by looking at Cultural Services. In order to carry out this follow up, let us first understand Marine and Coastal Ecosystem Cultural Services (MCECS).

• • Basic Understanding of Marine and Coastal Ecosystem Cultural Services

Our definition of cultural services provided by marine and coast ecosystems comes from the Millennium Ecosystem Assessment (1), which defines these services as

“The non-material benefits people obtain from ecosystem through spiritual enrichment, cognitive development, reflection, recreation, and aesthetic experiences, including: cultural diversity, spiritual and religious values, knowledge systems, educational values, social relations, sense of place, cultural heritage values, recreation and ecotourism”.

By classifying MCECS in terms of monetary and non monetary metrics provisioning, Joao Garcia Rodrigues et al. (2) explain that MCECS classes (like nature-based recreation, tourism, and landscape or seascape scenic beauty) provide monetary metrics. Besides that, MCECS also have non-material or non-monetary quantified benefits such as spiritual interactions, inspirational experiences, cultural identity, sense of place, bequest and existence values.

These provisions or benefits can be treated as means to follow the direction of poverty reduction.

• • Following the Direction of Poverty Reduction via MCECS

Coastal zones and their ecosystems provide objects of cultural and spiritual value and environments for recreation, as explained above. Because of that, it is possible to follow the direction of poverty reduction via MCECS.

The Millennium Ecosystem Assessment (op. cit.) states that people have benefited in many ways from cultural ecosystem services, including aesthetic enjoyment, recreation, artistic and spiritual fulfilment, and intellectual development. However, do those benefits reach poor people? Is there any relationship between MCECS and poverty reduction in coastal areas.

• • • Possible links and relationships between cultural services and poverty reduction

There are pros and cons arguments about links and relationships between cultural services and poverty reduction.

There are those who argue that cultural ecosystem services reflect people’s physical and cognitive interactions with nature and are increasingly recognised for providing non-material benefits to human societies. Among them are those who believe that cultural services (such as recreational, spiritual, religious and other non-material benefits) can benefit coastal poor because they are part of human societies.

In contrast, there are those who do not agree with that argument as they think that MCECS mostly benefit rich tourists or those who can afford go to coastal resorts and spend their money. For this body of opinions, there is little or no monetary benefit for coastal poor deriving from coastal tourism.

Looking at cultural services with the constituents of well-being (like security, basic material for good life, health, good social relations, freedom of choice and action), there are others who think that there are no many studies around the impact of MCECS on poverty and poverty reduction; therefore it is difficult to assert that there is or not a relationship between MCECS and coastal poverty reduction.

For example, Katrina Brown et al. (3) highlight the pro-poor perspective by saying that

“The main benefit of tourism is not a cultural ecosystem service but as a source of livelihood and is therefore classified [in this report] as a provisioning service” (p. 16).

Because of these differences in opinions and lacks of research findings, it makes sense that those who would like to investigate or know more about the above-stated impact to follow the direction of poverty reduction via cultural services.

• • • How can you help in following the direction of poverty reduction via Cultural Services?

Each of our members and supporters can follow the direction of poverty reduction via cultural services.

For those of our members, supporters and audiences heading towards coastal areas this Summer or just interested in this trending topic, they can enquire about whether or not cultural services are helping coastal poor to reduce poverty.

For those who have stories with hard evidence on this matter, they can as well add their inputs by contacting CENFACS with their stories and or data.

For example, those who may have opportunity to talk to coastal poor communities about the impacts of Marine and Coastal Ecosystem Services on them, they can share their findings with us. This is the same for those who have been involved in or running any pieces of research in the form of focus discussion group, a pilot research project, a survey, etc.

To follow the direction of poverty reduction via cultural services with us, please contact CENFACS.

• Happiness and Healthiness Journal 2023, Creative Activity No. 4: Create Your Journal of Real Disposable Income

With the lingering effects of the coronavirus and the impact of the cost-of-living crisis, many people’s real disposable incomes and income-generating capacity and opportunities have been changed or simply destroyed. Despite that one can create a journal that explains their experiences, feelings and thoughts in terms of happiness and healthiness about real disposable income over this Summer 2023. But, what is real disposable income?

• • Understanding Real Disposable Income to Create Your Journal of Happiness and Healthiness

Generally, income is any earning in the form of wages and salaries, the return of investments, pension contributions, and other receipts (such as profit, interest, dividend, rent, capital gains, royalties, etc.). This income can be real disposable. What is a real disposable income?

