Welcome to CENFACS’ Online Diary!

23 October 2024

Post No. 375

The Week’s Contents

• FACS, Issue No. 85, Autumn 2024, Issue Title: Pension Fund Management and Poverty Reduction by African Charities

• “A la une” (Autumn Leaves of Action for the Upkeep of the Nature in Existence) Campaign and Themed Activities – In Focus for Week Beginning 21/10/2024: Protecting African Wedgefish (Rynchobatas luebbert)

• Autumn Matching Organisation-Investor via Farming Charitable Loan – Match Period 23 to 29/10/2024: Matching Organisation-Investor via Loan Underwriting (Stage 3)

… And much more!

Key Messages

• FACS, Issue No. 85, Autumn 2024, Issue Title: Pension Fund Management and Poverty Reduction by African Charities

The 85th Issue deals with pension funds management carried out by African charities, particularly those working with CENFACS – Africa-based Sister Organisations (ASOs). Essentially, it focuses on the practice of pension funds management done by ASOs. Although it deals with practice, it also considers the theories of pension fund management. In particular, it considers both the financial theory of defined pension schemes and that of capital structure. It reconciles these theories with practices since the knowledge of a particular theory can lead to better choices in terms of investment options.

The 85th Issue mostly puts emphasis on ASOs’ pension schemes while considering pension funding risks in Africa. An example of pension funding risk could be the shortfall in contribution remittances to schemes like it happened during the coronavirus crisis.

The 85th Issue makes some proposals and explores grounds on which ASOs can affect the debate and practice over pension fund management in Africa. For example, some ideas have been explored on ways of improving pension fund management so that poor charity sector employees and other poor pensioners (like those from informal economy) can feel the real helpful difference in their retirement time.

Without providing specialist advice on pension fund management to African charities, the Issue No. 85 is a general advice clinic for those ASOs that would like to take pension fund management seriously to accumulate capital to be paid out as pension to their employees when they retire at the end of their careers.

To get further insights into the Issue No. 85, please read the summaries presented under the Main Development section of this post.

• “A la une” (Autumn Leaves of Action for the Upkeep of the Nature in Existence) Campaign and Themed Activities – In Focus for Week Beginning 21/10/2024: Protecting African Wedgefish (Rynchobatas luebbert)

To help Protect African Wedgefish (Rynchobatas luebbert), we have composed our note around the following headings:

σ What is the African Wedgefish (Rynchobatas luebbert)?

σ The conservation status of the African Wedgefish (Rynchobatas luebbert)

σ What can be done to Protect the African Wedgefish (Rynchobatas luebbert).

In addition, we shall provide the themed activity we have planned for this week. This themed activity is an e-discussion on Fish as Keeper of the Health of Our Ecosystems.

Let us look at each of the headings of this note.

• • What Is the African Wedgefish (Rynchobatas luebbert)?

According to ‘iucnredlist.org’ (1),

“The African Wedgefish (Rynchobatas luebbert) is a large (to ~ 300 cm total length) shark-like ray which is widespread off West Africa in the eastern Atlantic from Mauritania to Angola. It occurs in coastal and continental shelf waters from close inshore to depths of at least 35 m”.

As its definition indicates, the African Wedgefish (Rynchobatas luebbert) can be found in many parts of Africa. But, what is its conservation status?

• • The Conservation Status of the African Wedgefish (Rynchobatas luebbert)

In the IUN Red List of Threatened Species in 2018, the African Wedgefish (Rynchobatas luebbert) was listed as Critically Endangered under criteria A2d. It means that the African Wedgefish (Rynchobatas luebbert) faces an extremely high risk of extinction in the wild in the immediate future. If this is the case, then the African Wedgefish (Rynchobatas luebbert) needs protection. What is protection in this context?

Protection is, according to Chris Park (2),

“Defence against harm and danger” (p. 360)

From the perspective of Chris Park, Protecting African Wedgefish (Rynchobatas luebbert) is about conducting any activity that reduces losses or risks, maintains basic conditions and values of the African Wedgefish (Rynchobatas luebbert).

• • What Can Be Done to Protect African Wedgefish (Rynchobatas luebbert)

Within the literature relating to endangered fish species, there are arguments explaining why the African Wedgefish (Rynchobatas luebbert) is critically threatened. Among the arguments put forward are the following ones:

σ the current spate of unregulated fishing activities

σ the susceptibility in diverse fishing gears

σ and the high demand for its products.

Drawing inspiration from these knowledge and arguments, one can possibly develop a strategy to Protect the African Wedgefish (Rynchobatas luebbert).

Ways of protecting the African Wedgefish (Rynchobatas luebbert) can include the following ones:

σ Engaging stakeholders to instigate the establishment of a locally managed coastal protected area where the African Wedgefish (Rynchobatas luebbert) is mostly caught

σ Designing conservation strategy to protect it

σ Raising awareness or educating people around this issue

σ Promoting better human-fish relationships through sustainable fishing

σ Prevention of water pollution

σ Getting involved

etc.

Besides that, one can donate to causes relating to the protection of the African Wedgefish (Rynchobatas luebbert).

The above actions are the few ones. There is more that can be done to protect African Wedgefish (Rynchobatas luebbert). To stay within the scope of this note, we can limit ourselves to the above-mentioned actions or steps to Protect the African Wedgefish (Rynchobatas luebbert.

• • Add-on Activity of the Week’s Campaign: E-discussion on Fish as Keeper of the Health of Our Ecosystems

The fish themed activity of this week is an online discussion space on how fishes keep the health of ecosystems that humans depend upon for their lives.

To introduce this e-discussion, let us refer to what ‘thehumaneleague.org.uk’ (3) argues about fishes as indicators of ocean health, which is:

“Fish play a key role in helping us understand how the ocean is responding to our activity. As pointed out by a study appearing in the journal Water, there are numerous reasons why fish are often used as a means of tracking ocean health”.

During our e-discussion, we shall talk about the tracking of ocean health by fish. Ocean is one our ecosystems. People can contribute their answers and respond to other participants by making their agreement or difference, raising issues and sharing evidence, knowledge and data.

Those who may be interested in taking part in this e-discussion or fish themed activity, they can contact CENFACS.

To find out more about the entire “A la une” Campaign and Themed Activities, please communicate with CENFACS.

