Welcome to CENFACS’ Online Diary!

08 November 2023

Post No. 325

The Week’s Contents

• Festive Income Booster – In Focus for 2023 Edition: Financial Capacity and Capability – How to manage your financial affairs and make life-saving financial decisions

• 2023 “A la une” (Autumn Leaves of Action for the Upkeep of the Nature in Existence) Themed Activity and Action No.5 from Week Beginning 06/11/2023: Safekeeping Erikssonia Acraeina, Eriksson’s Copper

• Data and Insight Skills to Manage Your Household – On the Agenda from Wednesday 08/11/2023: Data Organisation Skills and Diagnostic Insights

… And much more!

Key Messages

• Festive Income Booster – In Focus for 2023 Edition: Financial Capacity and Capability – How to manage your financial affairs and make life-saving financial decisions

The lingering effects of the coronavirus and the enduring cost-of-living crisis have financially incapacitated many people including some members of the CENFACS Community. Many of these financially incapacitated are looking forward to recovering their financial capacity and or capability they had before these crises and/or to build new capacity and capability.

Besides these people who lost financial capacity or capability, there are others who are lacking the capacity or capability to make financial decisions on their life matter. This second category of people could have been subject to various circumstances of life such as illness, old age, accident, etc. They too need to find financial capacity or capability.

As we are heading towards the end of year 2023 and in the Festive Season, having some sort of financial capacity and/or capability can help to sustain the financial pressure of the Festive Season’s demand in terms of well managing money and making the right financial judgement. A good financial capacity and capability can as well assist in strengthening one’s financial health and wellbeing.

The 2023 Edition of Festive Income Booster focuses on two areas of financial empowerment: financial capacity and financial capability. Firstly, it will help our project beneficiaries to better manage their money and financial aspects of their festive events. Secondly, it will empower them to develop knowledge, attitudes, skills and behaviours with regard to managing their financial resources.

Briefly, the 2023 Edition of Festive Income Booster deals with the capacity and capability to manage finances and to make life-saving financial decisions.

We have provided key highlights about this Edition under the Main Development section of this post.

• 2023 “A la une” (Autumn Leaves of Action for the Upkeep of the Nature in Existence) Themed Activity and Action No.5 from Week Beginning 06/11/2023: Safekeeping Erikssonia Acraeina, Eriksson’s Copper

To keep safe Erikssonia Acraeina (Eriksson’s Copper), it is better to understand safekeeping, to get some key facts about this type of butterfly and to know what can be done to keep it safe. In addition to that, we are going to highlight the insect themed activity we planned for this week.

• • Understanding Safekeeping of Erikssonia Acraeina, Eriksson’s Copper

Safekeeping of Erikssonia Acraeina, Eriksson’s Copper is about caring and protecting it. It is about looking after it and being interested in it. By referring to the explanation of protection by Chris Park (1), Safekeeping of Erikssonia Acraeina, Eriksson’s Copper is its defence against harm and danger or any activity that reduces losses or risks as well as tends to maintain basic conditions and value (p. 360).

To help in safekeeping, some basic facts need to be collected about Erikssonia Acraeina, Eriksson’s Copper.

• • Facts Summary about Erikssonia Acraeina, Eriksson’s Copper

According to ‘earthsendangered.com’ (2),

“Erikssonia Acraeina, commonly known as Eriksson’s Copper, is a species of butterfly [in the family of Lycaenidae]…It is a species of concern belonging in the species group insects and found in the following area(s): Democratic Republic of Congo, South Africa, Zambia”.

Erikssonia Acraeina, Eriksson’s Copper belongs to Lycaenidae family, particularly in the subfamily of the coppers. They belong to the subfamily species of Gossamer-winged butterflies (the coppers). The other members of this subfamily are blues (Polyommatinae), hairstreaks (Theclinae), and harvesters (Miletinae). Erikssonia Acraeina, Eriksson’s Copper is known for its associaton or interaction with ants.

If Erikssonia Acraeina, Eriksson’s Copper is endangered, then it needs safekeeping.

• • Sakeeping Erikssonia Acraeina, Eriksson’s Copper

To keep safe Erikssonia Acraeina, Eriksson’s Copper, it needs to be fully protected as explained by ‘ukbutterflies.co.uk’ (3). The full protection implies the following:

√ not intentionally killing and injuring it

√ not damaging or destroying any structure or place used by Erikssonia Acraeina, Eriksson’s Copper for shelter or protection

√ not disturbing Erikssonia Acraeina, Eriksson’s Copper’s structure or place of occupancy

√ not obstructing their access to their structure or place

√ not illegally trading it

etc.