Using the definition provided by ‘tutor2u.net’ (4), real disposable income is

“The amount of money an individual or household has available to spend or save after accounting for taxes and adjusting for inflation. It is a key measure of the purchasing power and economic well-being of individuals or households”.

One can refer to this definition of real disposable income to create their Journal of Happiness and Healthiness.

• • An Example of Way of Creating a Journal of Real Disposable Income

One can explain how with restricted or limited income they have been able to meet Summer 2023 holiday expenses or simply do the things they wanted or planned to do with happiness and healthiness. They can as well include in their journal any efforts they undertook to make extra income to meet their Summer living costs or improve their economic well-being. They could finally impact share their story if they received or given any financial help.

• • Impact Record and Share of Your Journal of Real Disposable Income

They can impact record their thoughts, feelings, experiences, souvenirs and memories in relation to real disposable income and income-generating capacity or opportunities. They can impact share with the community their experience of happiness and healthiness with income. This can be recorded in their journal and be shared by the end of Summer 2023.

To impact share the contents of their happiness and healthiness journal relating to real disposable income and income-generation, to happy and healthy financial life via income, and help build a better Summer holiday experience; they can contact CENFACS.

Extra Messages

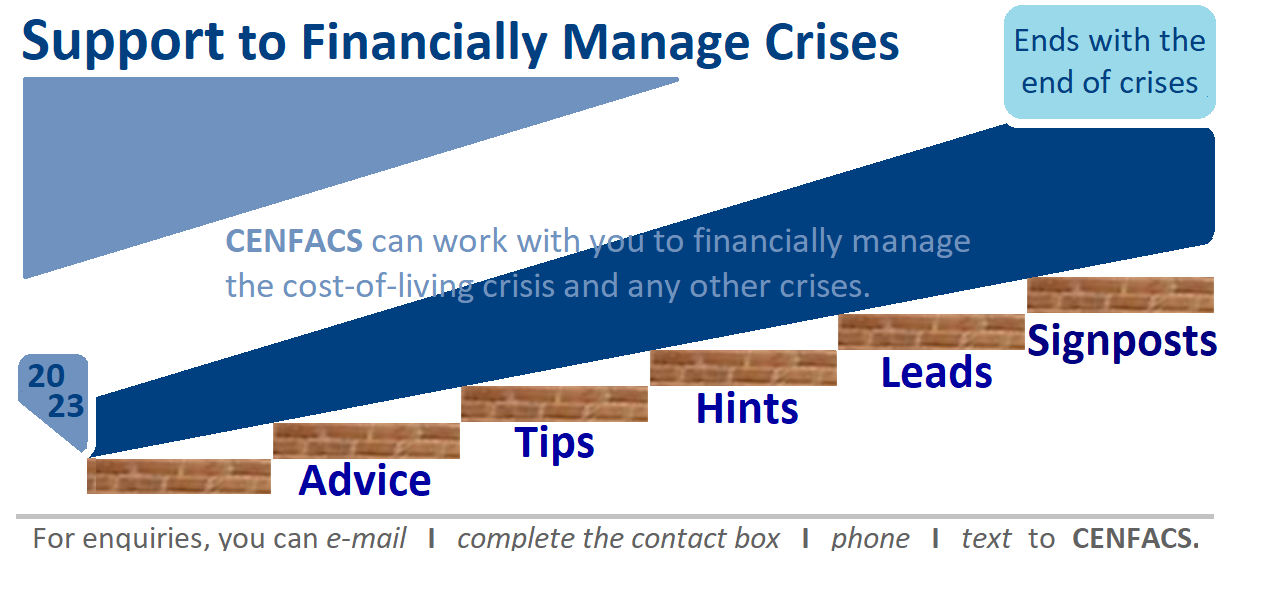

• Summer 2023 Activities, Projects and Programmes: Help, Support and Assistance are AVAILABLE!

• Summer Triple Pack is Still Running

• CENFACS’ Hub for Testing Hypotheses

• Summer 2023 Activities, Projects and Programmes: Help, Support and Assistance are AVAILABLE!

We believe that everybody is enjoying their Summer break wherever they are and whatever they are doing, despite the lingering effects of the coronavirus, extreme temperatures and the cost-of-living crisis.

We also hope that those who are working over this Summer are getting on well with their work while finding some space to accommodate and enjoy the good weather of Summer.