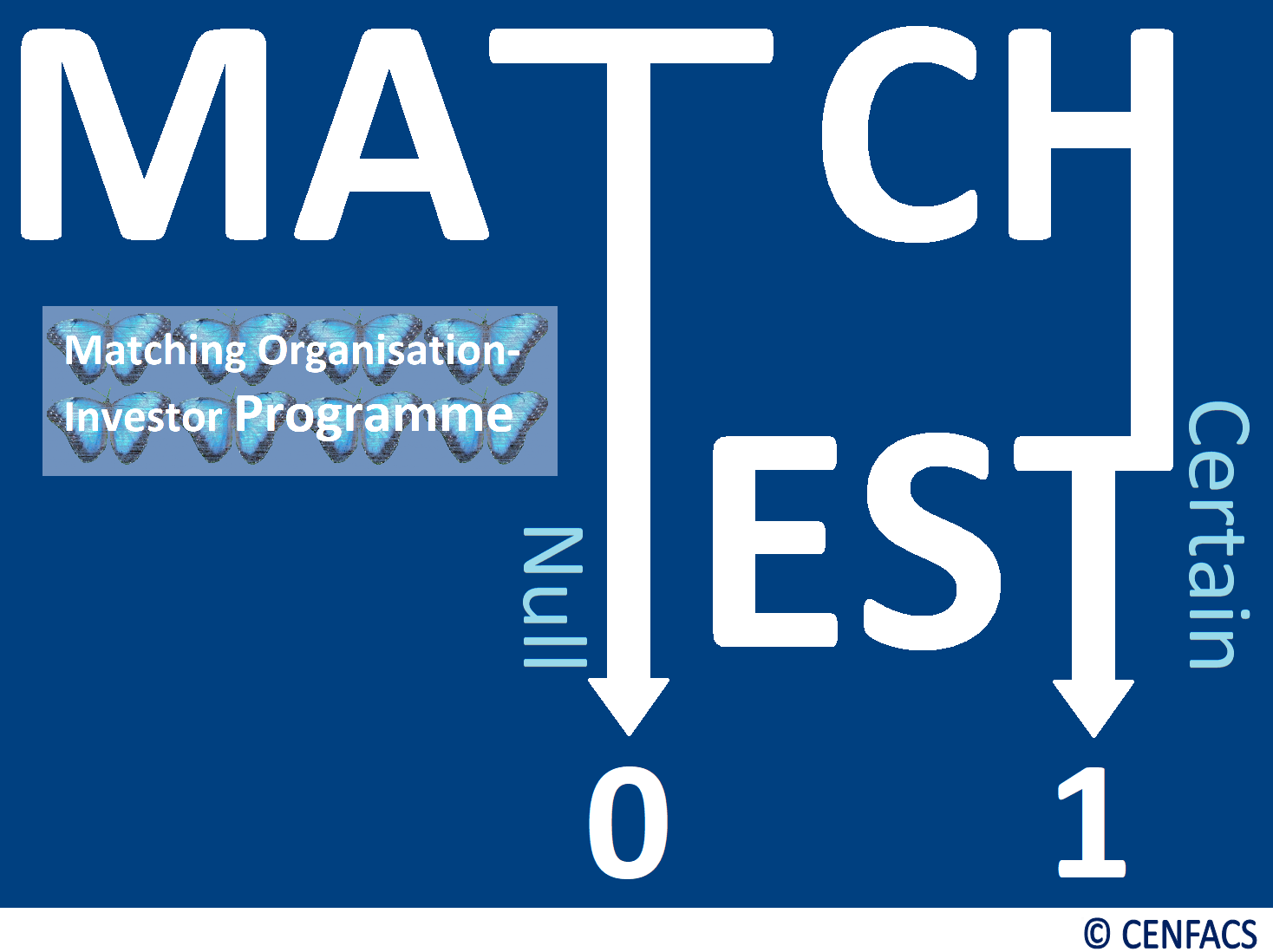

• Autumn Matching Organisation-Investor via Farming Charitable Loan – Match Period 23 to 29/10/2024: Matching Organisation-Investor via Loan Underwriting (Stage 3)

Both African Poverty Relief Organisation (APRC) and Not-for-profit (n-f-p) Farming Investor (FI) scored enough points in the Second Stage of the Matching Organisation-Investor via Farming Charitable Loan. They believe that it is useful to continue their talks and move to the third round of negotiations, which is Stage 3. This third round of talks consists of agreeing by the two sides of the matching talks on the underwriting process for the loan to be given to borrowers/debtors by APRC.

To explain what is going to happen at this Stage 3, we have organised our notes around the following headings:

σ What Is Underwriting?

σ Match Points for APRC

σ Match Points for N-f-p Farming Investor

σ The Match or Fit Test.

Let us look at each of these headings.

• • What Is Underwriting?

Underwriting can be defined in many ways. The website ‘inscribe.ai’ (4) explains that

“It is a lender’s process of evaluating and managing risk… It is the process of providing a careful review of a borrower’s credit history and financial background to determine their eligibility for a loan”.

There are many types of underwriting that lenders can perform. In the context of this Autumn Matching Organisation-Investor via Farming Charitable Loan, we are mostly interested in business loan underwriting. This is because APRC is planning to give micro-loans to its members or project beneficiaries to run a farming income-generating activity or business which can help them to transition away from poverty.

The same ‘inscribe.ai’ explains that

“Business underwriting is the process by which lenders and financial institutions assess the creditworthiness and risk associated with businesses applying for loans or credit”.

In the context of Autumn Matching Organisation-Investor via Farming Charitable Loan, APRC as a business lender will assess the creditworthiness of those seeking finance to start up or growth their farming business or income-generating activity. For the sake of this Autumn Matching Organisation-Investor via Farming Charitable Loan, APRC needs to demonstrate it will handle the underwriting process as it should be. What it needs to demonstrate is given under the heading Match Points for APRC.

• • Match Points for APRC

APRC will need to show that it or its credit underwriter will properly review prospective borrowers’/debtors’ financial statements, business plan, credit history, and the business/activity owner’s personal credit and financial stability. It can also explain if this will be done manually or proceed with automated underwriting. It has to make sure that credit underwriting process is a good match with n-f-p FI’s expectations on this process.

• • Match Points for N-f-p Farming Investor

The n-f-p FI will want to know how APRC’s credit underwriter will assess borrowers’ finances and pass credit decisions to give n-f-p FI an overview of the degree of risk involved. In particular, he/she would like to have some guarantee and to be informed on the following matters: borrowers’ credit report, applicants’ loan repayment ability and collateral; given that most these applicants will be poor people or income poor.

Furthermore, n-f-p FI will ask for insurance on the following negotiating points:

Ο The efficiency of APRC’s underwriting process

Ο Updates on underwriting process as it goes on

Ο Good analytics of applicants’ file

Ο The need to clarify if APRC’s underwriting will use Artificial Intelligence (AI-generated results) or Machine Learning technology

Ο How APRC will deal with document collection problems and fraud detection issues

Ο Will APRC invest in predictive analytics, business intelligence and reporting tools?

Ο Will APRC invest in the underwriting software?

To enable the negotiations to progress and reach an agreement, APRC will need to provide answer to the above-mentioned issues that can be raised by n-f-p FI. N-f-p FI will want convincing answers from APRC as he/she still believes investing in poverty and poor is high-risk. Given project costs, he/she takes this stance since this investment is done with the view to achieve a positive net return – however small it will be – while preserving charitable benefit.

There should be an agreement between APRC’s Plan for Underwriting Process and N-f-p FI’s Approach to Business Underwriting. If there is a disagreement, then the talks/negotiations could be subject to match or fit test.

• • The Match or Fit Test

As part of the match or fit test, n-f-p farming investor’s enquiries and queries must be matched with APRCs’ underwriting process. In other words, the information about APRCs’ underwriting process must successfully respond to the enquiries and queries that n-f-p farming investor may raise about the micro-loan initiative and model of working with local poor people and communities in Africa, particularly the way in which the loan will be underwritten.

The match can be perfect or close in order to reach an agreement. If there is a huge or glaring difference between the two (i.e., between the questions from the investor/n-f-p FI and the answers from the investee/APRCs), the probability or chance of having an agreement at this third round of negotiations could be null or uncertain.

