Welcome to CENFACS’ Online Diary!

06 March 2024

Post No. 342

The Week’s Contents

• Climate Actions 2024

• Matching Organisation-Property Investor Winter/Spring 2024 Activity – Fragment 2 (06 to 12/03/2024): Matching Organisation’s Analysis of the Site with Property Investor’s Investment Financing

• Activity/Task 3 of the ‘t’ Project: Help Combat Inequality in Climate Transitions

… And much more!

Key Messages

• Climate Actions 2024 –

Theme: Investing in the Environment and Poverty Reduction

Climate Actions 2024 within CENFACS will be about environmental and poverty reduction investing with impact, about acting on the projects that positively contribute to the environment and the reduction of poverty at the same time. Environmental investing just as investing in poverty reduction have been around quite a while. Not often, they have been linked together.

This March 2024, we are essentially trying to link them by bringing together climate investors and poverty reduction investors, by trying to advocate to climate investors that their investments can do more than just limiting to dealing with environmental issues. Their investments can also help reduce or end poverty, especially part of poverty stemming from the adverse impacts of climate change and the impacts of mitigating it..

We are thus working on environmental investments that positively impact the environment as well as the same investments positively impacting those people living in poverty or those who are looking for ways to get out of poverty. These are the climate actions that we would like to take this month. To act and explain that, we are going to develop four key notes for our theme (of Environmental and Poverty Reduction Investing) every Monday of March 2024 starting from 04 March 2024. However, these notes will be released or published every Wednesday of March 2024 through our weekly posts. The stated notes will be on four climate investment vehicles or actions, which are:

a) Investing in Green Bonds

b) Spending on Net Zero Brands

c) Supporting Crowdfunding Campaigns

d) Giving to Environmental Groups/Organisations.

Additionally, this year’s Month of Climate Actions will look at one of the outcomes from the 28th session of the Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change (1). This outcome is the phasing away from fossil fuels. In particular, we shall discuss how this move away will contribute to our climate ask, which is ‘giving poor children a climate stake‘.

For those who would like to get more informed about this first key message, they can read under the Main Development section of this post.

• Matching Organisation-Property Investor Winter/Spring 2024 Activity –

Fragment 2 (06 to 12/03/2024): Matching Organisation’s Analysis of the Site with Property Investor’s Investment Financing

The second fragment or episode of our 4-week Matching Organisation-Property Investor Winter/Spring 2024 Activity is about Matching Organisation’s Analysis of the Site with Property Investor’s Investment Financing.

Both Africa-based Sister Housing Charitable Organisation (ASHCO) and not-for-profit (n-f-p) property investor have decided to move with the matching talks as they scored points each of them during fragment 1. They agreed to move to fragment 2 while finalising the little bits remaining from fragment 1 of the matching negotiations.

At this level of talks, ASHCO is dealing with the Analysis of the Site while the n-f-p property investor is preoccupied with the Financing of the Investment. To reach a deal at this round of negotiations, they may need a match or fit test.

To summarise what is going to happen at this fragment 2, we have organised our notes around the following headings:

σ Africa-based Sister Housing Charitable Organisation’s Analysis of the Site

σ Not-for-profit Property Investor’s Investment Financing

σ The Match or Fit Test.

Let us look at each of these headings.

• • Africa-based Sister Housing Charitable Organisation’s Analysis of the Site

ASHCO will provide its analysis of the site. What does it mean? To understand what it means, let us briefly explain the meaning of site analysis. Our meaning of it comes from ‘archisoup.com’ (2), which argues that

“A site analysis in architecture refers to the process of evaluating a specific location to understand its various characteristics and constraints”.

According to the same ‘archisoup.com’, key aspects of the site analysis include location and context, topography, climate, vegetation, soil type, hydrology, access and circulation, utilities and services, regulatory factors, views and vistas, noise and air quality, sunlight and shad, wind patterns, etc.

The site analysis should address the above-mentioned elements.

As ‘archisoup.com’ puts it, the outcome of a site analysis is typically a comprehensive report that guides the design process, ensuring that the proposed structure harmoniously to regulatory requirements and meets the needs of its intended use.

Depending on the type of ASHCO’s housing project, this report can be simple or complex. What is important is not only to have a short or complex report, but to have a report that can help to win the argument to attract property investment/investor. This well crafted report will serve a basis for negotiation that can enable ASHCO to reach an agreement with potential not-for-profit (n-f-p) property investors.