We finally trust that Summer 2023 Happiness and Healthiness Projects, including other Summer activities and programmes we have offered so far, are meeting the community’s need to happily and healthily pass this Summer.

For those who need any help, support and assistance regarding any of the aspects of the Happiness and Healthiness Projects or any other Summer activities or programmes which are on offer, they should not hesitate to contact CENFACS.

We would like to reiterate our wish to all multi-dimensional Poor Children, Young People and Families of Happy, Healthy, Vulnerability-free, Peaceful, Safe and Sustainable Summer Days.

• Summer Triple Pack is Still Running

Our Summer Triple Pack made of Track, Trip and Trending continues this week. The key message we would like to get across this Triple Pack is to try to help reduce poverty by undertaking any of these three activities: running, visiting projects and analysing trends. Let us make some reminding points about each of them.

• • Healthy, Safe and Net Zero Track to Help Reduce the Cost-of-living Poverty

This activity (Activity 8.1) of the pack is about Safely, Healthily and Net Zero Run 2.5 miles (nearly 4 km) with people in need to create user-generated information opportunity through the use of influencing skills.

For those who have completed their 2.5 miles of running with people, please do not hesitate to share with us your experience. This activity is also performed under August 2023 Influence Year/Project (Activity 8.1).

For those who are deprived to physically run, they can virtually run to help reduce poverty with CENFACS. Among them are people who may be experiencing handicap to do physical activity of running to help reduce poverty. One could include the following in their list:

People or parents caring for very young children, pregnant women, elderly people, disable people, those who are not physically fit or mobile to run, those who do not have opportunity to physically run, etc.

If you are organising this kind of virtual activity or event, let us know. It is also better to advise us that the people participating in the virtual run are the physically deprived ones we have listed above or they have a serious handicap prohibiting them from undertaking any physical engagement.

• • Virtual or In-person Trips or Tours of 3 Influencing Projects or Activities

As part of Knowledge Year’s/Project Activities of the month and Activity 8.2, we have suggested to Undertake Virtual or In-person Visits or Tours of 3 Influencing projects or activities; projects or activities based on influencing facts, information and skills acquired through experience or education, and which use influencing methodology and tools to support people this Summer 2023.

These virtual visits are not only online recreational activities. They are also a learning and development opportunity in terms of understanding the following:

√ The way in which people or communities living with the lingering effects of the coronavirus, particularly those who are undertaking coping and survival strategies, are dealing with these effects as well as poverty and vulnerability induced by the cost-of-living crisis

√ What is needed to help them overcome the problems they have

√ What lessons that can be learnt and shared from their sensory experiences and knowledge-based projects to improve future actions, planning and decision-making processes

√ The demand in terms of policy development and response to meet similar needs in the future.

Furthermore, Virtual Trip as part of our Summer Triple Pack includes field work research in Africa and anywhere else in the context of poverty relief and sustainable development projects.

For those who are having or have had these experiences and results of field work research, please do not hesitate to share them.

• • Online Trending Activity by Following the Direction of Poverty Reduction via Marine and Coastal Ecosystem Services

As part of CENFACS’ Influence Year and Project and Activity 8.3, we have asked to those who can to Carry out online search to find 6 Trends in poverty reduction for projects that are based on the positive influence of people in need to navigate their way out of poverty.

The above mentioned Summer Triple Pack can be contextualised by considering the lingering impacts of the coronavirus, extreme temperatures and the damaging effects of the fall in real household disposable incomes.

• CENFACS’ Hub for Testing Hypotheses

As way of working with our community members who are involved in research and development for poverty reduction and sustainable development, CENFACS has a Hub for Testing Hypotheses or H-tests Hub for those investigating poverty reduction using statistics or any other quantitative methods.

• • Who is H-tests Hub for?

The H-tests Hub is open to those running poverty reduction projects aiming at testing or retesting specific hypotheses or predictions arising from theories of poverty reduction in order to back or disprove a theory or body of knowledge or a relationship between variables. But, the Hub will not decide the results of their tests, that is whether to reject or fail to reject beneficiaries’ null hypothesis.

In this respect, CENFACS Hypotheses Testing Hub provides an opportunity to share knowledge, good practice and experience in the field of poverty reduction and statistics related to poverty reduction. It is also a platform to network between our community members who are poverty reduction researchers or investigators or who are simply involved in any piece of research.