However, CENFACS can impact advise APRC to improve the contents of its underwriting process. CENFACS can as well guide n-f-p farming investors with impact to work out their expectations (or enquiries and queries) to a format that can be acceptable by potential APRCs. CENFACS’ impact advice for APRCs and guidance on impact investing for n-f-p farming investors, which are impartial, will help each of them (i.e., investee and investor) to make informed decisions and to reduce the likelihood of any significant losses or misunderstandings or mismatches.

The rule of the game is the more n-f-p farming investors are attracted by APRCs’ underwriting process the better for APRCs. Likewise, the more APRCs can successfully respond to n-f-p farming investors’ level of enquiries and queries the better for investors. In this respect, the matching game needs to be a win-win one to benefit both players (i.e., organisation and investor).

The above is the third stage of the Autumn Matching Organisation-Investor via Farming Charitable Loan.

Those potential organisations seeking investment to set up a farming charitable loan project to lift their members out of poverty via giving micro-loans to them and n-f-p farming investors looking for organisations that can be interested in their investments, they can contact CENFACS to arrange the match or fit test for them. They can have their fit test carried out by CENFACS’ Hub for Testing Hypotheses.

For any queries and/or enquiries about this third stage of Matching Organisation-Investor via Farming Charitable Loan and/or the programme itself, please do not hesitate to contact CENFACS.

Extra Messages

• CENFACS’ Climate Talks Follow-up Project & International System for Poverty Reduction (World Anti-poverty System)

• Happening on 27 and 28 October 2024: Making Memorable Positive Difference (MM+D) Project – In Focus: History of African Woven Loincloth

• CENFACS’ be.Africa Forum e-discusses Transition from Informal to Formal Economy in Africa

• CENFACS’ Climate Talks Follow-up Project & International System for Poverty Reduction (World Anti-poverty System)

As we are preparing to follow next month’s global climate talks (COP29), we are joining our Climate Talks Follow-up Project and our Campaign for an International System for Poverty Reduction (or World Anti-poverty System). Our Climate Talks Follow-up Project is now in Phase 3.3. which is known as Taking Climate Protection and Stake for African Children at the Implementation Level with Initial Implementation Sub-phase.

We are joining them (Climate Talks Follow-up Project and Campaign on World Anti-poverty System) as there are voices like in the United Nations Economic Commission for Africa (5) that are calling for the modernisation of the old Institutions of Bretton Woods ahead of COP29 to be convened in Baku, Azerbaijan, from 11 to 22 November 2024.

Voices are demanding for system reforms to global financial architecture to free funds for climate transitions if the world wants to transition away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050. The developing world, particularly but not exclusively Africa, needs finance on a massive scale to deliver on energy transitions. According to ‘lemonde.fr’ (6),

“Emerging-market and developing economies, excluding China, will need an estimated $2.4 trillion (€2.2. trillion) annually by 2030 for climate- and nature-related investments”.

In order to mobilise this colossal amount of funding, the need to reform the global financial architecture and set an ambitious new goal for international climate finance becomes self-explanatory.

Equally, CENFACS‘ WAS (World Anti-poverty System) Campaign is just about this type of reforms. CENFACS always campaign for an International System for Poverty Reduction, which does not exist, to serve the poor and bridge the gap in the institutions of Bretton Woods. An International System for Poverty Reduction is the missing piece from these institutions. System reforms to the global financial architecture will help to mobilise and channel funds for climate transitions in places (like Africa) where these transitions are unaffordable. Much better, an International System for Poverty Reduction will level up the plain field by providing voices and spaces for the poor to win the battle against poverty including poverty induced by climate change.

If you believe in reforming the global financial architecture and in a new International System for Poverty Reduction, you can support our joint work on Following Climate Talks and Setting up a New International System for Poverty Reduction (or World Anti-poverty System).

To support, please contact CENFACS.

• Happening on 27 and 28 October 2024: Making Memorable Positive Difference (MM+D) Project – In Focus: History of African Woven Loincloth

There will be Two Days of the History of African Woven Loincloth as follows:

∝ One day of identifying and profiling African Weavers of the History

∝ One day of assessing the historical contribution of woven loincloth in reducing clothing poverty and in creative economic development industry in Africa.

Let us summarise the contents of each day’s work.

• • Heritage/Patrimony/Weavers’ Day (27 October 2024): History of African Weavers of the Loincloth History

On the first day of our MM+D, we shall remember those talented and skilful African weavers of the loincloth history for their remarkable weaving skills, talents and techniques which were passed on to many generations of weavers. It is the day of learning a brief outline or sketch in terms of their profiles and their historical work.

Through the study of their profiles and weaving work, it will be possible to know the kind of role they played or did not play in the weaving loincloth field. They are part of Africa’s heritage and patrimony as they represent Africa’s historic weaving traditions and Africa’s wealth, that transcends many eras and was passed on to other generations. Their techniques are now inherited by contemporary and today’s weavers.

• • Legacies and Gifts Day (28 October 2024): The Historical Contribution of Woven Loincloth in Reducing Clothing Poverty and in the Creative Economy in Africa

During the Legacies and Gifts Day of MM+D, we shall learn what was handed on to the current generations in terms of woven loincloth knowledge/techniques or what the weavers of the past left. We shall as well recollect in our memory what these past weavers gave to today’s knowledge-based economic activities. In other words, we shall study the legacies and gifts of woven loincloth industry in reducing clothing poverty and creating wealth in Africa, although the weavers of the past time might or might not have thought about reducing clothing poverty.

The day will also assist in uncovering if the weaving of loincloth was income-generating potential at that time or just a cultural activity or both.

The above is this year’s MM+D theme. To engage with this theme and or support this project, please contact CENFACS on this site.

• CENFACS’ be.Africa Forum e-discusses Transition from Informal to Formal Economy in Africa

The informal economy/sector exists in Africa since Africa was Africa. In many African countries, there have been efforts or attempts to quantify or capture the activities making this economy/sector via national accounts and accounting. Some efforts did succeed, other attempts are still far away from success. Since this economy/sector represents a huge percentage of many African economies and since we are in a year of transitions within CENFACS, we would like to e-discuss ways forward in terms of transition from informal to formal economy in Africa.

This is what the World Bank (7) argues about the informal economy in Africa:

“The informal economy in Africa is large and diverse, and is the main source of employment in the region. It is projected to grow and create more jobs. The informal economy is well established in the region, but it also faces a host of development challenges”.

One of the challenges is about finding ways of transitioning from informal to formal for those people in need working or operating in this informal economy/sector. In particular, those who see this transition as a way of transitioning out of poverty and hardships.

To overcome these challenges, they have been some propositions. For example, ‘apec.org’ (8) made some proposals in those terms:

“Given the multidimensional nature of informality, a mix of policies should be considered. They include the need to create a suitable regulatory atmosphere that facilitates businesses, measures to improve governance, institutional quality and rule enforcement, incentives for compliance, and enhancing human capital through education and training”.

CENFACS would like to know your views on transitioning from informal to formal economy/sector. CENFACS wants to know what can be done in terms of much-needed support to informal people or workers lacking social protection to prevent them from continuing slipping into poverty.

For example, what can be done to help those working in the informal economy who have limited avenues to formal financial institutions or risk mitigation instruments to transition away from informal to formal employment.