Briefly, it is about acting in the interests of Erikssonia Acraeina, Eriksson’s Copper’s health and public care.

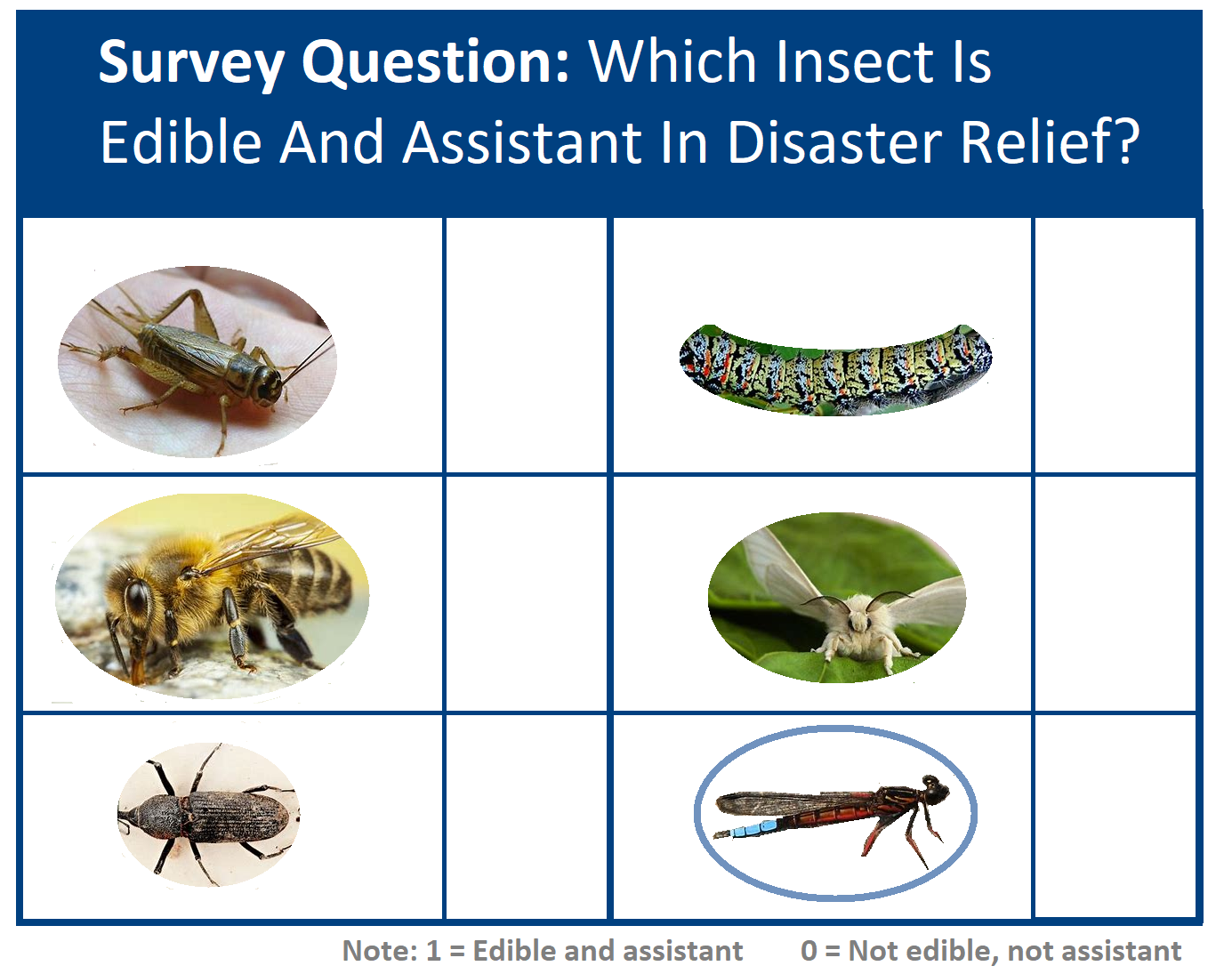

• • Add-on Activity of the Week’s Campaign: A Survey on Insects as Assistants in Disaster Relief

The insect themed activity of this week is a Survey on Insects as Assistants in Disaster Relief. What is this activity about?