• • Not-for-profit Property Investor’s Investment Financing

This is about funding for property acquisition. The n-f-p property investor can use cash (or cash resources) from their earnings or savings and profits, dividends, capital gains, etc. The n-f-p property investor can appeal to alternative funding sources like the following ones:

~ new financing providers such as friends, families, crowdfunding or any untapped source of financing

~ creative financing (e.g., rent to rent)

etc.

We have expressly excluded loans as we think that loans will be inappropriate in our model of property investing and financing, particularly for those n-f-p property investors who would like to support homeless or those who would like rent or own a property for the first time in their life. It would inappropriate to take loans to support someone else to buy or rent home, especially in Africa.

Idealistically, our property or real estate investor is a n-f-p person who will donate his/her money or invest in property or real estate in return for a specific rate of housing poverty reduction. There is no loan, no lending involved. He/she can also be a crowd funder or a person willing to give small amount of money as being part of large numbers of people. He/she want to fund organisations that are actively and tirelessly working towards generating long-term solutions to housing poverty.

Additionally, we are going to refer to the model of World Bank(3) relating to investment project financing (IPF). Because of that, the prospective n-f-p property investor is engaged in providing some level of technical assistance, including technical support and expertise in the areas of environmental and social impacts of the housing project.

In doing so, the matching process will be on impact investment, that is an investment seeking a quantifiable social and environmental impact alongside return in terms of the number of people to be lifted out of housing poverty. This is only if the investee needs it to make the housing project succeed beyond sheltering aspects.

Just as it is important to match the correct finance product to the right property project, it is also crucial to match your investment financing with the site analysis. In other words, the cost-effectiveness of the n-f-p property investor’s investment financing model will be tested against site analysis if there is a problem to reach an agreement.