If you have answer or argument to make about this matter, please do not hesitate to let CENFACS know.

Those who may be interested in this discussion can join our Poverty Reduction pundits and or contribute by contacting CENFACS’ be.Africa, which is a forum for discussion on matters of poverty reduction and sustainable development in Africa and which acts on behalf of its members in making proposals or ideas for actions for a better Africa.

To communicate with CENFACS regarding this discussion, please use our usual contact details on this website.

Message in French (Message en français)

• Initiatives à Triple Valeur pour le Père Noël: Collecter des fonds tout en jouant, en courant et en votant pour la réduction de la pauvreté pendant la longue période des fêtes

Vous pouvez aider le CENFACS à collecter des fonds vitaux dont il a besoin pour ses nobles et belles causes en incitant les participant(e)s ou les parties intéressées à des initiatives à triple valeur (ou projets tout au long de l’année) à s’habiller comme le Père Noël.

Les participant(e)s et les parties intéressées peuvent ensuite faire un don ou parrainer vos initiatives à triple valeur de jouer, de courir et de voter pour la réduction de la pauvreté.

Les revenus qui seront récoltés à ces occasions peuvent être reversés au CENFACS. Ces revenus aideront à soutenir les personnes qui en ont le plus besoin afin qu’elles puissent sortir de la pauvreté et des difficultés.

Cependant, pour lever des fonds via Initiatives à Triple Valeur pour le Père Noël, il faut d’abord discuter de la question, de votre plan/idée avec CENFACS. Ensemble avec vous, nous pouvons mieux planifier votre/notre campagne de collecte de fonds et aider à la réaliser de manière fluide et sans tracas tout en suivant les règles du jeu.

Pour collecter des fonds pour les Initiatives à Triple Valeur pour le Père Noël afin d’aider CENFACS et ses nobles et belles causes de réduction de la pauvreté et de développement durable, veuillez contacter CENFACS.

N’oubliez pas d’enregistrer et de rapporter vos scores, résultats et rencontres concernant vos initiatives à triple valeur (ou projets tout au long de l’année). Vous pouvez les partager avec nous pour présenter l’État des Jeux, Courses et Votes 2024.

À la fin du processus de projets tout au long de l’année et d’ici la fin de l’année, on devrait être prêt à annoncer les résultats de l’action 2024 pour l’un ou l’autre des projets: Courir ou Jouer ou Voter.

Les résultats finaux consisteront à découvrir et à révéler les éléments suivants pour cette année:

√ Les meilleurs pays africains de 2024 qui auraient le mieux réduit la pauvreté

√ Les meilleurs coureur(se)s africain(e)s des Jeux Mondiaux de 2024

√ Les meilleurs gestionnaires africains du développement et de la lutte contre la pauvreté de 2024.

Si vous n’avez pas encore pensé à cette découverte ou à cette révélation, commencez à réfléchir dès maintenant et donnez votre avis à ce sujet d’ici le 23 décembre 2024!

Main Development

• FACS, Issue No. 85, Autumn 2024, Issue Title: Pension Fund Management and Poverty Reduction by African Charities

The contents and key summaries of the 85th Issue of FACS are given below.

• • Contents and Pages

I. Key Terms Relating to the 85th Issue of FACS (Page 2)

II. Key Theories Used in the 85thIssue of FACS (Page 2)

III. Charities Fund Management Practices in Africa (Page 3)

IV. Charities and Assets under Management in Africa (Page 3)

V. Charities and Informal Sector Pensions in Africa (Page 3)

VI. Charities’ Investment Options and Pension Liabilities in Africa (Page 4)

VII. Africa-based Sister Organisations and Pension Fund Regulations (Page 4)

VIII. Organisations Sœurs Basées en Afrique et Contribution des Fonds de Pension en Temps de Crise (Page 5)

IX. Organisations Sœurs Basées en Afrique et Pensions de Vieillesse Contributives (Page 5)

X. Organisations Sœurs Basées en Afrique et Pools de Pension Locaux/Institutions d’Épargne Contractuelles (Page 6)

XI. Organisations Sœurs Basées en Afrique et Marchés Internationaux de Capitaux pour les Fonds de Pension (Page 6)

XII. Survey, Testing Hypotheses, E-questionnaire and E-discussion on Charity Pension Fund Management (Page 7)

XIII. Support, Tool and Metrics, Information and Guidance on Pension Fund Management (Page 8)

XIV. Workshop, Focus Group and Booster Activity about Charity Pension Fund Management and Poverty Reduction (Page 9)

XV. Giving and Project (Page 10)

• • Key Summaries

Please find below the key summaries of the 85th Issue of FACS from page 2 to page 10.

• • • Key Terms Relating to the 85th Issue of FACS (Page 2)

There are five terms used in the context of this Issue of FACS. These terms are pension fund management, pension/old age poverty reduction, African charities and defined pension schemes. Let us briefly explain these key terms.

• • • • Pension fund management

To understand the term pension fund management, one may need to know the meanings of pension and pension fund.

A pension is, according to Omollo et al. (9),

“A predetermined sum paid by an individual as an amount he will be entitled upon retirement”.

For the website ‘cfg.org.uk’ (10), pension is

“A form of savings and investment, designed to provide income in later life”.

A pension fund is defined by ‘corporatefinanceinstitute.com’ (11) as

“A fund that accumulates capital to be paid out as a pension for employees when they retire at the end of their careers”.

The same ‘corporatefinanceinstitute.com’ explains that pension funds typically aggregate large sums of money to be invested into the capital markets such as stock and bond markets, to generate profit (returns).

Pension fund management is the management of pension funds. It is the process of organising and directing the pension funds within an organisation so as to meet defined objectives. It involves planning, control, coordinating and motivating the process of accumulating capital to be paid out as pension for employees on their retirement. It means both use the monies to make day-to-day disbursements to pensioners and generate additional income and profit by investing in financial securities, government fixed-interest bonds, stocks, shares and property bonds.

The pension funds in which we are interested are those managed by charities (African charities). In the UK, pension funds managed by charities are not part of the charity’s assets. The funds are held as investments by the scheme until the scheme recipients reach their chosen retirement age.

• • • • Pension/old age poverty reduction

The definition of old age income poverty used in this Issue comes from the Organisation for Economic Cooperation and Development (OECD). The OECD (12) gives the relative concept of old age poverty by arguing that

“Old age income poor are individuals aged over 65 having an income below half the national median equivalised household disposable income”.

The same OECD considers that

“The yardstick for poverty depends on the medium household income in the total population in a particular country at a particular point in time”.

Old age poverty can be reduced or ended. Likewise, pension poverty can be reduced or ended.

Pension poverty reduction is any measure or effort to decrease this state in which resources are lacking for pension or pensioners. It can be viewed from various angles.

Looking at poverty reduction from the monetary perspective, Y. A. Bununu (13) thinks that

“Poverty reduction can be considered as the improvement of an individual’s or group’s monetary expenditure to an amount above the poverty line while improving access to education, healthcare, information, economic opportunities, security of land-tenure, all the other deprivations associated with it”.

From this perspective, reducing pension poverty is about improving of pensioners’ monetary expenditure to an amount above the poverty line while improving all the other conditions of better quality of their life.