We are trying to gather information using questions from a sample of people with the aim of understanding the gifts and benefits that insects provide to humans and nature. As part of this survey, we would like you to answer the following question:

Can you provide real-life examples on how insects can assist in a disaster relief situation?

To help some of you to respond to this question, we would like to recall the following statement from the Food and Agriculture Organisation of the United Nations (4) when writing about Forestry Responses to Conflict and Disasters:

“Refugees and Internally Displaced Persons may be granted access to forests, perhaps including protected areas, so they can supplement their diets with forest foods such as fruits, berries, roots, mushrooms, insects and wild meat, and to harvest medicinal plants”

This statement indicates that insects can help relieve hunger for refugees and internally displaced persons in the context of humanitarian disaster relief.

Those who may be interested in responding to the above-mentioned survey question or insect themed activity, they can contact CENFACS.

To find out more about the entire “A la une” Campaign and Themed Activities, please communicate with CENFACS.

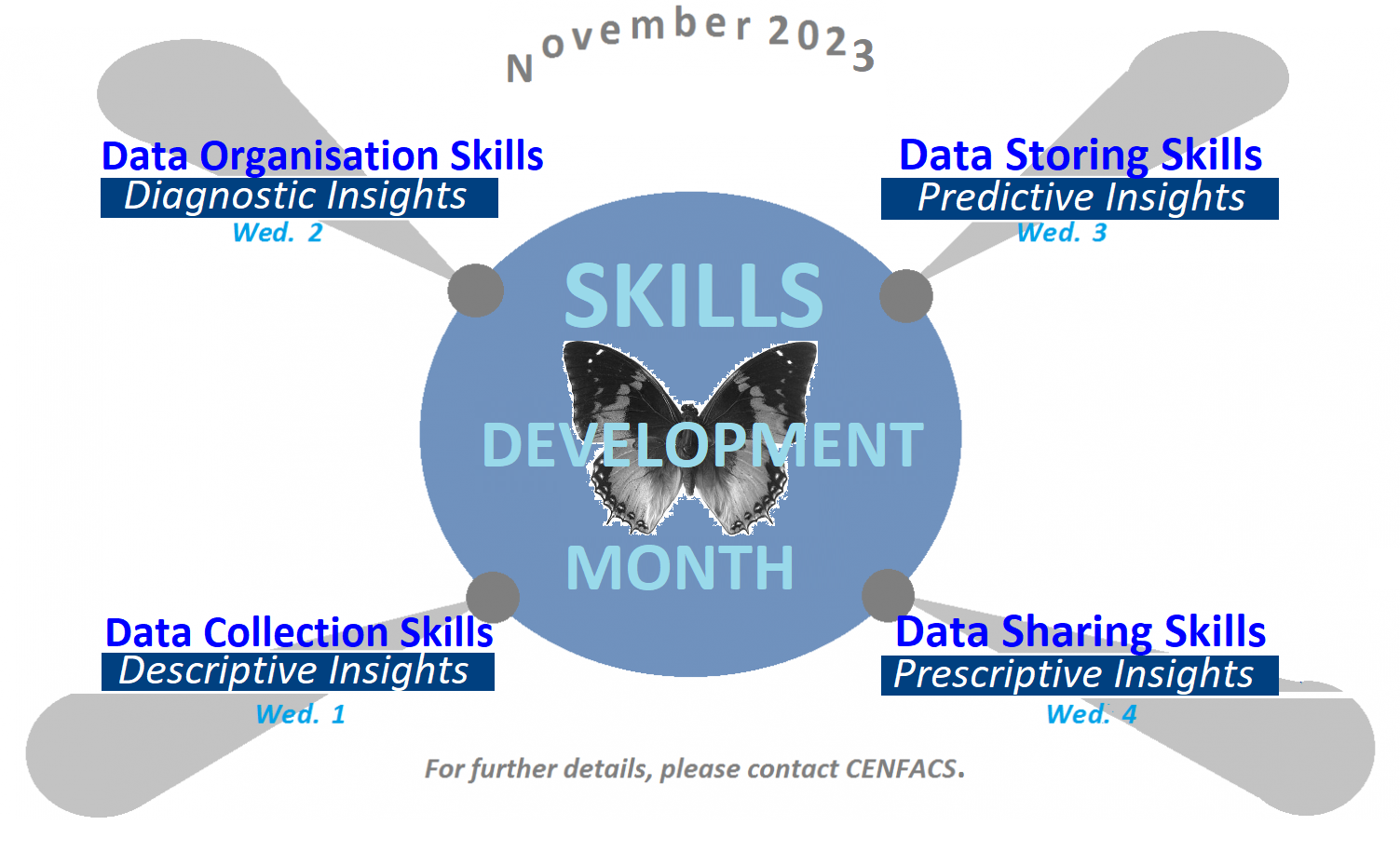

• Data and Insight Skills to Manage Your Household – On the Agenda from Wednesday 08/11/2023: Data Organisation and Diagnostic Insight Skills

To cover the above-mentioned skills, we are going briefly explain data and insights as well as the skills involve to carry them out. We shall put them in the context of household management life. We shall as well highlight how CENFACS is intending to work with its community in relation to Data and Insight Skills. As way of mastering these skills a weekend homework has also been provided.

• • Understanding Data Organisation and Diagnostic Insight Skills

• • • Understanding Data Organisation Skills

Our understanding of Data Organisation comes from ‘byjus.com’ (5) which explains that

“Data organisation is the way to arrange the raw data in an understandable order. Organising data include classification, frequency distribution table, picture representation, graphical representation, etc.”

To organise data, it requires skills. Amongst Data Organisation Skills, we can list the following:

√ Skills to name and structure files and folders

√ Skills to document (e.g., providing all the information necessary to interpret, understand and use a given dataset or a set of documents)

√ Skills to manage reference (e.g., noting your sources of information)

√ Skills to organise your e-mail (e.g., sorting your email messages so that information can be found and retrieved quickly as well as be stored securely)

etc.

• • • Knowing Diagnostic Insight Skills

According to ‘trailhead.salesforce.com’ (6),

“An insight is a finding in your data… Diagnostic insights show why it happened, drill deeper and help you understand which variables most significantly drive the business outcome you are analysing”.

