Welcome to CENFACS’ Online Diary!

14 August 2024

Post No. 365

The Week’s Contents

• FACS Issue No. 84, Summer 2024: African Charities Investment Management and Poverty Reduction

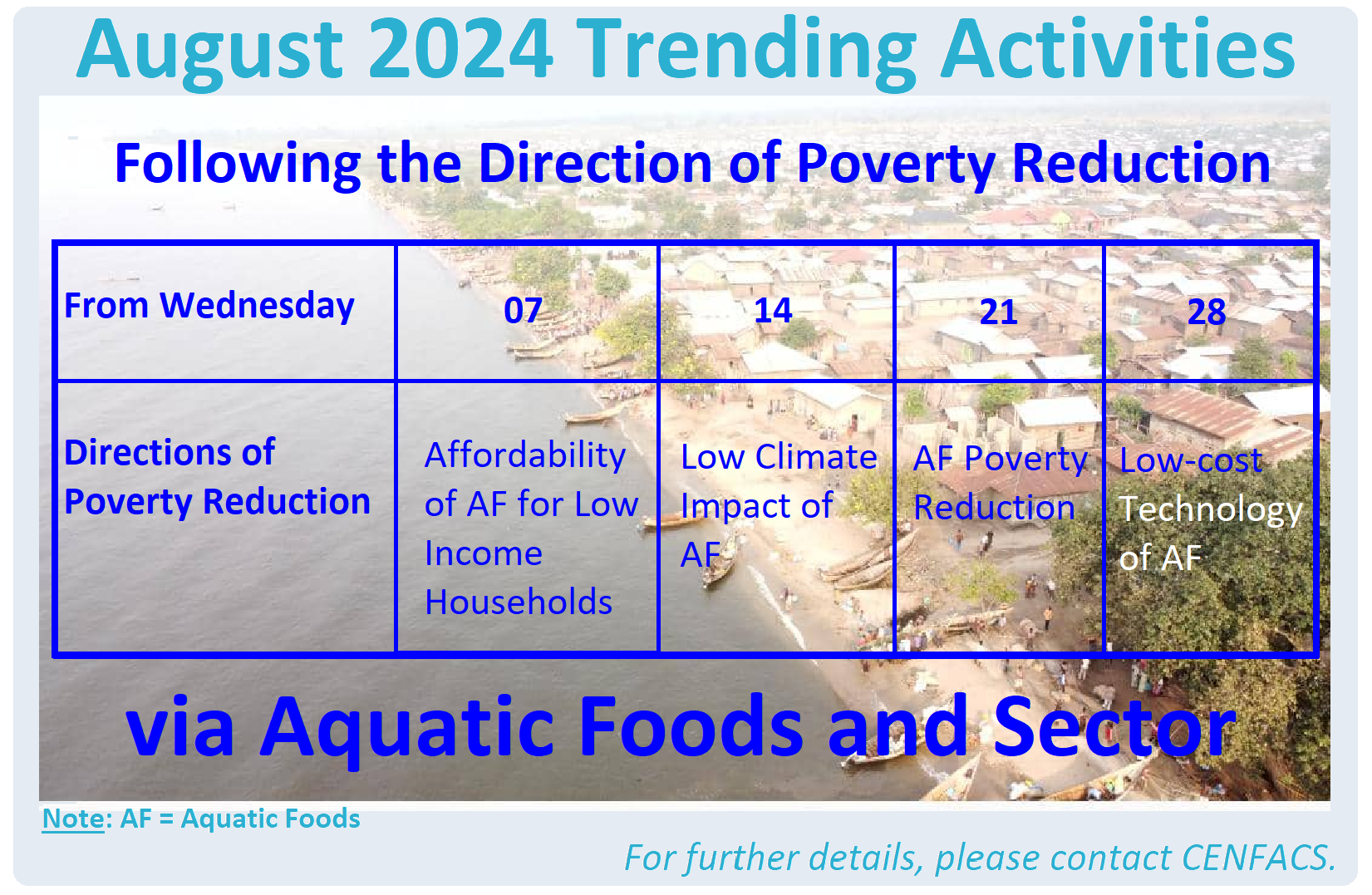

• Following the Direction of Poverty Reduction This Summer via Aquatic Foods, Trending Topic in Focus from Wednesday 14/08/2024: Low-climate Impact of Aquatic Foods

• Happiness, Healthiness and Wellness Journal 2024, Creative Activity 4: Create Your Journal of Real Disposable Incomes

… And much more!

Key Messages

• FACS Issue No. 84, Summer 2024: African Charities Investment Management and Poverty Reduction

Like any charity, Africa-based charities make investment decisions. However, they would act within their charity power to invest and according to their governing documents (i.e., articles of association). It is this type of investment that their investment managers are able to decide and make that the 84th Issue of FACS is concerned with.

The Issue 84 deals with strategy to manage investment risks; strategy that consists of spreading investments across asset classes and industries. In doing so, this strategy allows to balance returns on investment and concerns on the same investments.

The Issue 84 is also be a story of Africa-based charities’ care and skills in investment decisions. In particular, emphasis is put on investment managers of these charities, on how they manage portfolio and deal with investment policies while supporting their organisations to measure risk tolerance relating to investments and reduce the impact of adverse economic change on portfolios and to continue to meet the needs of the poor. They can advise their organisations to invest in mixed assets funds or national equity funds or global equity funds or fixed interest funds or property and cash funds or green bonds.

Because we are talking about charities, investment management is looked at in its capacity of helping these charities to achieve their charitable mission, particularly but not limited to poverty reduction. This is so crucial in challenging times like of those systemic crises namely the health disaster (e.g., coronavirus) and other major shocks such as debt crisis in Africa. In these exceptional times, a good investment management can provide the foundations for resilience against these systemic crises or shocks.

To achieve their mission via investment management, CENFACS‘ Africa-based Sister Organisations have investment options from which they can choose. The 84th Issue explores these options together the fund management houses in Africa, in particular how they can be helpful in responding to Africa-based Sister Organisations’ (ASOs’) investment strategic plan.

Without providing specialist advice on investment management to African charities, the Issue No. 84 is a general advice clinic for those ASOs that would like to take investment management path seriously to help them achieve their mission without having to continuously worry if they have some lump of sum kept away from present expenditure in the hope to receive a reward.

To get inside scoop on the Issue No. 84, please read under the Main Development section of this post the key summaries we have provided about them.

• Following the Direction of Poverty Reduction This Summer via Aquatic Foods, Trending Topic in Focus from Wednesday 14/08/2024: Low-climate Impact of Aquatic Foods

The second trending topic will be approached by briefly explaining low-climate impact and highlighting the role of aquatic foods in climate action.