Taking a historical and intertemporal view of poverty reduction, the website ‘borgenproject.org’ (14) argues that poverty reduction is evolving concept. It evolves from a simple to complex concept throughout the time to mean the following:

σ financial contributions to governments of poverty-stricken nations

σ achieving the goal of lifting as many people above the poverty line as possible

σ the extended relief programmes and education programmes focusing on sustainability in target communities.

The goalposts of poverty reduction keep moving depending on the types of hardship people face at a particular time of the history.

In short, the possibility of pension to reduce old age poverty depends on many factors as well as methodology used to treat data.

• • • • African charities

To explain African charities, let us first explain the word ‘charity’. Our explanation of this word comes from ‘howcharitieswork.com’ (15) which provides three statements, which are:

“a) A charity’s aims have to fall into categories that the law says are charitable b) It has to be established exclusively for what is known as public benefit c) Charities can’t make profits (that is; all the money they raise has to go towards achieving their aims; a charity can’t have owners or shareholders who benefit from it)”.

The term African charities relate to charities from Africa. We presume that our African counterpart charities would share the above-mentioned rules for charity. We also assume that the law in African countries would classify the African charities we are talking about as charitable as it is in the UK.

• • • • Defined pension schemes

This 85th Issue considers two defined pension schemes: a defined benefit pension scheme and defined contribution pension scheme.

According to ‘assets.publishing.service.gov.uk’ (16),

“The most common form of defined benefit pension scheme is also known as a final salary pension scheme. Under these schemes employee members are entitled to a particular level of benefit depending on their length of service and the level of their salary when they retire”.

The same ‘assets.publishing.service.gov.uk’ explains that

“A defined contribution pension scheme is known as a money purchase scheme. These are pension schemes into which an employer pays a regular contribution fixed as an amount or percentage of the employee member’s pay. The employee may also make contributions into the scheme”.

Regarding the two schemes, ‘ifc.org’ (17) notes that

“The shift from defined benefit to defined contribution has been gaining momentum across the region [Africa] over the past decade and a half under pension system reforms that allow a large role for privately managed pension fund administrators that have targeted growing middle classes”.

The 85th Issue reconciles these schemes with the practice of pension by African charities.

The above-named definitions shape the contents of the 85th Issue of FACS.

• • • Key Theories Used in the 85th Issue of FACS (Page 2)

The 85th Issue refers to the financial theory of defined pension schemes as explained by Cj Exley et al. (18). In particular, it focuses on the application of market-based approach to pension fund management in charity practical situations.

It also considers financial theories on pension fund portfolios as suggested by Omollo et al. (op. cit.) In this respect, the 85th Issue is concerned with financial theory practices interventions in terms of asset allocation in regard to equity.

Finally, the Issue takes into account capital structure theories in pension economics that the custodians of African charities’ pension funds or pension fund managers apply.

• • • Charities Fund Management Practices in Africa (Page 3)

Their practices are those that can be found elsewhere in the charity world. They include the following:

σ complying with the legal and regulatory frameworks in countries they operate in Africa

σ having good governance and transparency

σ caring about tax framework which is important factor for investing pension funds

σ networking and collaborating on pension fund management matters

σ keeping good human capital policies

etc.

They try to build best practices in the above-mentioned areas which benefit their drive on pension fund management.

• • • Charities and Assets under Management in Africa (Page 3)

The development of pension assets for African Charities is important to provide for their employees’ retirement. Charities operating in Africa’s top ten pension pools can learn how they can use pension fund management skills to boost their pension assets. According to ‘brightafrica.riscura.com (19), the top ten pools in Africa include Nigeria, South Africa, Egypt, Kenya, Tanzania, Malawi, Mauritania, Namibia, Botswana and Ghana.

This pension fund boost can generate additional income. African Charities can as well maintain a careful balance between their immediate liquidity needs and long term investment returns in the portfolios.

• • • Charities and Informal Sector Pensions in Africa (Page 3)

It is about the development of schemes to attract pension savings for and from workers in the informal sector in Africa; workers who tend to be poor. In this respect, African Charities try to carefully choose suitable investment instruments for poor informal household savers to help these informal workers implement long-term savings and open pension accounts. In other words, they help provide some form of social protection for the informal economy workers through a service on savings and pension accounts for the informal sector. ASOs can help in any work to cover the need of the informal sector workers who literally represent 95% of the private sector.

• • • Charities’ Investment Options and Pension Liabilities in Africa (Page 4)

There is a growing funding risk as pension liabilities grows with uncontrollable events (such as health and natural disasters). This growth of pension liabilities quite often outpaces assets. In addition, higher life expectancies amongst African Charities’ workers can mean more contribution .

In their pension fund management, African Charities are forced to include these two factors (uncontrollable life events/disasters and increase in life expectancies). These factors have led to the mismatch between pension liabilities and assets. This mismatch could only result in pension crisis, which a good pension fund management can help prevent or reduce.

An example of this mismatch is the lingering effects of the coronavirus crisis that led to a shortfall in contribution remittances to pension schemes which negatively impacted the funding needs.

• • • Africa-based Sister Organisations and Pension Fund Regulations (Page 4)

Most African countries have pension fund regulations. CENFACS‘ Africa-based Sister Organisations (ASOs) operating in those countries will normally follow these regulations when it comes to dealing with pension funds and pension fund management. ASOs can also negotiate on behalf of their members and staff so that these regulations can be softened.

For example, they can demand relaxation on employer contribution requirements in case of fund member job losses and unpaid leave.

• • • Organisations Sœurs Basées en Afrique (OSBA) et Contribution des Fonds de Pension en Temps de Crise (page 5)

Les OSBA ont eux-mêmes des politiques pour faire face aux crises et aux chocs de multiples formes (comme les catastrophes sanitaires, les événements naturels, les guerres, etc.). En ces temps difficiles, elles peuvent s’arranger pour que leurs politiques reflètent ces crises et ces chocs.

Par exemple, en temps de crise, le rendement des fonds de pension peut être utilisé pour réduire l’impact d’une crise, à condition que les fonds de pension et les gestionnaires d’actifs soient d’accord sans compromettre l’objectif principal des fonds de pension.

Elles doivent adapter leur réflexion et leurs pratiques en matière de risque d’investissement pour faire face à l’augmentation des risques et des chocs systémiques.

• • • Organisations Sœurs Basées en Afrique et Pensions de Vieillesse Contributives (page 5)

Les OSBA peuvent travailler dans les pays africains qui ont réformé leurs systèmes de sécurité sociale pour étendre la couverture des pensions de vieillesse aux groupes difficiles à atteindre. Parmi ces pays figurent la Côte d’Ivoire, l’Égypte, le Maroc, le Nigeria et la Zambie.

Pour être plus précis, les OSA peuvent travailler avec les groupes suivants: les travailleurs du secteur informel comme ceux de la Côte d’Ivoire, de la Zambie et de l’Égypte; les travailleurs indépendants aux revenus faibles et irréguliers, les travailleurs non salariés des professions libérales au Maroc, les indépendants et les travailleurs des micro-entreprises comme au Nigeria, etc.

La contribution de retraite qui sera collectée peut être investie pour augmenter les paiements de pension pour ces groupes pauvres. Cela peut être intégré dans les plans de gestion des fonds de pension des OSBA.