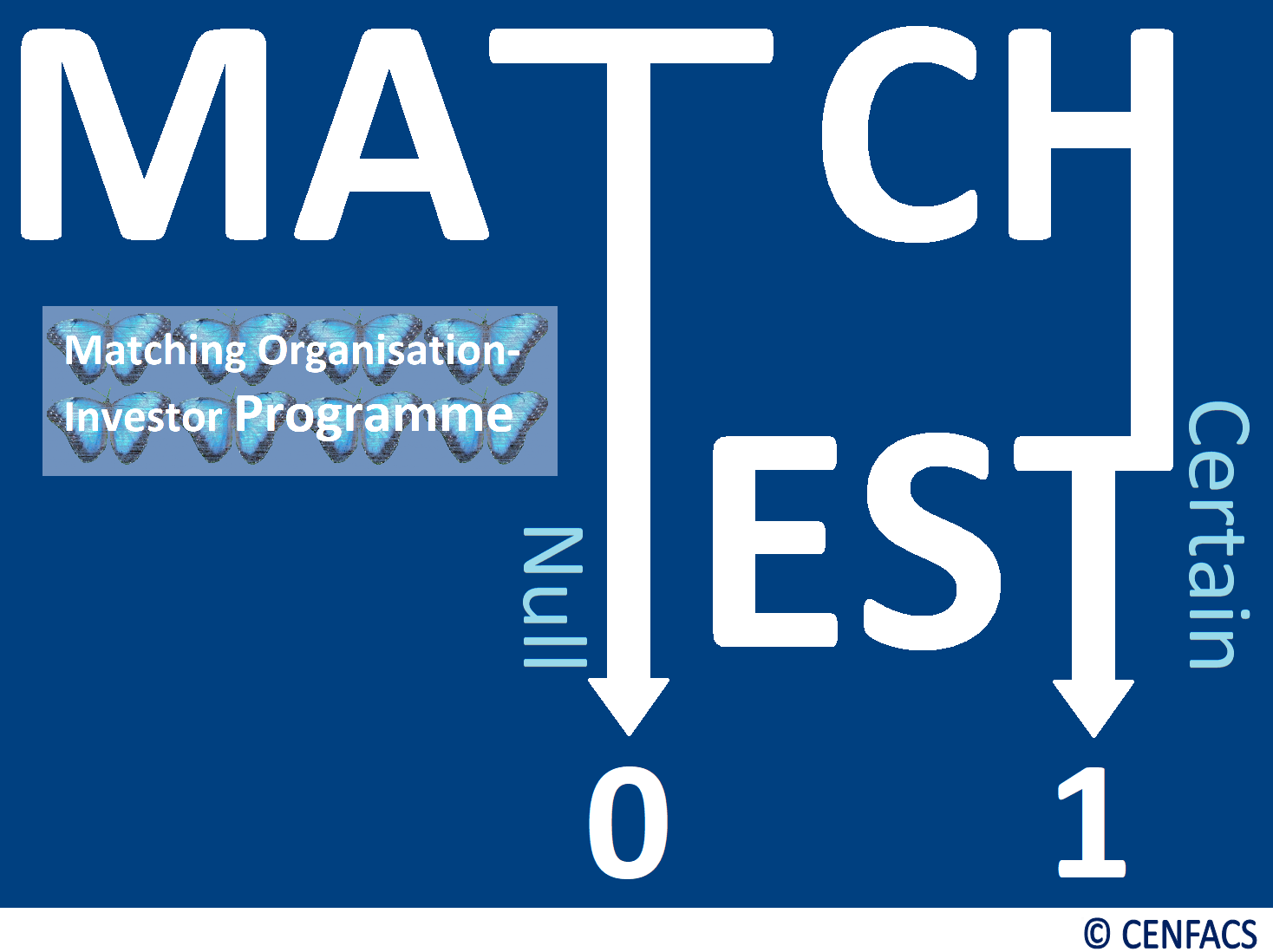

• • The Match or Fit Test

As part of the match or fit test, n-f-p property investor’s file for financing the property needs to match ASHCO’s site analysis. The match can be perfect or close in order to reach an agreement. If there is a huge or glaring difference between the two, the probability or chance of having an agreement at this second round of negotiations could be null or uncertain.

However, CENFACS can impact advise ASHCO to improve its site analysis. CENFACS can as well guide n-f-p property investors with impact to ameliorate their file about investment financing to a format that can be acceptable by potential ASHCOs. CENFACS’ impact advice for ASHCOs and guidance on impact investing for n-f-p property investor will help each of them (i.e., investee and investor) to make informed decisions and to reduce the likelihood of any significant losses or misunderstandings or mismatches.

The rule of the game is the more property investors are attracted by ASHCOs’ site analysis report the better for ASHCOs. Likewise, the more ASHCOs are willing to adopt property investors’ file for investment financing the better for investors. In this respect, the matching game needs to be a win-win one to benefit both players (i.e., organisation and investor).

The above is the second fragment of the Matching Organisation-Property Investor Winter/Spring 2024 Activity.

Those potential organisations seeking investment and n-f-p property investors looking for organisations who are interested in it, they can contact CENFACS to arrange the match or fit test for them. They can have their fit test carried out by CENFACS’ Hub for Testing Hypotheses.

For any queries and/or enquiries about this second fragment of Matching Organisation-Property Investor Winter/Spring 2024 Activity and/or the programme itself, please do not hesitate to contact CENFACS.

• Activity/Task 3 of the ‘t’ Project: Help Combat Inequality in Climate Transitions

The third activity/task of the “t” Project is about helping combat inequality in climate transitions that affect the members of the CENFACS Community and others. This activity is also about maximising the benefits of climate action while minimising the negative impacts for those in need in the community.

Indeed, ‘lse.ac.uk’ (4) explains that the impacts of climate change on people are unequal, just as the impact of attempts to mitigate carbon emissions are dissymmetrical. The same ‘lse.ac.uk’ speaks about just transition, which is based on human rights approach and which aims at eliminating existing inequalities, enabling social inclusion and promoting different forms of equity.

So, those suffering from inequality in climate transitions require justice or just transitions. Helping them to combat inequality in climate transitions could be a way to establish justice in transitions.

The above is what activity/task 3 is about. For those who need any help before embarking on this activity/task, they can speak to CENFACS.

For any other queries and enquiries about the ‘t‘ project and this year’s dedication, please contact CENFACS as well.