• • Brief Explanation of Low-climate Impact

Climate impacts are the phenomena or events like storms, floods, extreme heat, droughts, and wildfires. The repercussions of these events can be high, moderate and low. Low-climate impacts provide the opportunities to avoid or reduce greenhouse gas emissions.

For example, small pelagic fish such as anchovies, sardines and low trophic level species generate fewer greenhouse gases. Because of the fewer greenhouse gases emission from this type of fish, particular attention can be put on fisheries and aquaculture. Indeed, sustainable and climate-resilient fisheries and aquaculture management can help limit the impacts of climate change. Foods coming from fisheries and aquaculture can play a role in climate action.

• • The Role of Aquatic Foods in Climate Action

Aquatic foods (foods which derived from marine animals, plants and algae) play an active role in climate action as many studies show. Aquatic foods provide critical climate solutions. It is important to integrate these solutions in any strategy to reduce food poverty.

Because the work of CENFACS is on poverty reduction, we are interested in the second trending topic, mostly in the aspects or attributes constituting the role of aquatic foods in climate action; aspects or attributes that relate to poverty reduction. In particular, we are following the direction of poverty reduction via aquatic foods in their role in climate action or low-climate impact.

So, aquatic food sector is a key to the low-carbon transition as it has a low-climate impact. Aquatic ecosystems offer promising solutions to the climate crisis and poverty reduction.

The above is our trending work from Wednesday 14 to 20/08/2024.

To follow with us the direction of poverty reduction via aquatic foods, please contact CENFACS.

• Happiness, Healthiness and Wellness Journal 2024, Creative Activity 4: Create Your Journal of Real Disposable Incomes

There are relationships between happiness and income, between healthiness and income, between wellness and income. One can express these relationships through the production of a journal. Before embarking on journaling, let us briefly explain these relationships.

• • Relationship between Happiness and Income

Regarding this relationship, Laura Kudrna and Kostadim Kushlev (1) explain the following:

“More income provides people with opportunities and, sometimes, capabilities to consume more and thus satisfy more of their preferences, meet their desires and obtain more of what they want and need. These are all reasons to assume that higher income will bring greater happiness – or, at least, that low income will bring low happiness”.

Kudrna and Kushlev also argue that

“Some research challenges the assumption that earning more should lead to greater happiness”.

One can use the explanation and argument of Kudrna and Kushlev to journal their own experiences, feelings and thoughts in terms of the relationship between happiness and their income.

• • Relationship between Healthiness and Income

There are many studies about the relationship between health and income. One of them was by ‘health.org.uk’ (2) in 2021, which explained that

“44% of people on the lowest income rate their health as fair, bad or very bad (less than good). In the middle (the fifth income decile) this figure is 25% and for people on the highest incomes the figure is 12%. Across the income spectrum, higher incomes are associated with better self-reported health”.

Likewise, ‘healthaffairs.org’ (3) talking about the USA case argues that

“There is an extensive body of research examining the relationship between income and health, and this evidence, both correlational and causal, predominantly finds that higher income is associated with better health. Findings from large-scale observational studies indicate that people with lower incomes have shorter lifespans and greater morbidity relative to those with higher incomes and that these health risks are greatest amongst people living in poverty”.

From the explanation of ‘health.org.uk’, ‘healthaffairs.org’ and other ones, one can write about their own experiences, feelings and thoughts in terms of the relationship between their health and income.

• • Relationship between Wellness and Income

To explain this relationship, let us first define wellness. One of its definitions comes from the Global Wellness Institute (4), which argues that

“Wellness is the active pursuit of activities, choices and lifestyles that lead to a state of holistic health”.

There could be links between the choices we make about our lives and holistic health, between our lifestyles and holistic health, between the activities we undertake and holistic health.

Those who would like to narrate their own experiences, feelings and thoughts in terms of their wellness and income, they can journal their perspective.

When speaking about income, we mean real disposable income. But, what is real disposable income?

• • Understanding Real Disposable Income to Create Your Journal of Happiness, Healthiness and Wellness

Generally, income is any earning in the form of wages and salaries, the return of investments, pension contributions, and other receipts (such as profit, interest, dividend, rent, capital gains, royalties, etc.). This income can be real disposable. What is a real disposable income?

Using the definition provided by ‘tutor2u.net’ (5), real disposable income is

“The amount of money an individual or household has available to spend or save after accounting for taxes and adjusting for inflation. It is a key measure of the purchasing power and economic well-being of individuals or households”.

One can refer to this definition of real disposable income to create their Journal of Happiness, Healthiness and Wellness.

• • An Example of Way of Creating a Journal of Real Disposable Income

One can explain how with restricted or limited income they have been able to meet Summer 2024 holiday expenses or simply do the things they wanted or planned to do with happiness, healthiness ad wellness. They can as well include in their journal any efforts they undertook to make extra income to meet their Summer living costs or improve their economic well-being. They could finally impact share their story if they received or given any financial help.

• • Impact Record and Share of Your Journal of Real Disposable Income

They can impact record their thoughts, feelings, experiences, souvenirs and memories in relation to real disposable income and income-generating capacity or opportunities. They can impact share with the community their experience of happiness, healthiness and wellness with income. This can be recorded in their journal and be shared by the end of Summer 2024.

To impact share the contents of their happiness, healthiness and wellness journal relating to real disposable income and income-generation, to happy, healthy and good financial life via income, and help build a better Summer holiday experience; they can contact CENFACS.

Extra Messages

• Online TRACK to CENFACS Zero-Waste e-charity Summer Shop for Summer Goods Donations and Buys: Turn Your Waste into Relief for Others

• Virtual and In-person Trips for Fieldwork Research

• CENFACS’ be.Africa Forum e-discusses Sports World Order and Poverty Reduction in Africa

• Online TRACK to CENFACS Zero-Waste e-charity Summer Shop for Summer Goods Donations and Buys: Turn Your Waste into Relief for Others

Every season is an opportunity to do something about the environment and poverty.

You can recycle or donate your unwanted or unused goods and presents to do something about the environment and or poverty.

You can also buy goods to meet the same ends.

This Summer you can online track CENFACS e-charity shop to help the environment and poverty relief. You can turn your waste into relief for those in need.

If you are a fun of online tracking and shopping, you can take an online course of action or online path or even course of travel to save the environment and reduce poverty with CENFACS.