• • • Organisations Sœurs Basées en Afrique et Pools de Pension Locaux/Institutions D’épargne Contractuelles (page 6)

Les actifs des fonds de pension africains sont encore relativement faibles au niveau mondial, bien que l’Afrique du Sud ait le plus haut niveau d’actifs sous gestion en Afrique. Pour expliquer ce faible niveau d’actifs sous gestion en Afrique, fsdafrica.org (20) fait valoir que

«Les actifs des régimes de retraite de l’Afrique représentent moins de 1 % des actifs mondiaux, avec une couverture de retraite de seulement 9,6 %, ce qui expose un pourcentage important de personnes âgées au risque de pauvreté des personnes âgées. »

De même, le site web ‘pensionfundsafrica.com’ (21) énonce que

«Le marché africain des retraites est très fragmenté et, dans la plupart des pays, le secteur est minuscule – sur ce chiffre, 90 % sont concentrés au Nigeria, en Afrique du Sud, en Namibie et au Botswana, souligne le rapport Making Finance Work for Africa».

En revanche, le site web ‘pensionfundsafrica.com’ (op. cit.) note que

«Les fonds du secteur des retraites du continent s’accumulent de manière impressionnante, atteignant plus de 1 billion de dollars. »

Les OSA peuvent saisir cet élan pour développer la gestion de leurs fonds de pension.

• • • Organisations Sœurs Basées en Afrique et Marchés Internationaux de Capitaux pour les Fonds de Pension (page 6)

Les OSBA peuvent élaborer une stratégie internationale de fonds de pension tout en examinant les fenêtres d’opportunité offertes par le marché international des capitaux pour les régimes de retraite, afin de renforcer leurs départements de gestion de fonds de pension.

En effet, le site web «wtwco.com» (22) rapporte que

«En 2023, les actifs sous gestion des 300 premières caisses de retraite ont enregistré une augmentation de 10 % pour atteindre 22,6 billions de dollars, contre 20,6 billions de dollars à la fin de 2022, alors que les marchés se sont quelque peu stabilisés par rapport au niveau élevé d’incertitude économique mondiale de l’année précédente».

Les chiffres ci-dessus indiquent qu’il existe un potentiel que les OSBA peuvent essayer d’exploiter en élaborant une stratégie ambitieuse de gestion des fonds de pension.

• • • Survey, Testing Hypotheses, E-questionnaire and E-discussion on Pension Fund Management (Page 7)

• • • • Survey on the role of charity pension fund managers

Charity pension fund managers can help increase assets in African charity pension funds which are very small compared to other charities in other regions of the world; in doing so enabling African charities to achieve their mission.

The purpose of this survey is to collect information from a sample of our Africa-based Sister Organisations and community members regarding their perception on charity fund managers.

Participation to this survey is voluntary.

As part of the survey, we are running a questionnaire which contains some questions. One of these questions is:

Q: Are charity pension fund managers the best option for African charities looking to improve their assets and portfolios instead of trustees handling this role or is it better to have both charity pension fund managers and trustees to handle this role?

You can respond and directly send your answer to CENFACS.

• • • • Testing hypotheses about causal relationships between pension fund management and the reduction of pension/old age poverty

For those of our members who would like to dive deep into the impact of pension fund management on the reduction of pension/old age poverty, we have some educational activities for them. They can test the inference of the following hypotheses:

a.1) Null hypothesis (Ho): The type of pension fund management chosen has an effect on the effect of capital structure on growth of pension funds in Africa

a.2) Alternative hypothesis (H1): The type of pension fund management chosen has not an effect on the effect of capital structure on growth of pension funds in Africa

b.1) Null hypothesis (Ho): There is a correlation between African charities’ style of pension fund management and the probability of reducing pension/old age poverty amongst their workers

b.2) Null hypothesis (Ho): There is not a correlation between African charities’ style of pension fund management and the probability of reducing pension/old age poverty amongst their workers

The above tests are for those of our members who would like to dive deep into charity pension fund management and pension/old age poverty reduction. In order to conduct these tests, one needs data on a particular African charity.

• • • • E-question on your view about pension funds

Pension funds aggregate large sums of money to be invested into the capital markets such as stock and bond markets, to generate profit (returns). Yet, charities exist to delivery public benefit not profit. This can raise the following question:

Q: Is charity pension fund management helpful in furthering charity’s purposes or simply moving charities away from their founding mission?

Any of our readers and users can answer the above-mentioned question. You can provide your answer directly to CENFACS.

For those answering any of this question and needing first to discuss pension fund management matter, they can contact CENFACS.

• • • • E-discussion on preference between today’s cash and tomorrow’s pension

The e-discussion is about what people prefer in terms living with their cash today or saving for late life. This is because some people within the community argue that they want to live today as they do not know if they will live tomorrow. The e-discussion is on whether they want cash today or save with the promise of pension tomorrow.

For those who may have any views or thoughts or even experience to share with regard to this matter, they can join our e-discussion to exchange their views or thoughts or experience with others.

To e-discuss with us and others, please contact CENFACS.

• • • Support, Tool and Metrics, Information and Guidance on Pension Fund Management (Page 8)

• • • • Ask CENFACS for Guidance regarding the reduction of pension/old age poverty via pension fund management

Pension fund management can help generate additional income and profit by investing in financial securities, government fixed-interest bonds, stocks, shares and property bonds. This income generation can help narrow the wealth gap and build generational wealth to escape from intergenerational pension/old age poverty.

For those ASOs who would like find out how they can align their pension fund management goals with their goals of pension/old age poverty reduction, they can contact CENFACS.

CENFACS can work with them to explore ways of aligning the two goals with their mission.

We can work with them under our International Advice-, Guidance- and Information-giving Service. We can as well signpost them to organisations working on charity pension fund management and pension/old age poverty.

Need advice, guidance and information; please contact CENFACS for support.

• • • • Tools and metrics of the 85th Issue of FACS

The 85th Issue of FACS is concerned with seven types of tools or metrics which are: pension assets to GDP, pension calculator, old age dependency ratio, return on investment, surplus margin, earned income and poverty gap ratio.

Let us briefly explain these tools or metrics.

• • • • • Pension tools and metrics

The Issue 85 uses three pension metrics, which are pension assets to gross domestic product, pension calculator and old age dependency ratio.

a) Pension Assets to Gross Domestic Product (GDP)

The website ‘brightafrica.riscura.com’ (op. cit.) explains that Pension Assets to GDP is a common measure to determine the significance of pension assets to a country’s economy.

For example, although Nigeria and Egypt are among the 10 top pension pools in Africa, they have the lowest pension assets to GDP percentage at 6.77% and 1.51%, respectively.

b) Pension Calculator as a tool

One of the tools we find that could be useful for our community members is Pension Calculator.

A pension calculator (23) tells you how much money you need in retirement and the way of having it.

Those who would like to discuss the relevancy of this tool and its application, they can feel free to contact CENFACS.

c) Old Age Dependency Ratio

The old age dependency ratio is a measure of the burden of supporting the elderly population on the working-age population. The ‘data.oecd.org’ (24) speaks about the old-age to working-age demographic ratio which it defines as

“The number of individuals aged 65 and over per 100 people of working age defined as those at ages 20 to 64”.