• • How H-tests Hub Can Help

This Hub, which is part of the research and development function within CENFACS, will assist beneficiaries in performing statistical tests.

• • Projects Eligible at H-tests Hub

Projects eligible will be those that can help the community to reduce poverty and or enhance sustainable development.

Those who have projects to be tested (online or in-person) or would like to discuss with us their tests in terms of two or a group of variables linked to poverty reduction, they should not hesitate to contact CENFACS. Likewise, those who would like to support the hub they shall do the same.

For any enquiries and queries about CENFACS Hypotheses Testing Hub, please do not hesitate to contact CENFACS.

Message in French (Message en français)

• FACS n° 80, été 2023 : Pension et réduction de la pauvreté des personnes âgées

Le numéro 80 du FACS du CENFACS, qui traite de « La retraite et la réduction de la pauvreté des personnes âgées en Afrique », montre comment la pension peut être utilisée pour réduire la pauvreté parmi les générationes âgées en Afrique. Dans ce numéro, il s’agit d’une enquête sur les moyens de permettre aux pauvres de continuer à consommer après avoir cessé de travailler sans tomber dans la pauvreté de consommation. En tant que discussion sur l’alignement des pensions au niveau ou au-dessus du seuil de pauvreté, le numéro 80 est une histoire crue de construction d’une retraite durable pour éviter la pauvreté multidimensionnelle chez les personnes âgées.

Pour raconter cette histoire, le numéro 80 se réfère aux théories économiques de la retraite ou de l’économie de la pension comme celles de Nicholas Barr et Peter Diamond (5) pour expliquer les liens et les relations entre la pension et la pauvreté des personnes âgées, pour examiner la corrélation entre la pension sociale universelle (non ciblée) et la réduction de la pauvreté des personnes âgées en Afrique.

En effet, il y a des études qui ont été faites sur la pension et le bien-être des personnes âgées. Par exemple, Barr et Diamond (op. cit.) soutiennent que le but de la pension est d’assurer la sécurité économique des personnes âgées. Dans ce but, Barr et Diamond fournissent les objectifs suivants en matière de retraite: lissage de la consommation, assurance, réduction de la pauvreté et redistribution. Ils comprennent également d’autres objectifs de la pension comme le développement économique et la croissance économique.

Le numéro 80 met l’accent sur les objectifs de réduction de la pauvreté et de développement durable dans le but d’assurer une sécurité durable dans la vieillesse. Le but de la sécurité durable incarne la nécessité de s’attaquer aux facteurs interconnectés de l’insécurité pour les personnes âgées en incluant la durabilité économique, environnementale et sociale pour elles tout en allant au-delà de ces éléments bien connus de durabilité.

Le numéro 80, qui adopte une vision micro-économique des retraites, revient néanmoins sur les impacts des régimes de retraite non contributifs – pour les pays qui les gèrent – sur la réduction de la pauvreté et le développement durable. Cette revisite aide à comprendre comment, par exemple, les organisations sœurs basées en Afrique s’organisent pour créer et innover un soutien aux retraites pour les personnes âgées des communautés qu’elles servent afin de réduire et éventuellement de mettre fin à la pauvreté des personnes âgées.

Étant donné que la croissance économique actuelle de l’Afrique n’est pas suffisante pour réduire la pauvreté, le numéro 80 explore les moyens d’assimiler la pension minimale et le revenu moyen pour aider à réduire la pauvreté des personnes âgées dans ce contexte restreint de croissance économique limitée.

Les chiffres qui suivent donnent une indication de cette croissance et de la pauvreté en Afrique. Selon la Banque Mondiale (6), la croissance économique en Afrique subsaharienne a ralenti à 3,6% en 2022, contre 4,1% en 2021. D’après « statista.com » (7), en 2022, environ 431 millions de personnes en Afrique vivaient dans l’extrême pauvreté, avec un seuil de pauvreté de 1,90 dollar par jour.

Le numéro 80 utilise des classes de mesures sur les indicateurs de pauvreté (tels que le ratio d’écart de pauvreté) afin de plaider en faveur de ce qui doit être fait pour soutenir les Africain(e)s âgé(e)s, qui sont bénéficiaires des projets gérés par nos organisations sœur basées en Afrique, qui ne peuvent pas compter sur le soutien familial pour obtenir le soutien dont ils/elles ont besoin.