Instead of you in-person going to physically shop or donate your goods, you can from the comfort of your home buy or donate goods to CENFACS e-charity shop to help the beautiful and noble cause of poverty relief and sustainable development.

To support us either by shopping or supplying us with products or goods you no longer want or use so that we can sell and raise the money for the beautiful cause of poverty relief, please go to http://cenfacs.org.uk/shop/

• Virtual and In-person Trips for Fieldwork Research

Trips to the local need this week include as well those travels made or to be made to conduct fieldwork research in Africa and anywhere else in the context of poverty relief and sustainable development projects.

We recommend to those who want do trips for fieldwork research to take extra care in terms of health and safety. Where health risks are nullified or minor, people can in-person visit local projects and those running them. These trips can also be done virtually.

When in-person visiting projects and people, it is in the interest of everybody that they should take care of the following:

√ They have to be fully vaccinated and or negatively tested against any diseases that may threaten them

√ They should wear appropriate personal protective equipment to protect themselves and others against the coronavirus if the latter is still a major threat to health where they go

√ They should follow local, national and international rules related to the protection against any threatening disease or epidemic symptoms.

These fieldwork researches or practical experiences to gain knowledge and skills could be of varying forms such as observation and collection of raw data, interviews, focus group discussions, practical activities to support overseas development projects, etc.

If you are a researcher and did or are doing some fieldwork research on sustainable development and poverty reduction, and think that your work can enhance CENFACS’ work, you could share with us your experience, research findings or outcomes.

To share the experiences and results of your fieldwork research, just contact CENFACS and CENFACS will get back to you.

• CENFACS’ be.Africa Forum e-discusses Sports World Order and Poverty Reduction in Africa

Sports World Order can provide opportunities and openings for Africa, in particular to reduce poverty and enhance sustainable development. In our programme of the discussion for the August 2024, we are dealing with the impacts of the World Order in sports on Africa, specifically on the reduction of poverty in Africa.

To tackle this e-discussion, one may need to know the meaning of sports world order.

• • What Is Sports World Order?

A way of explaining this is to start with the understanding of world order. The website ‘pesd.princeton.edu’ (6) states that world order is both analytical and prescriptive concept. According to ‘pesd.princeton.edu’,

“Analytically, world order refers to the arrangement of power and authority that provides the framework for the conduct of diplomacy and world politics on a global scale. Prescriptively, world order refers to a preferred arrangement of power and authority that is associated with the realisation of such values as peace, economic growth and equity, human rights, and environmental quality and sustainability”.

From these definitions of world order, it is possible to argue that sports world order is prescriptively an arrangement of power and authority that is associated with the realisation of the values of peace, poverty reduction, friendship and equity in sports. We have included poverty reduction as we believe that sports is also the vehicle to reduce poverty. If this is the case, what can the sports world order do for the poor?

• • Sports World Order and Poverty Reduction

Sports World Order can work with Africa to further reduce poverty in Africa. In other words, the arrangement of power and authority in terms of sports need to accompany the poor in Africa so that a big number of them can be lifted out of poverty. The geopolitics and geo-economics of sports need to further integrate the needs and demands of the poor. The organisation of sports systems and programmes should not limit itself to cultural and sport values. It needs to cross the boundaries to be embodied by poverty reduction goals and targets without loosing its nature or essence.

The above is the terms of reference for our discussion. Those who may be interested in this discussion of August 2024 can join in and or contribute by contacting CENFACS’ be.Africa, which is a forum for discussion on matters of poverty reduction and sustainable development in Africa and which acts on behalf of its members in making proposals or ideas for actions for a better Africa.

To communicate with CENFACS regarding this discussion, please use our usual contact details on this website.

Message in French (Message en français)

FACS Numéro 84, Été 2024: Gestion des investissements des organisations caritatives africaines et réduction de la pauvreté

Comme toute organisation caritative, les organisations caritatives basées en Afrique prennent des décisions d’investissement. Cependant, elles agiraient dans le cadre de leur pouvoir d’investir et conformément à leurs documents constitutifs (c’est-à-dire les statuts de l’association). C’est ce type d’investissement que leurs gestionnaires d’investissement sont en mesure de décider et de faire qui fait l’objet de la 84e édition de la FACS.

Le numéro 84 traite de la stratégie de gestion des risques d’investissement; stratégie qui consiste à répartir les investissements entre les classes d’actifs et les secteurs. Ce faisant, cette stratégie permet d’équilibrer les retours sur investissement et les préoccupations sur les mêmes investissements.

Le numéro 84 est également une histoire sur le soin et les compétences des organisations caritatives basées en Afrique dans les décisions d’investissement. En particulier, l’accent est mis sur les gestionnaires d’investissement de ces organisations caritatives, sur la façon dont ils gèrent les portefeuilles et gèrent les politiques d’investissement, tout en aidant leurs organisations à mesurer la tolérance au risque liée aux investissements et à réduire l’impact des changements économiques négatifs sur les portefeuilles et à continuer à répondre aux besoins des pauvres.

Ils peuvent conseiller à leurs organisations d’investir dans des fonds d’actifs mixtes, des fonds d’actions nationales, des fonds d’actions mondiales, des fonds à intérêt fixe, des fonds immobiliers et de trésorerie ou des obligations vertes.

Comme il s’agit d’organismes de bienfaisance, la gestion des placements est considérée dans sa capacité d’aider ces organismes à réaliser leur mission de bienfaisance, en particulier, mais sans s’y limiter, la réduction de la pauvreté. C’est tellement crucial en période difficile comme celle des crises systémiques, à savoir la catastrophe sanitaire (par exemple, le coronavirus) et d’autres chocs majeurs tels que la crise de la dette en Afrique. En ces temps exceptionnels, une bonne gestion des investissements peut jeter les bases de la résilience face à ces crises ou chocs systémiques.

Pour réaliser leur mission par le biais de la gestion d’investissements, les organisations sœurs de CENFACS basées en Afrique disposent d’options d’investissement parmi lesquelles elles peuvent choisir. Le numéro 84 explore ces options avec les sociétés de gestion de fonds en Afrique, en particulier comment elles peuvent être utiles pour répondre au plan stratégique d’investissement des organisations sœurs basées en Afrique (OSA).

Sans fournir de conseils spécialisés sur la gestion des investissements aux organisations caritatives africaines, le numéro 84 est une clinique de conseil général pour les OSA qui souhaitent prendre au sérieux la voie de la gestion des investissements pour les aider à réaliser leur mission sans avoir à s’inquiéter continuellement de savoir si elles ont une somme importante conservée à l’écart des dépenses actuelles dans l’espoir de recevoir une récompense.