Extra Messages

• Nature Projects and Nature-based Solutions to Poverty – In Focus for Week Beginning 04/03/2024: Respect of Cultures and Rights

• Financial Controls 2024 – In Discussion for Wednesday 06/03/2024: Reconciliation

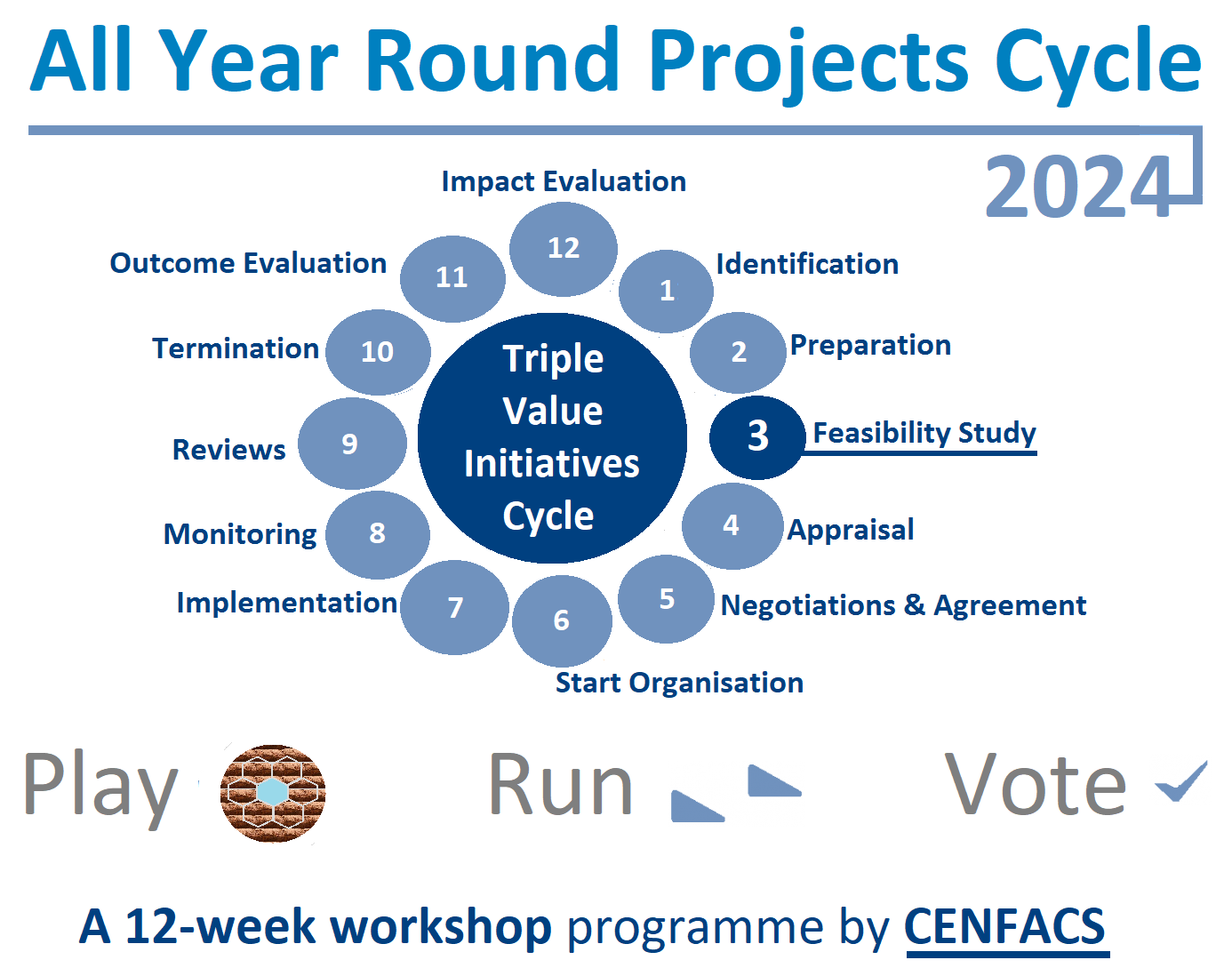

• All-year Round Projects Cycle (Triple Value Initiatives Cycle) – Step/Workshop 3: Conducting a Feasibility Study on Your Play, Run and Vote Projects

• Nature Projects and Nature-based Solutions to Poverty – In Focus for Week Beginning 04/03/2024: Respect of Cultures and Rights

This activity will be about valuing people’s customs and ideas while appreciating people’s powers. Those who may be interested in it will take part to a survey or art or design work to express their skills on respecting people’s cultures and rights as far as nature and nature-based solutions to poverty are concerned.

To clarify this activity, it is better to explain its aim and what it consists of.

a) Aim of Activity 3

The aim of this activity is defend cultural diversity and human rights linked to nature matters. In doing so, one can find ways of valuing different cultures, different powers and differences.

As ‘ohchr.org’ (5) explains it:

“The defence of cultural diversity is an ethical imperative, inseparable from respect for human dignity. It implies a commitment to human rights and fundamental freedoms, in particular the rights of persons belongings to minorities and those of indigenous peoples”.

b) What Does Activity 3 Consist of?