The old-age dependency ratio is calculated as:

([Population ages 65-plus] ÷ [Population ages 16-64]) x 100

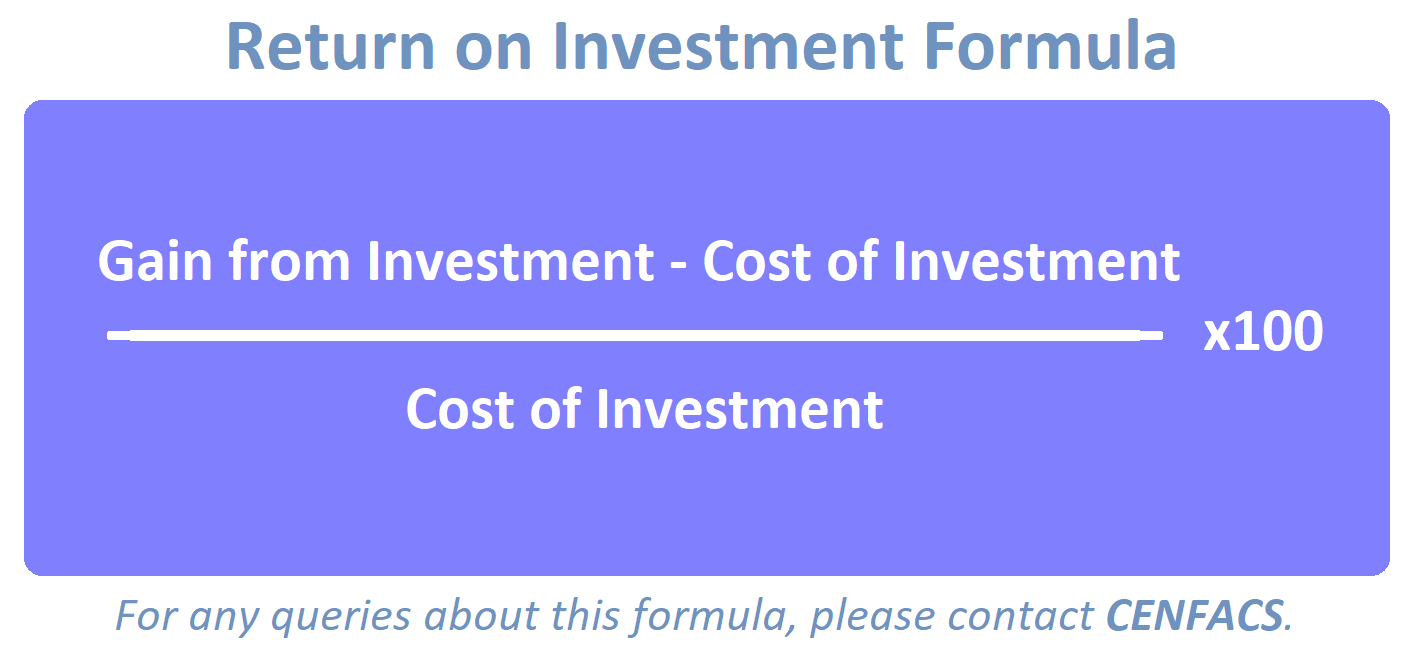

• • • • • Investment tool and metrics: Return on Investment

The 85th Issue utilises as tool Return on Investment since pension fund involves investing. This return on investment (ROI) does not necessarily to be financial (income). It can be capital growth, social or environmental return, happiness and so on.

If one chooses financial ROI, then they need to explain what it means and how to measure it. Definitions of ROI tend to overlap.

For example, ‘corporatefinanceinstitute.com’ (25) defines ROI as

“A performance measure used to evaluate the returns of an investment or to compare the relative efficiency of different investments”.

Another definition comes from ‘forbes.com’ (26) that states

“ROI is a metric used to understand the profitability of an investment”.

There is also online ROI calculator for those who will be interested in it.

Because charities exist to delivery public benefit not profit, the 85th Issue is also interested in non-financial ROI.

Furthermore, the 85th Issue considers the impact of your investments on poverty reduction. In other words, it deals with impact investing. According to ‘renewcapital.com’ (27),

“Impact investing allows you to invest in Africa in a way that makes a positive social or environmental difference while seeking a financial return on investment”.

• • • • • Other suite of tools and metrics

They include surplus margin, earned to unearned income ratio, and poverty gap ratio.

• • • • • • Surplus margin

The 85th Issue also uses Surplus Margin as metrics. What is it?

It is the following measure:

(Net income/Total income) x 100

The website ‘cranfieldtrust.org’ (28) explains that

“Generating a surplus allows a charity to invest in the improvement/expansion of charitable activities. If the surplus marginal overall is positive, you have made a surplus and your reserves will be boosted”.

For example, this measure can be used to find out the surplus margin of ASO investors and their investment portfolios, particularly for investments made through pension fund management.

Additionally, one could consider the number of charitable organisations that are pension fund investors and the types of their investments or assets under management.

Alternatively, one could try to find answers to the following questions:

Q1: Do they invest in mixed assets funds or national equity funds or global equity funds or fixed interest funds or property and cash funds or green bonds?

Q2: What do their investment portfolios look like (the structure of their portfolio or capital)?

Q3: Do they achieve a surplus margin?

Q4: What is the profile of their margins?

• • • • • • Earned to unearned income ratio

The 85th Issue also employs the ratio of earned to unearned income. This ratio can be written as follows:

Earned Income / Unearned Income

The website ‘cranfieldtrust.org’ (op. cit.) argues that

“The ratio of earned to unearned income helps to show that the charity has developed diversified income as it has evolved. It is useful for donors and funders”.

For example, our ASOs that would like to invest can utilise this ratio to compare income earn from investments to incomes from unearned sources. Their pension fund managers can compare the contributions they received to the capital they accumulate via investment.

• • • • • • Poverty gap ratio

This is an interesting metrics of poverty as it measures the intensity of poverty.

The online ‘marketbusinessnews.com’ (29) explains that

“The poverty gap ratio or poverty gap index is the average of the ratio of the poverty gap to the poverty line. Economists and statisticians express it as a percentage of the poverty line for a region or whole country…The poverty gap ratio considers how far, on the average, poor people are from poverty line”.

ASOs can use it to compare how far the pension/old age poor are from the poverty line.

The above tools and metrics can be used in dealing with pension fund management and pension/old age poverty reduction in Africa.

For example, one can use the poverty gap ratio to measure the average shortfall of the income of the pension/old age poor women in Africa from the poverty line.

• • • • Information and guidance on pension fund management and pension/old age poverty reduction

Information and Guidance include two types areas of support via CENFACS, which are:

a) Information and guidance on pension fund management and pension/old age poverty reduction

b) Signposts to improve Users’ Experience about impact investing and pension/old age poverty reduction.

• • • • • Information and guidance on pension fund management and pension/old age poverty reduction

Those Africa-based Sister Organisations (ASOs) that are looking for information and guidance on pension fund management and that do not know what to do, CENFACS can work with them (via needs assessment conducted under CENFACS’ International Advice Service) or provide them with leads about other organisations, institutions and services that can help them.

• • • • • Signposts to improve Users’ Experience about impact investing and pension/old age poverty reduction

For those who are looking for whereabout to find help about impact investing queries, we can direct them to the relevant services and organisations.