Pour en savoir plus sur le numéro 84, veuillez contacter le CENFACS.

Main Development

• FACS Issue No. 84, Summer 2024: African Charities Investment Management and Poverty Reduction

The contents and key summaries of the 84th Issue of FACS are given below.

• • Contents and Pages

I. Key Terms Relating to the 84th Issue of FACS (Page 2)

II. Africa-based Sister Organisations (ASOs) and Advice on Investment Management (Page 2)

III. ASOs and Infrastructure Investment Management (Page 3)

IV. ASOs and Investment Policy Statement (Page 3)

V. ASOs and the Quantification of Their Investment Aims (Page 3)

VI. ASOs and Investment Priorities (Page 4)

VII. ASOs and Diversified Portfolio (Page 4)

VIII. Les Organisations sœurs basées en Afrique (OSA) et évaluation des risques d’investissement (Page 5)

IX. Les Organisations sœurs basées en Afrique et leurs objectifs d’investissement (Page 5)

X. Les Organisations sœurs basées en Afrique et leur sélection d’investissements (Page 6)

XI. Les Organisations sœurs basées en Afrique et le suivi de leurs investissements (Page 6)

XII. Survey, Testing Hypotheses, E-questionnaire and E-discussion on Charity Investment Management (Page 7)

XIII. Support, Tool and Metrics, Information and Guidance on Investment Management (Page 8)

XIV. Workshop, Focus Group and Booster Activity about Charity Investment Management and Poverty Reduction (Page 9)

XV. Giving and Project (Page 10)

• • Key Summaries

Please find below the key summaries of the 84th Issue of FACS from page 2 to page 10.

• • • Key Terms Relating to the 84th Issue of FACS (Page 2)

There are five terms used in the context of this Issue of FACS. These terms are financial investment, African charity investment management, risk tolerance, investment manager and poverty reduction. Let us briefly explain these key terms.

• • • • Financial Investment

The 84th Issue of FACS deals with financial investment. Financial investment is about investing with the ultimate objective of making money by one or both of the following: generating income from an investment and increasing the value of an investment (capital growth).

Like their counterparts in the other regions of the world, African charities can undertake the following financial investments: renting out a building or property, buying shares, and placing cash on deposit. All depends on the legislation of the African countries where they operate or they want to undertake investment management.

• • • • African Charity Investment Management

Let us first start by explaining investment management. To explain it, let us refer to what ‘nerdwallet.com’ (7) says about it, which is

“Investment management is the maintenance of an investment portfolio, or a collection of financial assets. It can include purchasing and selling assets, creating short – or long-term investment strategies, overseeing a portfolio’s asset allocation and developing a tax strategy. Portfolio management and asset management are other terms that also broadly refer to services that provide oversight of a client’s investments”.

From this definition of investment management, we can argue that African charity investment management is simply investment management that applies to or carried out by African charities. However, let us emphasis that charity investment decisions in the UK are undertaken to further charity’s purposes, according to the UK Government (8). In the UK Government’s spirit, it means that trustees are required to do what will best help their charity to carry out its purposes, both now and for the future. African charities, particularly CENFACS‘ Africa-based Sister Organisations, can do the same depending on what the rules of the African government where they operate say.

• • • • Risk tolerance

Investment comes with risk that investor may or may not tolerate. Risk tolerance is defined by ‘corporatefinanceinstitute.com’ (9) as

“The amount of loss an investor is prepared to handle while making an investment decision”.

The website ‘forbes.com’ (10) goes further by arguing that

“Risk tolerance is a measure of your comfort in assuming risk. The more comfortable you are with risk, the less likely you are to be risk averse in investment decision-making and lower investment returns”.

Those who deal with investments (e.g., trustees or investment managers) in charity will be required to make a good judgement on the level of risk that the charity can tolerate. They can as well use online risk tolerance calculator to guide them.

• • • • Investment manager

Investment management can be done independently or with an investment manager’s help or expertise. Those Africa-based Organisations that will choose to have an investment manager, they need to be aware about what an investment manager can do for them (that is, investment manager’s job description and person specification). They are required to know what an investment manager is.

According to ‘dbs.com’ (11),

“An investment manager is an individual or organisation who invests in security, portfolio on behalf their clients. Also known as fund or asset managers”.

Investment managers for funds are broadly classified into three types: a) personal fund managers b) business fund managers c) corporate fund managers.

Investment managers in the context of the 84th Issue are charity fund managers. They can give advice about planning and managing charity’s investments (advisory management). They can as well have some powers to make investment decisions on charity’s behalf (discretionary management).

ASOs that can afford would employ an investment manger as part of their staff or hire outside investment manager.

• • • • Poverty reduction

Poverty reduction is any measure or effort to decrease this state in which resources are lacking. It can be viewed from various angles. Looking at poverty reduction from the monetary perspective, Y. A. Bununu (12) thinks that

“Poverty reduction can be considered as the improvement of an individual’s or group’s monetary expenditure to an amount above the poverty line while improving access to education, healthcare, information, economic opportunities, security of land-tenure, all the other deprivations associated with it”.

Taking a historical and intertemporal view of poverty reduction, the website ‘borgenproject.org’ (13) argues that poverty reduction is evolving concept. It evolves from a simple to complex concept throughout the time to mean the following:

σ financial contributions to governments of poverty-stricken nations

σ achieving the goal of lifting as many people above the poverty line as possible

σ the extended relief programmes and education programmes focusing on sustainability in target communities.

The goalposts of poverty reduction keep moving depending on the types of hardship people face at a particular time of the history.

The above-named definitions shape the contents of the 84th Issue of FACS.

• • • Africa-based Sister Organisations (ASOs) and Advice on Investment Management (Page 2)

ASOs can manage their investments by themselves (through their trustees or in-house investment managers) or seek advice on investment management from a third party (outside investment managers).

If they choose to hire outside investment managers, the latter will provide them with advice including advice on investment risk tolerance. There are a number of organisations in Africa that are specialised in providing advice on investment management. African Capital Alliance (14) is one of them.

Within CENFACS we can as well source advisory support for those ASOs looking for advice on how to manage investments. This can done under CENFACS’ International Advice Service. For those ASOs that are needing this sort of advice, they should hesitate to contact CENFACS.

• • • ASOs and Infrastructure Investment Management (Page 3)

For those ASOs that would like to get involved in infrastructure investment management activities, they can invest in private equity infrastructure funds and long-term institutional unlisted equity.