À cet égard, le numéro 80 fournit quelques idées sur la manière dont les organisations sœurs basées en Afrique peuvent soutenir et / ou aider les personnes âgées à sortir des crises qui se chevauchent (y compris la crise des retraites) auxquelles l’Afrique est confrontée et à protéger leur assurance. Elles le font en les aidant à accéder à des programmes de transferts monétaires pour les personnes âgées.

Pour avoir un aperçu de la façon dont les pensions peuvent être utilisées pour réduire la pauvreté parmi les générations âgées en Afrique, veuillez contacter le CENFACS.

Main Development

• Financial Updates – In Focus for 2023 Edition: Financial History

How to build your financial past for poverty reduction

Financial history is important for people’s financial wellbeing at all times, especially in the process of recovering and rebuilding from crises. Most people who have been impacted by crises (personal or collective ones) may need a sort of financial history to recover and rebuild. They may be in need of it if potential supporters, creditors and lenders ask them. Financial history can also be necessary to recollect the past financial events that led people into financial trouble, especially for the financial poor, so that they can learn and draw lessons from these events.

As ‘gatesfoundation.org’ (8) puts it,

“Without formal financial histories, people are [also] cut off from potentially stabilising and uplifting opportunities”.

After learning from past financial mistakes, taking actionable corrective decisions and building on their financial history; they will have opportunities and openings to lift themselves out of poverty and hardships.

The following highlights explain how to build your financial past for poverty reduction.

• • Key Highlights of this Summer Financial Updates

The following headings contain the main points highlighted in this Year’s SFU:

∝ What is financial history?

∝ Financial history as a key in the process of recovering and rebuilding from crises

∝ Project beneficiaries’ upkeep of financial information justifying their financial past

∝ Guidance, tips and hints to build forward financial history

∝ Application of money, financial and banking knowledge in every day life

∝ Identification of and learning from past financial mistakes

∝ Financial wellbeing and record keeping and tracking

∝ Historiography of your finances

∝ Improving the relationship between financial history and financial poverty reduction

∝ Making financial projections from your financial past

∝ How to use past financial mistakes to achieve the goal of financial poverty reduction

∝ Working with users to empower them with tools to build their financial history and achieve the goal of financial poverty reduction.

Let us unpack the above headings.

• • What is Financial History?

Financial history can mean something different things for many persons. For ‘lawinsider.com’ (9), financial history means

“Information about income, employee’s finances, assets, salaries, wages, monetary incentives, beneficiaries, insurance, benefits, financial transactions, credit worthiness, and debts”.

In short, financial history is a record or account of one’s financial past events and developments. Financial history includes past knowledge given or gained about any of the above listed elements in this definition. It is about explaining what happened in the past about these elements. Revealing these pasts can be a key in the process of recovering and rebuilding from crises.

• • Financial History as a Key in the Process of Recovering and Rebuilding from Crises

To recover and rebuild from crises, in particular where a crisis has led to the financial or economic collapse of people, it requires an understanding of the financial past of the financially and economically collapsed people.

For example, if one went to reduce or end a financial crisis as a result of alcoholism, it would be better to understand the alcohol-addicted persons’ past or history with both alcohol drinking habit and money in order for them to better recover and rebuild their life.

To add value to this example, the ‘graniterecoverycenters.com’ (10) give tips to help rebuild financial health relating to the rehabilitating process. These tips include the following:

get financial assistance, secure a job, expand your personal inventory, create your budget, separate needs and wants, and rebuild your credit score.

These tips can also be used in a different setting in the process of recovering and rebuilding from crises (like the cost-of-living crisis).

• • Project Beneficiaries’ Upkeep of Financial Information Justifying Their Financial Past

It is true that in time of crises (like natural disasters, war events, involuntary displacement, health catastrophes, etc.), the crises-impacted people could sometimes loose control of things including financial information relating to their lives, especially where people are forced to make difficult life-saving decisions and choices (that is, between life and nonlife).

All depends on the magnitude and deepness of the crisis. Whatever the difficult circumstances of life and depth of the crisis, it is always wise to keep financial information, particularly sensitive information that can help to justify financial past.

Those having some problems to look after their financial information, this Year’s SFU provides some tips to keep up project beneficiaries’ vital financial information.

• • Guidance, Tips and Hints to Build Forward Financial History

The tips and hints given within this resource are mostly in the form of non-regulated financial guidance. Likewise, the financial services it contains are designed to help our community to build forward their financial history.