This Activity consists of gathering information through the use of relevant questions from a sample of our community members with the aim of understanding their perception of the respect of cultures and rights. Through this activity, we shall for instance have evidence on the way they strike a balance between curiosity and appreciation.

For those who would like to engage with Activity 3 and/or any of the activities covered so far in our presentation of Nature Projects and Nature-based Solutions to Poverty, they should not hesitate to contact CENFACS.

For those who would like to find out more about Nature Projects and Nature-based Solutions to Poverty, they can also communicate with CENFACS.

• Financial Controls 2024 – In Discussion for Wednesday 06/03/2024: Reconciliation

This week, the financial control that we have planned to work with the community is Reconciliation.

Like any other organisation, households or families making the CENFACS Community need to reconcile their financial records against financial statements they receive from whoever they have financial relations or deals. Before going any further, let us explain reconciliation.

• • Basic Meaning of Reconciliation

Without going into any technical financial jargon, let us refer to what ‘thebalancemoney.com’ (6) says about reconciliation. The website ‘thebalancemoney.com’ explains that

“A reconciliation is the process of comparing internal financial records against monthly statements from external sources – such as bank, credit card company or other financial institution – to make sure they match up”.

For example, you received your energy bill statement from your energy provider. On the statement, the energy provider advised you that there are reversed charges whereby the energy provider recalculated your previous charges. You can compare the statement you received against the financial records you hold to find out if there is a need of reconciliation.

Some members of our community are familiar with this process. Those who are not familiar with it, CENFACS is available to work with them.

• • Working with Households on Reconciliation

For those who would like to work with CENFACS on Reconciliation, they are welcome to speak to CENFACS.

Working with households on Reconciliation could include the following:

√ checking with them that the two types of records they have are correct and in agreement

√ catching improper spending

√ checking outgoing and incoming funds

√ spotting financial errors

etc.

Working with them could also be about suggesting to them accounting software to reconcile their accounts for those who would to dive into self-study.

The above is the fourth financial control we wanted to share with our users or beneficiaries who may be households.

If anyone of our members need support regarding their financial controls and in particular Reconciliation within their household, they should not hesitate to contact CENFACS.

• All-year Round Projects Cycle (Triple Value Initiatives Cycle) –

Step/Workshop 3: Conducting a Feasibility Study on Your Play, Run and Vote Projects

In this 3rd step or workshop, users will learn (for those users who are new to project planning) or revisit (for those who are familiar with project planning) the evaluation of the practicality of their chosen Play or Run or Vote project. In project planning terms, it means they need to conduct feasibility study. But, what is feasibility study?

• • Basic Understanding of Feasibility Study

Feasibility study is a ‘go/no-go’ decision time for any project planner. In other words, it is the time when an All-year-round project user will decide whether or not to continue with their proposed project.

As ‘simplilearn.com’ (7) puts it,

“A feasibility study is a comprehensive evaluation of a proposed project that evaluates all factors critical to its success in order to assess its likelihood of success”.

Referring to this definition or any suitable definition, All-year-round project users will look at the practicality of the Play, Run and Vote projects from the perspective of required cost and expected value. To proceed, they may outweigh different types of feasibility and select the ones that are affordable and suitable to their projects.

• • Types of Feasibility

Feasibility can cover many aspects of the project to be implemented; aspects like technical, economic, financial, operational, legal, etc. To simplify the matter, we are going to limit in this workshop to the technical and economic aspects of feasibility study; leaving to those who would like to dive deeper into feasibility study to let us know what other aspects of feasibility study they may be interested in.

The technical feasibility of your Play, Run and Vote projects will include the technical resources and capacities to convert your idea of playing, running and voting into a workable or working project. The economic feasibility will analyse the cost and benefit of the same projects.

• • Example of Feasibility Study: Your 2024 Vote for African Poverty Reduction and Development Manager

In order to conduct your feasibility study of your vote, you need to carry out the following tasks:

~ Evaluate if your Vote project is technically achievable by determining and steering the technical resources (like time, budget, technical skills, etc.) to be committed to drive you to the process of looking for your Poverty Reduction and Development Manager of the year and of voting him/her

~ Carry out a viability test in terms of the cost associated with your selection process and benefits linked with your Vote project

~ Financially work out the cost and benefit of your Vote project as you will do in the recruitment selection process of any personnel.