There are sectors in Africa in which they can hopefully invest in infrastructure projects. These promising sectors include digital revolution (e.g., smart phone and mobile internet, cloud and fibre technologies), urbanisation (with many people moving to cities in Africa and looking for accommodation and other infrastructures to meet their needs), energy transition (with the need to electrify Africa’s huge population without electricity).

There are African infrastructure investment organisations working on these sectors and issues. ASOs can approach these organisations to explore the possibility of investing. Among them is African Infrastructure Investment Managers (15).

• • • ASOs and Investment Policy Statement (Page 3)

To invest, ASOs could be required to set up an investment policy statement if they do not have one or to revisit it if they have it. Their investment policy statement needs to indicate where they want to go in terms of investments. If ASOs can craft this policy by themselves is OK. If they cannot, they can seek support from investment managers working with charities.

The policy and investment arrangements need to state the position of ASOs with regard to risk tolerance. They are also required to indicate the suitability of investments in line with their strategy and income/capital return targets. As ‘rathbones.com’ (16) puts it:

“An investment policy statement sets out a charity’s investment objectives and how it intends to achieve them, which in turn enables the trustees to demonstrate they have complied with their duties. It also provides investment managers with a framework to make informed investment decisions within the charity’s parameters”.

• • • ASOs and the Quantification of Their Investment Aims (Page 3)

It is worth for ASOs to have quantified aims. Whether ASOs work independently on investment management or use external investment managers, they need to set up the following:

∝ annual investment income

∝ a quantified risk budget

∝ meaningful targets to track and measure progress

∝ expected average total return over the long-term period

∝ the volatility of return to be experienced or the level of volatility tolerance

etc.

The above-mentioned quantified aims will equip them to monitor the performance of their investment management drive.

• • • ASOs and Investment Priorities (Page 4)

ASOs need to decide what they want to prioritise when investing or dealing with investment management. They can choose between the different options. They can prioritise income (how much income they would like to achieve), total return (the amount of yearly return they can expect from their investments) and relative risk (how much risk they are willing to take for the level of investment they are prepared to commit themselves).

So, prioritisation in terms of investing or investment management will enable those working on investment management for ASOs to better focus on what to work on and facilitate ASOs to accomplish their mission. It means they will put in place a schedule for immediate investments which they can focus upon.

• • • ASOs and Diversified Portfolio (Page 4)

With a sound investment management, ASOs that have not already done so can build a diversified collection of financial securities comprising of short, medium and long term earnings. The choice of portfolio will depend on the mix of income and capital growth that ASOs expect. This will enable them to spread the risk associated to portfolio. Such portfolio will provide to them the possibility of bearing a minimum amount of risk for a certain level of investment return. No matter the size of ASOs, it is good for ASOs that have not diversified their portfolio to start doing it.

So, regardless of their size, ASOs can build and diversify their financial portfolio to meet their objectives, values and in line with their risk profile. They can do it by themselves if they have the competency and capacity in portfolio management or they can appoint an portfolio/asset class specialist.

• • • Les Organisations sœurs basées en Afrique (OSA) et évaluation des risques d’investissement (Page 5)

Tout investissement comporte des risques. Il est bon d’évaluer ce risque avant de se lancer dans l’investissement. Les ASO peuvent utiliser le cycle d’évaluation des risques pour gérer leur investissement. Il peut s’agir de différents types.

Par exemple, au Royaume-Uni, le gouvernement (17) a adopté le modèle d’évaluation des risques suivant pour les organismes de bienfaisance, qui consiste en

∝ Identifier, évaluer et hiérarchiser les risques

∝ Concevoir des systèmes et des procédures pour atténuer les risques

∝ Former le personnel et mettre en œuvre des systèmes et des procédures

∝ Surveiller et examiner les performances.

En fonction de l’endroit où chaque ASO intervient en Afrique et de ses compétences, elles peuvent appliquer le modèle d’identification, de quantification, d’évaluation et de gestion des risques et incertitudes potentiels qui leur convient et qui répond aux besoins locaux.

• • • Les Organisations sœurs basées en Afrique et leurs objectifs d’investissement (Page 5)

Pour investir, les ASO peuvent définir clairement leurs objectifs d’investissement. Les objectifs d’investissement définissent la direction que ces organisations souhaitent prendre. Comme le dit ‘bestrategicplanning.com’ (18)

“Les objectifs d’investissement font référence aux objectifs ou aspirations financières spécifiques que les individus, les entreprises et les investisseurs se fixent tous pour leurs entreprises d’investissement. Ces objectifs aident à établir un sentiment d’orientation et de but dans le domaine de l’investissement, en guidant les décisions sur où et comment investir de l’argent”.

Ainsi, les ASO qui ont besoin d’investir ou de maintenir leurs investissements, elles doivent également développer des objectifs d’investissement clairs et essayer d’adapter ces objectifs à la réalité du marché et du monde de la réduction de la pauvreté.

• • • Les Organisations sœurs basées en Afrique et leur sélection d’investissements (Page 6)

Comme toute organisation, les ASO ont leur vision, leur mission, leurs buts et objectifs. Lorsqu’il s’agit d’identifier et de choisir les types d’investissements qu’elles aimeraient entreprendre, il est préférable pour elles de sélectionner ceux qui correspondent à leur vision, à leur mission, à leurs buts et à leurs objectifs.

Cette sélection minutieuse permettra d’éviter les conflits entre la sélection de leurs investissements et leur vision, leur mission, leurs buts et objectifs. Cela les aidera également dans la manière dont elles s’engagent avec les différentes parties prenantes impliquées dans leur campagne d’investissement. Cette sélection inclura également le niveau de tolérance qu’elles ont pour un risque donné.

• • • Les Organisations sœurs basées en Afrique et le suivi de leurs investissements (Page 6)

Le suivi de la performance d’un investissement au fil du temps est crucial pour les ASO. Ce suivi doit être un processus continu. C’est aussi le processus d’évaluation de la performance du portefeuille d’investissement. Cependant, ce processus n’aura de valeur que s’il s’aligne sur la mission, les objectifs financiers et la tolérance au risque des ASO.

Le suivi collectera et enregistrera régulièrement des informations sur les investissements en fonction du temps que les ASO fixent pour suivre leurs investissements.

Il y a des organismes de surveillance des investissements qui sont familiers avec ce type d’exercice de surveillance ou de suivi des investissements, en particulier ceux qui ont mis en place un système à cet effet. Pour ceux qui ne sont pas familiers avec le suivi des investissements, il n’est pas tard pour demander de l’aide.

• • • Survey, Testing Hypotheses, E-questionnaire and E-discussion on Charity Investment Management (Page 7)

• • • • Survey on investment and their substitution effect

Charity investment can be a viable option for African charities to generate extra income or grow their capital from financial investment to achieve their mission.