Not all user households making the CENFACS Community have the skills and capacity to deal with their financial history problems with confidence. Some of them need advice, guidance, tips and hints to track and sort out their financial history.

The good news for them is that this year’s SFU provides guidance, resources (both online and in print), tips and hints on financial history matters.

For example, there is a tip on how to work out your personal income, which is generally made of salaries or wages received plus interest received plus rent received plus dividend received plus any transfer payments from the Government social benefits.

For those who would like to access the guidance, support information, tips and hints about their financial history, they are welcome to contact CENFACS.

• • Application of Money, Financial and Banking Knowledge in Every Day Life

Generally speaking, most people deal with money, financial and banking matters revolving around their daily life. However, does every body have the knowledge of these matters? This knowledge is important as it can affect people’s financial behaviour. The application of this knowledge is even more relevant because knowing something is not the same as applying it in real life.

Concerning the application of money knowledge, one needs skills, knowledge and behaviour to money management and financial well-being. In this respect, CENFACS can work with project beneficiaries to guide them to develop money management competency.

Regarding the application of financial knowledge, Tania Morris et al. (11) explain that

“According to several authors, adopting adequate financial behaviour depends largely on one’s financial knowledge. Financial knowledge tends to affect financial behaviour”.

From this perspective, the application of financial knowledge can determine certain types of financial behaviour.

As to the application of banking knowledge, many statistically-driven researches show that there is a positive relationship between the levels of financial literacy and frequency of i-banking use. This could suggest that financial literacy helps people to better apply banking knowledge in their every daily life.

There could be interlinkages between the three applications, that is of money, financial and banking knowledge in people’s life.

• • Identification of and Learning from Past Financial Mistakes

In order to build your financial past for poverty reduction, there could be a need to know your past financial mistakes or errors. The knowledge of those past financial mistakes and errors can contribute to learning and development of new skills and strategies to avoid their repeat. Mistakes can come from you or the people around you or those who came before you, the older generation. As Deepthi Nair (12) puts it,

“No matter your age, you can always learn from previous generations’ money mistakes to help you make more prudent financial decisions”.

• • Financial Wellbeing and Record Keeping and Tracking

Tracking and keeping your financial record can contribute to your financial wellbeing. It can improve the way you make money, you deal with the financial unexpected and you track your financial health. It can help you to stay financially resilient, confident and empowered if one refers to the meaning of financial well-being as provided by Money and Pensions Service (13).

Money and Pensions Service defines financial wellbeing as

“It is a about making the most of your money from day to day, dealing with the unexpected, and being on track for a healthy financial future. In short: financially resilient, confident and empowered”.

• • Historiography of Your Finances

Through this Year’s SFU, project beneficiaries will have the opportunity to reconstruct a record of their past financial activities and behaviour in order to have a more and better understanding of their finances. The historiography of their finances is thus the study of the history of their finances. They can do it by carrying out a critical examination about how the history or film of their finances looks like and evolves.

Those members of our community who will be interested in carrying out the historiography of their finances and need some support, they can ask CENFACS to help.

• • Improving the Relationship between Financial History and Financial Poverty Reduction

The study of the history of people’s finances can help to understand or to get insights if there is any relationship between this history and the financial difficulties they are experiencing. In other words, it is about establishing if there is any correlation between their financial past and efforts to reduce financial poverty they are undergoing. In this study, the attempt is to improve the relationship between financial history of our members and their efforts to come out financial poverty.

Through their financial stories about their financial history, CENFACS will work with them to explore ways of improving this relationship.

• • Making Financial Projections from Your Financial Past

The good thing about studying and learning about your financial past is the knowledge you get from your past will help to make financial projections. In other words, you will forecast your expected financial performance and position via expected metrics. This exercise will be based on a set of predictions about your financial future.

Some of our user households do some estimates of their future financial performance. However, what is not known if they relate them to their past financial data. From the perspective of financial history, there is a need for them to base their estimates from past financial data and circumstances in order to build the future.

• • How to Use Past Financial Mistakes to Achieve the Goal of Financial Poverty Reduction

Learning about past financial mistakes or faults is not an end itself. It can lead to a number of possibilities or outcomes. One of these possibilities or outcomes is that past financial mistakes can provide information and the willingness to reduce financial poverty for those suffering from it. What is financial poverty?