Feasibility study can be basic (simple) or complex depending on the type of your Vote project. In the above example, we have simplified the matter.

For those who would like to dive deeper into feasibility study, including the tools, metrics, examples, skills and steps in feasibility study of their Play or Run or Vote project; they should not hesitate to contact CENFACS.

Message in French (Message en français)

• Activité/Tâche 3 du projet «t»: Contribuer à la lutte contre les inégalités dans les transitions climatiques

La troisième activité/tâche du projet «t» consiste à contribuer à la lutte contre les inégalités dans les transitions climatiques qui affectent les membres de la communauté CENFACS et d’autres. Cette activité vise également à maximiser les avantages de l’action climatique et à minimiser les impacts négatifs pour les personnes dans le besoin dans la communauté.

En effet, «lse.ac.uk» (4) explique que les impacts du changement climatique sur les populations sont inégaux, tout comme l’impact des tentatives d’atténuation des émissions de carbone est dissymétrique. Le même «lse.ac.uk» parle de transition juste, qui est basée sur l’approche des droits de l’homme et qui vise à éliminer les inégalités existantes, à permettre l’inclusion sociale et à promouvoir différentes formes d’équité.

Ainsi, ceux ou celles qui souffrent d’inégalités dans les transitions climatiques ont besoin de justice ou de transitions justes. Les aider à lutter contre les inégalités dans les transitions climatiques pourrait être un moyen d’instaurer la justice dans les transitions.

Ce qui précède est l’objet de l’activité/tâche 3. Pour ceux ou celles qui ont besoin d’aide avant de se lancer dans cette activité/tâche, ils/elles peuvent s’adresser au CENFACS.

Pour toute autre question ou demande de renseignements sur le projet «t» et le dévouement de cette année, veuillez également contacter le CENFACS.

Main Development

• Climate Actions 2024

Theme: Investing in the Environment and Poverty Reduction

The following items are the ones shaping the contents of our Climate Action Month and its theme:

a) Meaning of the Climate Action

b) Direct and Indirect Climate Actions

c) Key Terms

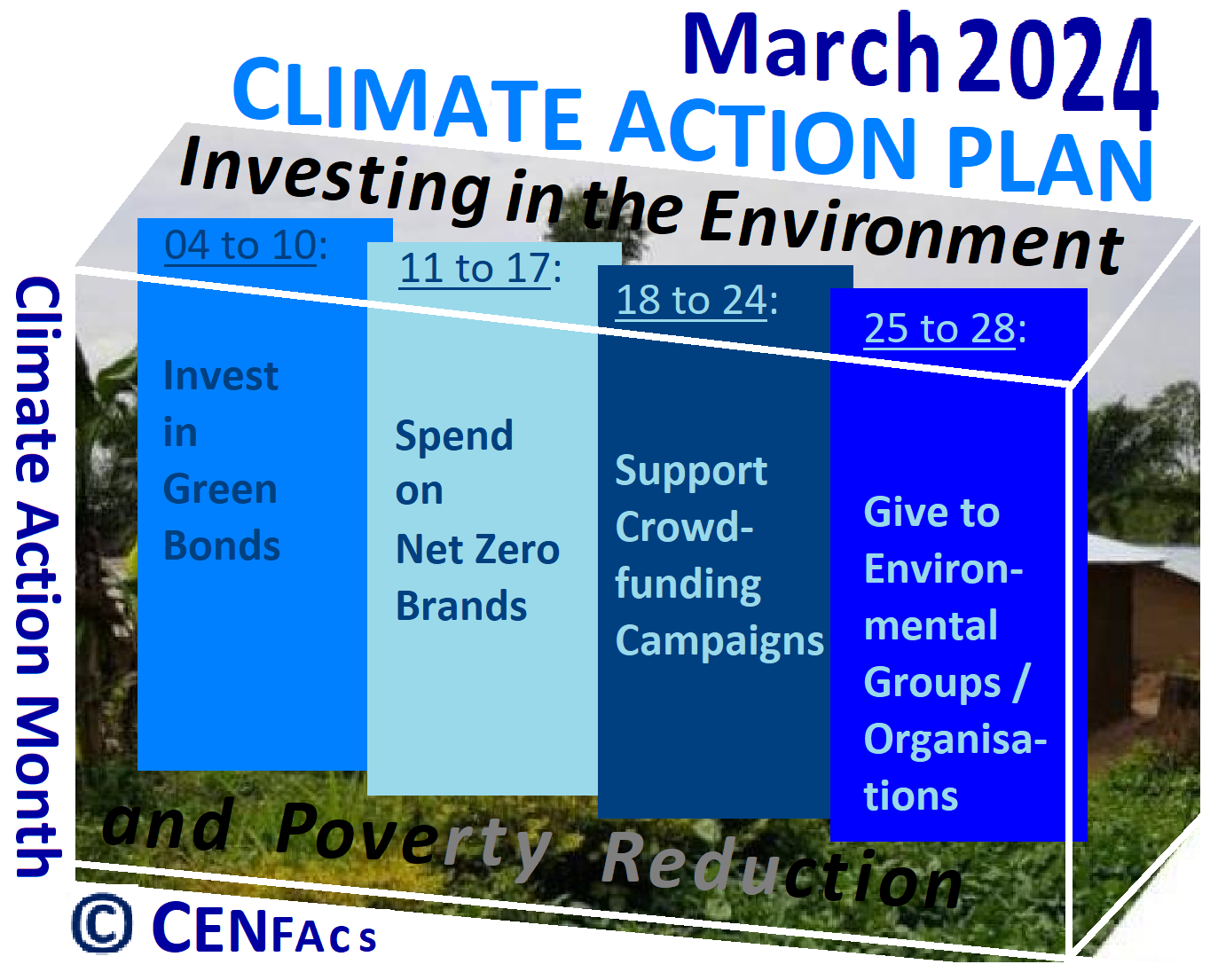

d) Work plan for Climate Action March 2024

e) Action 1: Investing in Green Bonds and Poverty Reduction.

Let us look at the contents of our Climate Action Month.

• • Contents of 2024 Climate Action Month

Before kicking off our action, let us precise the working definitions to be used for climate action.

• • • Meaning of the Climate Action

Climate action is an activity of engaging and putting ideas into practice to deal with any natural or induced change in the long term average weather conditions of a place, especially when this change adversely affects people’s and communities’ lives and livelihoods. In other words, it is any effort to mitigate the adverse effects of this change by reducing greenhouse gas emissions while strengthening capacities and resilience to climate-induced impacts.

Climate action is also the 13th Goal of the United Nations’ (8) 17 Sustainable Development Goals and 2030 Agenda.

In the context of CENFACS’ Climate Action Month for this year, climate action is about acting on environmental investing while investing in poverty reduction with impact.

These climate actions or efforts could be direct or indirect.

• • • Direct and Indirect Climate Actions

Direct climate actions can directly lead to outcomes such as reductions of greenhouse gas emissions, poor quality air, pollution, etc. They could also include the increase in the number of poor people benefiting from carbon markets through projects generating greenhouse gas emissions reductions or removals.

As to indirect climate actions, they can help to keep the advocacy and campaign about measures and activities to be carried out to reduce the adverse impacts of climate change going. Examples of such indirect climate actions will include the prevention of the next pandemic to happen, a campaign to halt human-induced extinction of known threatened species, etc.

Without breaking climate actions into direct and indirect ones, the coming periods and sub-themes of climate action will guide our readers and audiences about the kind of climate actions CENFACS is conducting this month. This guidance will help those who may be interested to join in. But, before that let us try to briefly explain the key terms of our Climate Actions 2024, terms which are: environmental investing and investing in poverty reduction.

• • • Key Terms: Environmental Investing and Investing in Poverty Reduction

What is environmental investing, what is investing in poverty reduction?

• • • • Basic Understanding of Environmental Investing

There are many definitions of environmental investing. One of its definitions comes from ‘carboncollective.co’ (9), which explains that

“Environmental investing, also known as green or sustainable investing, is the practice of directing financial resources towards investments that prioritise environmental, social, and governance (ESG) factors”.

According to the same ‘carboncollective.co’, these investments support businesses and projects that contribute positively to the environment and society while generating returns for investors.

As far as we are concerned, we are interested in those environmental investments supporting organisations and projects that positively contribute to the environment and society while reducing poverty. In other words, we are interested in those investors who would like to positively impact the environment and the lives of those living in poverty. Investing in the environment does not necessary lead to poverty reduction, unless the model/project of investment specifies it and efforts have been deployed to realise this result.

• • • • What Is Investing in Poverty Reduction?