The purpose of this survey is to collect information from a sample of our Africa-based Sister Organisations and community members regarding their perception on charity investment and their substitution effect compared to other ways of raising funds.

Participation to this survey is voluntary.

As part of the survey, we are running a questionnaire which contains some questions. One of these questions is:

Q: Is investment management the best option for African charities looking to maintain a financial portfolio and collection of financial assets that align with their poverty reduction goals?

You can respond and directly send your answer to CENFACS.

• • • • Testing hypotheses about charity investments to poverty reduction

According to the Scottish Charity Regular (19),

“Charity’s investments can involve a range of assets, such as a building from which you receive rental income, cash placed on deposit which generated interest, a portfolio of stocks, shares and other assets, or a right to income from other asset, for example royalty income arising from owning the copyright to a book”.

Considering this spectrum of investments, one can conduct the following test:

∝ Null Hypothesis (Ho): There is a correlation between charity’s return on investments and its contribution to its cause.

∝ Alternative Hypothesis (H1): There is not a correlation between charity’s return on investments and its contribution to its cause.

The above test is for those of our members who would like to dive deep into charity’s investments and their impact on its cause. In order to conduct these tests, one needs data on charity’s return on investments and to know the charity cause they are talking about.

• • • • E-question on your view about charity financial investment

Financial investment is about investing with the ultimate objective of making money. Any money made via this way is called a financial return. This can raise the following question:

Q: Is charity financial investment helpful in furthering charity’s purposes or simply moving charities away from their founding mission?

Any of our readers and users can answer the above-mentioned question. You can provide your answer directly to CENFACS.

For those answering any of this question and needing first to discuss charity investment management, they can contact CENFACS.

• • • • E-discussion on risk tolerance

The e-discussion is about one’s ability to endure savings in investment returns and stock market fluctuations. This is because many of our members have their own view about risk tolerance. Some of them can assume high risk to invest. Others are risk averse no matter the level of investments. Others more can take average risk depending on circumstances.

For those who may have any views or thoughts or even experience to share with regard to this matter, they can join our e-discussion to exchange their views or thoughts or experience with others.

To e-discuss with us and others, please contact CENFACS.

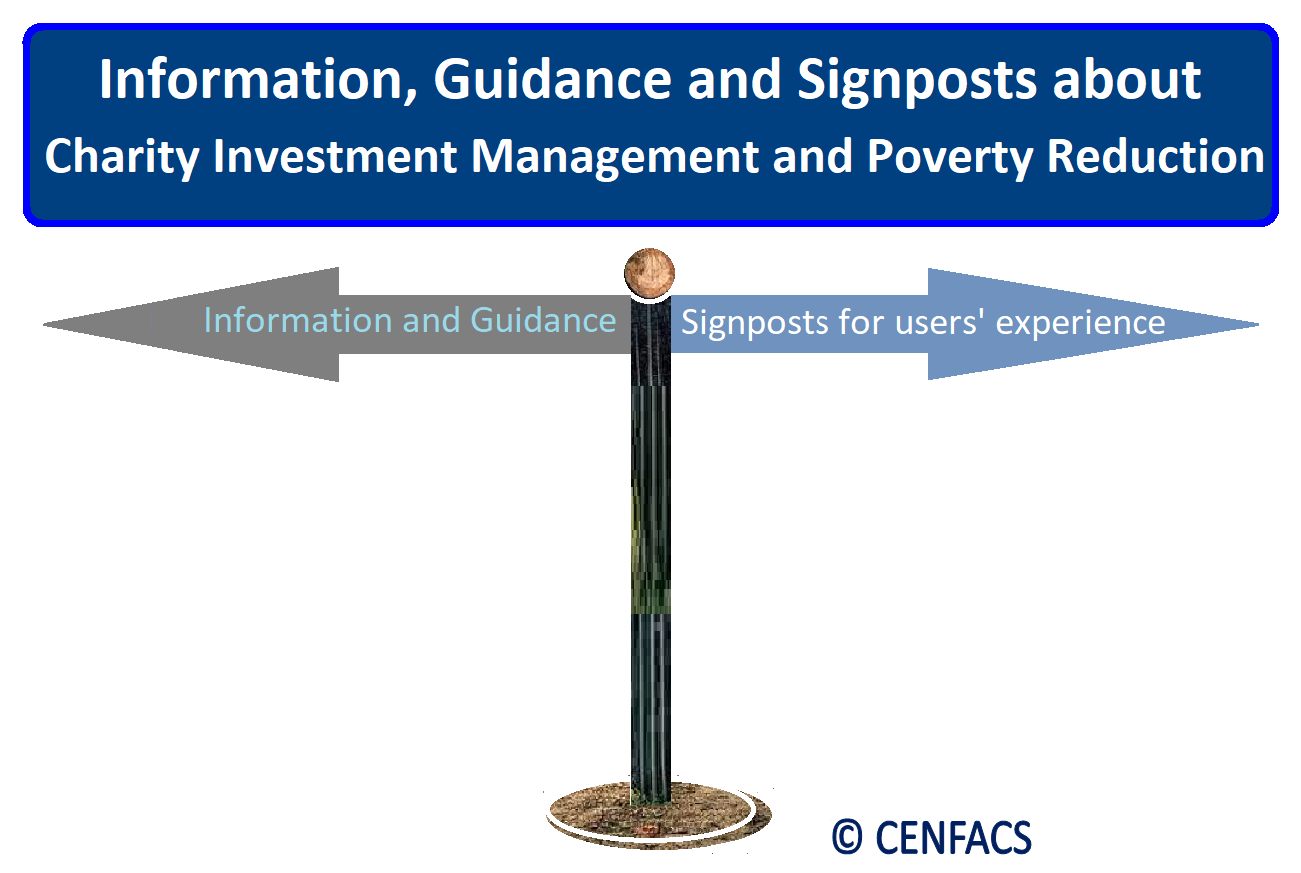

• • • Support, Tool and Metrics, Information and Guidance on Investment Management (Page 8)

• • • • Ask CENFACS for Guidance regarding the reduction of poverty via investment management

An investment management, that is aligned with a charity’s mission and goal of poverty reduction, can help to narrow the wealth gap and build generational wealth to escape from intergenerational poverty.

For those ASOs who would like find out how they can align their investment management with their goals of poverty reduction, they can contact CENFACS.

CENFACS can work with them to explore ways of aligning their investment management strategy with their mission.