The definition of financial poverty used in this Year’s SFU comes from the article of Blessing Gweshengwe and Noor Hasharina Hassan (14) who explained the multidimensionality and complexity of poverty by arguing that

“Financial dimension of poverty refers to a lack or low level of income or having an income below a country’s minimum wage or income-poverty line; lack of access to loans from legal financial institutions, lack of savings, and being in debt”.

By learning from past financial mistakes, one can try to reduce any dimensions of financial poverty they are experiencing. One can use the financial guidance, tips and hints provided in this Year’s SFU to start or to continue to reduce financial poverty.

• • Working with Users to Empower them with Tools to Build Their Financial History and Achieve the Goal of Financial Poverty Reduction

The all purpose of SFU is not to provide theories or descriptions or even assumptions. Instead, SFU as a resource is designed to capacitate the CENFACS Community to address challenging issues they face. In this case, the challenging issue is how to build their financial past for poverty reduction.

In this exercise of addressing challenges, our members are not let alone. CENFACS can work with them. CENFACS can work with them to accomplish specific tasks to deal with their financial history, in particular to conduct the historiography of their finances relating to the following matters:

~ income and finances

~ savings

~ assets

~ salaries and wages

~ monetary incentives

~ insurance

~ state benefits

~ credit history

~ pension

~ debts

~ investments

etc.

CENFACS will carry out this historiography with them and support them to build forward to reduce poverty.

For those who need help with their financial history, what we could do with them would be more than just helping them to find out their online credit score number or percentage with a credit score agency. What we can try to achieve with them is to fully understand and analyse their financial past. From the knowledge gained from this analysis or cartography of their financial past, we can together steer a strategy to build forward better their financial credibility.

The above highlights are just a selection of some of matters raised in this year’s SFU. For those who need help to track and trace their financial history, they are welcome to contact CENFACS. Likewise, those who want to read this year’s resource of SFU beyond the aforementioned highlights, they can as well contact CENFACS.

_________

• References

(1) Millennium Ecosystem Assessment (2005), Ecosystems and Human Well-being: Synthesis, Island Press, Washington, D.C.

(2) Garcia Rodrigues, J. et al. (2017) at https://doi.org/10.3897/oneeco.2.e12290 (accessed in August 2023)

(3) Brown, K., Daw, T., Rosendo, S., Bunce, M. & Cherrett, N., (2008), Ecosystem Services for Poverty Alleviation: Marine and Coastal Situational Analysis; Synthesis Report at https://assets.publishing.service.gov.uk/media/57a08bb640f0b652dd000e36/MarineandCoastal_Synthesis-Report.pdf (accessed in August 2023)

(4) https://www.tutor2u.net/economics/reference/what-is-disposable-income (accessed in August 2023)

(5) Barr, N. and Diamond, P. (2006), The economics of pension, Oxford Review of Economic Policy, Vol. 22, No. 1

(6) https://www.worldbank.org/en/region/afr//overview (accessed in August 2023)

(7) https://www.statista.com/statistics/1228533/number-of-people-living-below-the-extreme-poverty-line-in-africa/ (accessed in August 2023)

(8) https://www.gatesfoundation.org/our-work/programmes/global-growth-and-opportunity/financial-services-for-the-poor (accessed in September 2022)

(9) https://www.lawinsider.com/dictionary/financial-history# (accessed in August 2023)

(10) https://www.graniterecoverycenters.com/resources/rebuilding-your-financial-health-in-recovery/ (accessed in August 2023)

(11) Morris, T., Maillet, S. & Koffi, V., (2022), Financial knowledge, financial confidence and learning capacity on financial behaviour: a Canadian Study, Cogent Social Sciences, 8:1, DOI: 10.1080/23311886.2021.1996919

(12) Nair, D., (2021), How to avoid money mistakes, at https://www.thenationalnews.com/business/money/2021/08/31/how-to-learn-from-money-mistakes-made-by-previous-generations (accessed in August 2023)

(13) https://moneyandpensionsservice.org.uk/what-is-financial-wellbeing (accessed in August 2023)

(14) Gweshengwe, B. and Hassan, N. H., [Xuejun Duan (Reviewing editor)], (2020), Defining the characteristics of poverty and their implications for poverty analysis, Cogent Social Sciences, 6:1, DOI: 10.1080/23311886.2020.1768669

_________

• Help CENFACS Keep the Poverty Relief Work Going this Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2023 and beyond.

With many thanks.