More tips and hints relating to the matter can be obtained from CENFACS‘ Advice-giving Service and Sessions.

Additionally, you can request from CENFACS a list of organisations and services providing help and support in the area of charity pension fund management, although the Issue 85 does not list them. Before making any request, one needs to specify the kind of organisations they are looking for.

To make your request, just contact CENFACS with your name and contact details.

• • • Workshop, Focus Group and Booster Activity about Charity Pension Fund Management and Pension/Old Age Poverty Reduction (Page 9)

• • • • Mini themed workshop on pension fund management skills to reduce pension/old age poverty

Although pension funds are better managed by those specialised in this role, those who run African charities, especially the smaller ones, can learn some skills on the way pension fund management work. This is also true for those organisations that cannot afford to hire pension fund managers.

They can boost their knowledge and skills about the reduction of pension/old age poverty via pension fund management skills with CENFACS.

The workshop aims at supporting those without or with less information and knowledge about pension fund management skills and knowledge while improving the quality of their pensioners or future pensioners. The workshop will provide recommendations for actions with options and opportunities for the participants.

To enquire about the boost, please contact CENFACS.

• • • • Focus group on impact investing

The focus group will deal with how to invest not only to realise a good return on your investment, but also to create a lasting impact. Impact investing will be approached from the perspective of win-win.

To take part in the focus group, group that will use deliberative practice strategies, please contact CENFACS.

• • • • Autumn 2024 activity: Consulting Pension Fund Managers

This user involvement activity revolves around the answers to the following questions:

Q1: Do you consult an pension fund manager or fund/asset manager for your pension or investment decisions?

Q2: Do you have an investment account with a pension fund manager?

Those who would like to answer these two questions and participate to our Consulting Pension Fund Managers Activity, they are welcome.

To take part in this activity, please contact CENFACS.

• • • Giving and Project (Page 10)

• • • • Readers’ giving

You can support FACS, CENFACS bilingual newsletter, which explains what is happening within and around CENFACS.

FACS also provides a wealth of information, tips, tricks and hacks on how to reduce poverty and enhance sustainable development.

You can help to continue its publication and to reward efforts made in producing it.

To support, just contact CENFACS on this site.

• • • • African Pension Fund Manager Project (APFMP)

APFMP is an initiative that consists of investing the contributions received, accumulating them, administrating the funds, developing pension policies and pension and benefits packages, reviewing, discussing and agreeing fund strategy and structure with African Charities.

The real aim of this project is to reduce and possibly end pension poverty or old age poverty.

APFMP will work across African charities to support them meet and implement their pension fund management strategy and aim while contributing to their goal of reducing pension poverty or old age poverty among their users and workers.

To support or contribute to APFMP, please contact CENFACS.

For further details including the implementation plan of the APFMP, please contact CENFACS.

The full copy of the 85th Issue of FACS is available on request.

For any queries and comments about this Issue, please do not hesitate to contact CENFACS.

_________

• References

(1) https://www.iucnredlist.org/ja/species/60180/124448712#assessment-information (accessed in October 2024)

(2) Park, C., (2011), Oxford Dictionary of Environment and Conservation, Oxford University Press, Oxford & New York

(3) https://www.thehumaneleague.org.uk/article/fishes-why-are-fish-important-and-how-do-they-suffer (accessed in October 2024)

(4) https://www.inscribe.ai/loan-underwriting# (accessed in October 2024)

(5) https://www.uneca.org/stories/timely-reforms-of-the-global-financial-institutions-and-architecture-crucial-for-sustainable (accessed in October 2024)

(6) https://www.lemonde.fr/en/opinion/article/2024/10/18/cop29-the-need-to-reform-the-global-financial-architecture-has-become-even-clearer_6729782_23.html (accessed in October 2024)

(7) https://documents.worldbank.org/en/publications/documents-reports/documentdetail/946341635913066829/social-protection-for-the-informal-economy-operational-lessons-for-developing-countries-in-africa-and-beyond (accessed in October 2024)

(8) https://www.apec.org/publications/2024/02/addressing-informality-transitioning-to-the-formal-economy# (accessed in October 2024)

(9) https://mpra.ub.uni-muenchen.de/109216/MPRA Paper No.109216 (accessed in October 2024)

(10) https://www.cfg.org.uk/knowledge-hub/charities_pensions_and_net_zero_1 (accessed in October 2024)

(11) https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/pension-fund/ (accessed in October 2024)

(12) https://www.oecd-ilibrary.org/sites/d76e4-fad-en/index.html?itemld=/content/component/d76e4fad-en (accessed in June 2023)

(13) Bununu, Y. A. (2020). Poverty Reduction: Concept, Approaches, and Case Studies. In: Leal Filho, W., Azul, A., Brandli, L., Özuyar, P., Wall, T. (eds) Decent Work and Economic Growth. Encyclopedia of the UN Sustainable Development Goals. Springer. Cham. https://doi.org/10.1007/978-3-319-71058-7_31-1 (accessed in April 2024)

(14) https://borgenproject.org/what-is-poverty-reduction/ (accessed in April 2024)

(15) https://howcharitieswork.com/about-charities/what-is-a-charity/ (accessed in October 2024)

(16) https://assets.publishing.service.gov.uk/media/5a7cfc96e5274a33be6483d7/Defined_benefit_pension_schemes_questions_and_answers.pdf (accessed in October 2024)

(17) https://www.ifc.org/content/dam/ifc/doc/mgrt/african-pension-funds-final-10-9-20.pdf (accessed in October 2024)

(18) Exley Cj, Mehta SjB, Smith AD. The Financial Theory of Defined Pension Schemes. British Actuarial Journal. 1997; 3(4): 835-966. doi: 10.1017?S13573217 0000516X (accessed in October 2024)

(19) https://www.brightafrica.riscura.com/sources-of-capital-on-the-continent/pension-funds/africa-pension-fund-assets/ (accessed in October 2024)

(20) https://www. fsdafrica.org/projects/africa-pensions-superviors-network-programme (accessed in October 2024)

(21) https://www.pensionfundsafrica.com/news/how-africa-is-uniting-to-advance-pension-fund-growth/ (accessed in October 2024)

(22) https://www.wtwco.com/en-au/news/2024/09/worlds-largest-pension-funds-return-to-growth#(accesed in October 2024)

(23) https://www.moneyhelper.org.uk/en/pensions-and-retirement/pensions-basics/pension-calculator (accessed in August 2023)

(24) https://data.oecd.org/pop/old-age-dependency-ratio.htm (accessed in August 2023)

(25) https://corporatefinanceinstitute.com/resources/accouting/what-is-return-on-investment-roi/ (accessed in April 2024)

(26) https://www.forbes.com/advisor/investing/roi-on-investment/ (accessed in April 2024)

(27) https://renewcapital.com/newsroom/charitable-investment-options-for-benevolent-investors (accessed in August 2024)

(28) https://www.cranfieldtrust.org/articles/top-10-financial-ratios-forcharities (accessed in April 2024)

(29) https://marketbusinessnews.com/information-on-credit/gap-ratio–definition-meaning (accessed in August 2023)

_________

• Help CENFACS Keep the Poverty Relief Work Going This Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE AND BEAUTIFUL CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2024 and beyond.

With many thanks.