We can work with them under our International Advice-, Guidance- and Information-giving Service. We can as well signpost them to organisations working on charity investment management matter.

Need advice, guidance and information; please contact CENFACS for support.

• • • • Tools and metrics of the 84th Issue of FACS

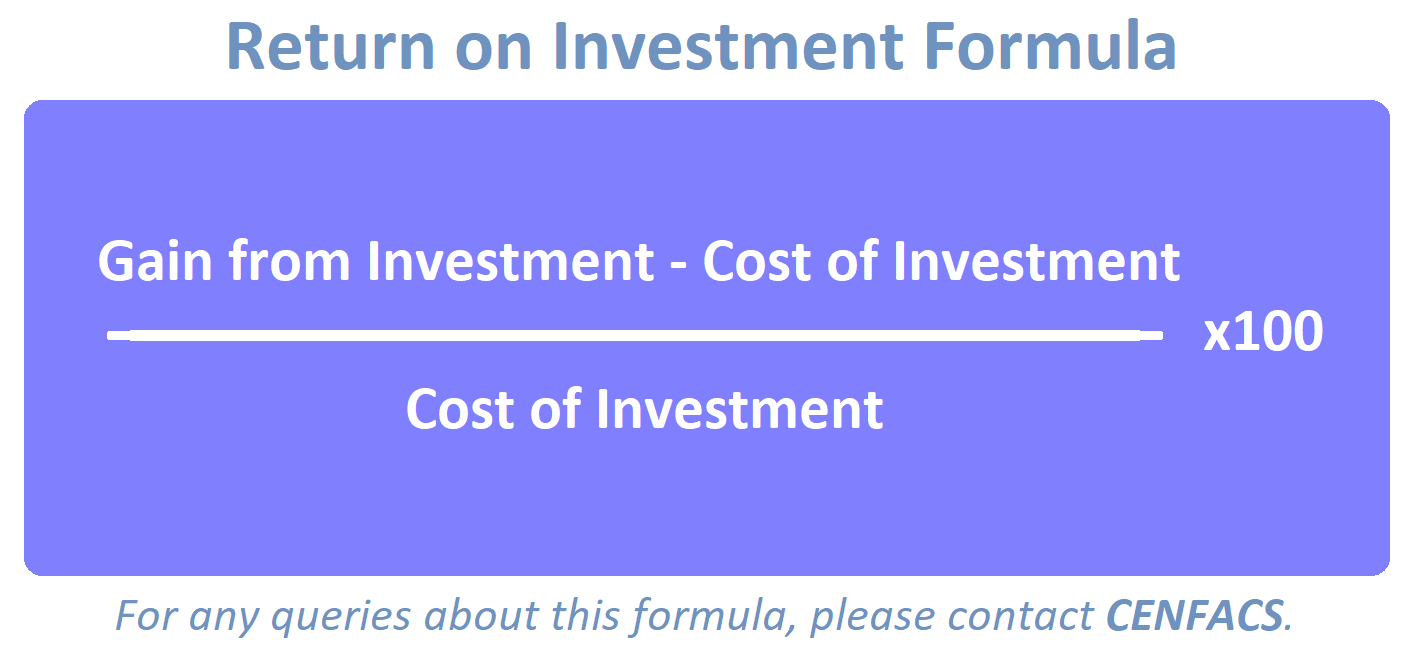

The 84th Issue of FACS is concerned with four types of tools or metrics which are: return on investment, surplus margin, earned income and poverty gap ratio.

Let us briefly explain these tools or metrics.

• • • • • Investment tool and metrics: Return on Investment

The 84th Issue utilises as tool Return on Investment. This return on investment (ROI) does not necessarily to be financial (income). It can be capital growth, social or environmental return, happiness and so on.

If one chooses financial ROI, then they need to explain what it means and how to measure it. Definitions of ROI tend to overlap.

For example, ‘corporatefinanceinstitute.com’ (20) defines ROI as

“A performance measure used to evaluate the returns of an investment or to compare the relative efficiency of different investments”.

Another definition comes from ‘forbes.com’ (21) that states

“ROI is a metric used to understand the profitability of an investment”.

There is also online ROI calculator for those who will be interested in it.

Because charities exist to delivery public benefit not profit, the 84th Issue is also interested in non-financial ROI. Furthermore, the 84th Issue considers the impact of your investments on poverty reduction. In other words, it deals with impact investing. According to ‘renewcapital.com’ (22),

“Impact investing allows you to invest in Africa in a way that makes a positive social or environmental difference while seeking a financial return on investment”.

• • • • • Surplus margin

The second metrics that the 84th Issue uses is Surplus Margin. What is it?

It is the following measure:

(Net income/Total income) x 100

The website ‘cranfieldtrust.org’ (23) explains that

“Generating a surplus allows a charity to invest in the improvement/expansion of charitable activities. If the surplus marginal overall is positive, you have made a surplus and your reserves will be boosted”.

For example, this measure can be used to find out the surplus margin of ASO investors and their investment portfolios.

Additionally, one could consider the number of charitable organisations that are investors and the types of their investments.

Alternatively, one could try to find answers to the following questions:

Q1: Do they invest in mixed assets funds or national equity funds or global equity funds or fixed interest funds or property and cash funds or green bonds?

Q2: What do their investment portfolios look like?

Q3: Do they achieve a surplus margin?

Q4: What is the profile of their margins?

• • • • • Earned to unearned income ratio

The 84th Issue also employs the ratio of earned to unearned income. This ratio can be written as follows:

Earned Income / Unearned Income

The website ‘cranfieldtrust.org’ (op. cit.) argues that

“The ratio of earned to unearned income helps to show that the charity has developed diversified income as it has evolved. It is useful for donors and funders”.

For example, our ASOs that would like to invest can utilise this ratio to compare income earn from investments to incomes from unearned sources.

• • • • • Poverty gap ratio

This is an interesting metrics of poverty as it measures the intensity of poverty.

The online ‘marketbusinessnews.com’ (24) explains that

“The poverty gap ratio or poverty gap index is the average of the ratio of the poverty gap to the poverty line. Economists and statisticians express it as a percentage of the poverty line for a region or whole country…The poverty gap ratio considers how far, on the average, poor people are from poverty line”.

The above tools and metrics can be used in dealing with charity investment and poverty reduction in Africa. For example, one can use the poverty gap ratio to measure the average shortfall of the income of the poor women and youth in Africa from the poverty line.

• • • • Information and guidance on charity investment management and poverty reduction

Information and Guidance include two types areas of support via CENFACS, which are:

a) Information and guidance on charity investment management and poverty reduction

b) Signposts to improve Users’ Experience about impact investing and poverty reduction.