It is about devoting your time, effort, energy, money, etc. in measures that are intended to economically, socially and environmentally lift people out of poverty on a lasting basis. These measures can be taken at various levels and by different persons (both moral and physical). Climate actions are also about investing in those measures to relieve those suffering from climate poverty or poverty induced by climate change and its consequences.

The above-mentioned understanding will help to better execute our working plan for Climate Action March 2024.

• • • Work Plan for Climate Action March 2024

The following Climate Actions and periods of March 2024 make up our work plan:

∝ Action 1: Invest in Green Bonds (04 to 10/03/2024)

∝ Action 2: Spend on Net Zero Brands (11 to 17/03/2024)

∝ Action 3: Support Crowdfunding Campaigns (18 to 24/03/2024)

∝ Action 4: Give to Environmental Groups/Organisations (25 to 28/03/2024).

Within the above broad actions, there will be specific actions to be taken. Because our 2024 Climate Actions are on Environmental Investing and Investing in Climate Poverty Reduction, each of these actions will be linked to climate poverty reduction.

Finally, there will be impact monitoring and evaluation on 29 and 30/03/2024 to end the Climate Action March 2024.

• • • Climate Action 1: Invest in Green Bonds (04 to 10/03/2024)

To enable to take the first action, we have organised the following notes:

σ What are green bonds?

σ Investing in green bonds to reduce climate poverty

σ Working with the Community on Green Bonds and Environmental Investing.

Let us explain the above-mentioned points.

• • • • What Are Green Bonds?

Green bonds can defined in many ways. The definition of green bonds we have selected comes from ‘gsam.com’ (10), which explains that

“Green bonds are standard fixed income securities with a green element. Their financial characteristics such as structure, risk and return are similar to those of traditional bonds. The main difference is that the goal for green bonds is to exclusively finance projects or activities with a specific environmental purpose”.

Although their goal is exclusively finance projects or activities with a specific environmental purpose, this does not stop them to positively impact those living in poverty because of the consequences of environmental impacts of climate change.

• • • • Investing in Green Bonds to Reduce Climate Poverty

Investing in green bonds can help finance green buildings and infrastructures for sustainable development and climate poverty reduction. It can contribute to maximise the benefits of climate action while minimising the negative impacts on those in need, the climate poor. It is possible to invest in green bonds to reduce climate poverty or inequality in climate transitions. This will as well help to transition to a more inclusive and sustainable future.

For example, despite limited financial infrastructure and capacity-building needs, Africa needs to develop and issue green bonds to reduce climate induced poverty. Africa needs to find innovative approaches to attract diverse climate investors who can both invest in the environment and in climate poverty reduction.

• • • • Working with the Community on Green Bonds and Environmental Investing

The all purpose of writing this note is to guide our action. In other words, what is key here is to take action. The note is only a guided principle.

For instance, taking action together could be on how to make green bonds market or the issuance of green bonds in Africa support the poor, particularly the climate poor ones.

Those members of our community in the UK and Africa-based Sister Organisations willing to work with CENFACS on Investing in Green Bonds and Investing in Climate Poverty Reduction, they can take climate actions with us.

For any queries or enquiries about Climate Action 1 and Climate Actions Month, please do not hesitate to contact CENFACS.

_________

• References

(1) https://www.cop28.com/en/ (accessed in March 2024)

(2) https://www.archisoup.com/architecture-site-analysis-introduction# (accessed in March 2024)

(3) https://www.worldbank.org/en/what-we-do/products-and-services/financing-instruments/investment-project-financing (accessed in March 2024)

(4) https://www.lse.ac.uk/granthaminstitute/explainers/what-is-the-just-transition-and-what-does-it-mean-for-climate-action/ (accessed in March 2024)

(5) https://www.ohchr.org/en/instruments-mechanisms/instruments/universal-declaration-cultural-diversity# (accessed in March 2024)

(6) https://www.thebalancemoney.com/what-is-account-reconciliation-1293657 (accessed in March 2024)

(7) https://www.simplilearn.com/feasibility-study-article (Accessed in March 2023)

(8) https://sdgs.un.org/2030agenda (accessed in February 2024)

(9) https://www.carboncollective.co/sustainable-investing/environmental-investing# (accessed in March 2024)

(10) https://www.gsam.com/content/gsam/global/en/market-insights/gsam-insights/perspectives/2022/green-bonds-fixed-income-capital.html (accessed in March 2024)

_________

• Help CENFACS Keep the Poverty Relief Work Going this Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE AND BEAUTIFUL CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2024 and beyond.

With many thanks.