• • • • • Information and guidance on charity investment management and poverty reduction

Those Africa-based Sister Organisations (ASOs) that are looking for information and guidance on charity investment management and that do not know what to do, CENFACS can work with them (via needs assessment conducted under CENFACS’ International Advice Service) or provide them with leads about other organisations, institutions and services that can help them.

• • • • • Signposts to improve Users’ Experience about impact investing and poverty reduction

For those who are looking for whereabout to find help about impact investing queries, we can direct them to the relevant services and organisations.

More tips and hints relating to the matter can be obtained from CENFACS‘ Advice-giving Service and Sessions.

Additionally, you can request from CENFACS a list of organisations and services providing help and support in the area of charity investment management, although the Issue 84 does not list them. Before making any request, one needs to specify the kind of organisations they are looking for.

To make your request, just contact CENFACS with your name and contact details.

• • • Workshop, Focus Group and Booster Activity about Charity Investment Management and Poverty Reduction (Page 9)

• • • • Mini themed workshop on investment management skills to reduce poverty

Boost your knowledge and skills about the reduction of poverty via investment management skills with CENFACS.

The workshop aims at supporting those without or with less information and knowledge about investment management skills and knowledge while improving the quality of their lives. The workshop will provide recommendations for actions with options and opportunities for the participants.

To enquire about the boost, please contact CENFACS.

• • • • Focus group on impact investing

The focus group will deal with how to invest not only to realise a good return on your investment, but also to create a lasting impact. Impact investing will be approached from the perspective of win-win.

To take part in the focus group, group that will use deliberative practice strategies, please contact CENFACS.

• • • • Summer activity: Consulting Investment Managers

This user involvement activity revolves around the answers to the following questions:

Q1: Do you consult an investment manager or fund/asset manager for your investment decisions?

Q2: Do you have an investment account with an investment manager?

Those who would like to answer these two questions and participate to our Consulting Investment Managers Activity, they are welcome.

To take part in this activity, please contact CENFACS.

• • • Giving and Project (Page 10)

• • • • Readers’ giving

You can support FACS, CENFACS bilingual newsletter, which explains what is happening within and around CENFACS.

FACS also provides a wealth of information, tips, tricks and hacks on how to reduce poverty and enhance sustainable development.

You can help to continue its publication and to reward efforts made in producing it.

To support, just contact CENFACS on this site.

• • • • African Charities Investment Management Project (ACIMP)

ACIMP is an advisory management project designed by CENFACS to work together with Africa-based Sister Organisations looking to plan and manage their investments so that they can realise their mission with peace of mind without to worry to much about investment issues. The project will help to avoid investment mistakes while tolerating risk at fairly acceptable level.

Through this project, organisations will build generational investment management capacity and wealth that will help them and their beneficiaries to escape from intergenerational poverty.

To support or contribute to ACIMP, please contact CENFACS.

For further details including the implementation plan of the ACIMP, please contact CENFACS.

The full copy of the 84th Issue of FACS is available on request.

For any queries and comments about this Issue, please do not hesitate to contact CENFACS.

_________

• References

(1) Kudrna, L. & Kushlev, K. (2022), Money Does Not Always Buy Happiness, but Are Richer People Less Happy in Their Daily Lives? It Depends on How You Analyse Income, available at https://www.frontiersin.org/journals/psychology/articles/10.3389/fpsyg.2022.883137/full (accessed in August 2024)

(2) https://www.health.org.uk/evidence-hub/money-and-resources/income/relationship-between-income-and-health (accessed in August 2024)

(3) https://www.healthaffairs.org/doi/10.1377/hlthaff.2022.00846 (accessed in August 2024)

(4) https://globalwellnessinstitute.org/what-is-wellness/ (accessed in July 2024)

(5) https://www.tutor2u.net/economics/reference/what-is-disposable-income (accessed in August 2023)

(6) https://pesd.princeton.edu/node/696 (accessed in August 2024)

(7) https://www.nerdwallet.com/article/investing/what-is-investment-management (accessed in August 2024)

(8) https://www.gov.uk/government/publications/charities-and-investment-matters-a-guide-for-trustees-cc14/charities-and-investment-matter-a-guide-for-trustees#:~:text=Trustee%20oversightYou (accessed in August 2024)

(9) https://corporatefinanceinstitute.com/resources/wealth-management/risk-tolerance/ (accessed in August 2024)

(10) https://www.forbes.com/advisor/investing/what-is-your-risk-tolerance/ (accessed in August 2024)

(11) https://www.dbs.com/in/treasures/investment-manager (accessed in August 2024)

(12) Bununu, Y. A. (2020). Poverty Reduction: Concept, Approaches, and Case Studies. In: Leal Filho, W., Azul, A., Brandli, L., Özuyar, P., Wall, T. (eds) Decent Work and Economic Growth. Encyclopedia of the UN Sustainable Development Goals. Springer. Cham. https://doi.org/10.1007/978-3-319-71058-7_31-1 (accessed in April 2024)

(13) https://borgenproject.org/what-is-poverty-reduction/ (accessed in April 2024)

(14) https://acagp.com (accessed in August 2024)

(15) https://aiimafrica.com (accessed in August 2024)

(16) https://www.rathbones.com/sites/rathbones.com/files/imce/final_what_to_include_in_an_Investment_policy_statement.pdf (accessed in August 2024)

(17) https://assets.publishing.service.gov.uk/government/uploads/system/uploads/system/uploads/attachment_data/file/550688/Tool_1.pdf (accessed in August 2024)

(18) https://bestrategicplanning.com/investment-goals (accessed in August 2024)

(19) https://www.oscr.org.uk/guidance-and-forms/charity-investments-guidance-and-good-practice/2-what-is-an-investment/# (accessed in April 2024)

(20) https://corporatefinanceinstitute.com/resources/accouting/what-is-return-on-investment-roi/ (accessed in April 2024)

(21) https://www.forbes.com/advisor/investing/roi-on-investment/ (accessed in April 2024)

(22) https://renewcapital.com/newsroom/charitable-investment-options-for-benevolent-investors (accessed in August 2024)

(23) https://www.cranfieldtrust.org/articles/top-10-financial-ratios-forcharities (accessed in April 2024)

(24) https://marketbusinessnews.com/information-on-credit/gap-ratio–definition-meaning (accessed in August 2023)

_________

• Help CENFACS Keep the Poverty Relief Work Going This Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE AND BEAUTIFUL CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2024 and beyond.

With many thanks.