Diagnostic in data analytics helps to answer the question, “Why did this happen?, as explained by Catherine Cote (7).

Although households or families are not business organisations, it is possible to track diagnostic insights into their lives.

To diagnose, one needs to understand what happened to be able to identify why it happened. So, Diagnostic Insight Skills are the skills to help answer the question, “Why did things happen?”

There could be the skills of diagnosticating things like the following:

√ Household budget

√ Outstanding bills

√ Distressed assets

√ Account balance

√ The inflow of email messages into your inbox

etc.

CENFACS Community members can work with CENFACS either to acquire the above-mentioned skills or to improve them.

• • • Working with the Community Members on Data Organisation and Diagnostic Insights to Manage their Households

CENFACS can work with those who need help and support on data organisation and diagnostic insights so that they can effectively and efficiently manage their households. Also, we can conduct with them basic data and insights analytics using the tools of poverty reduction we have in our box.

Where our capacity is limited in comparison to their demand or specific needs, we can signpost or refer them to relevant data insight and analytics services or organisations that are available on the market and can be accessible to them.

For those members of our community who will be interested in Data Organisation and Diagnostic Insight Skills to Manage Their Households, they can contact CENFACS. CENFACS can work with them to enhance their Data Organisation and Diagnostic Insight Skills to Manage Their Households.

• • • Homework for This Week’s End: Organise Your Mail and Diagnostically Extract Insights from It

As part of Christmas holiday preparation, you would like to organise and sort out your mail (both paper and paperless) which is unorganised and unprocessed.

Since the school started last September, you have been receiving letters from your children’s schools, banks, doctors, tradesmen, government, insurance companies, charities for appeals, etc. which you opened and read, but did not filed. There are also emails pending in your inbox which you read, but you have not been able to sort out as you did not have enough time between work and household life. Now, you want to prepare your household for Christmas. You want to organise your mail and recycle some of them.

Additionally, you would like to deep-dive into your data to understand what this pile of unorganised and unprocessed mail is telling. You want to extract and track insights by answering the question, “Why did this happen?”.

Those who have any queries about this homework, they can submit their queries to CENFACS.

To get further insight into Skills Development Month at CENFACS, please continue to read our weekly posts.

Extra Messages

• Coming This 19 November 2023: The 14th Edition of the Women & Children FIRST Development Day

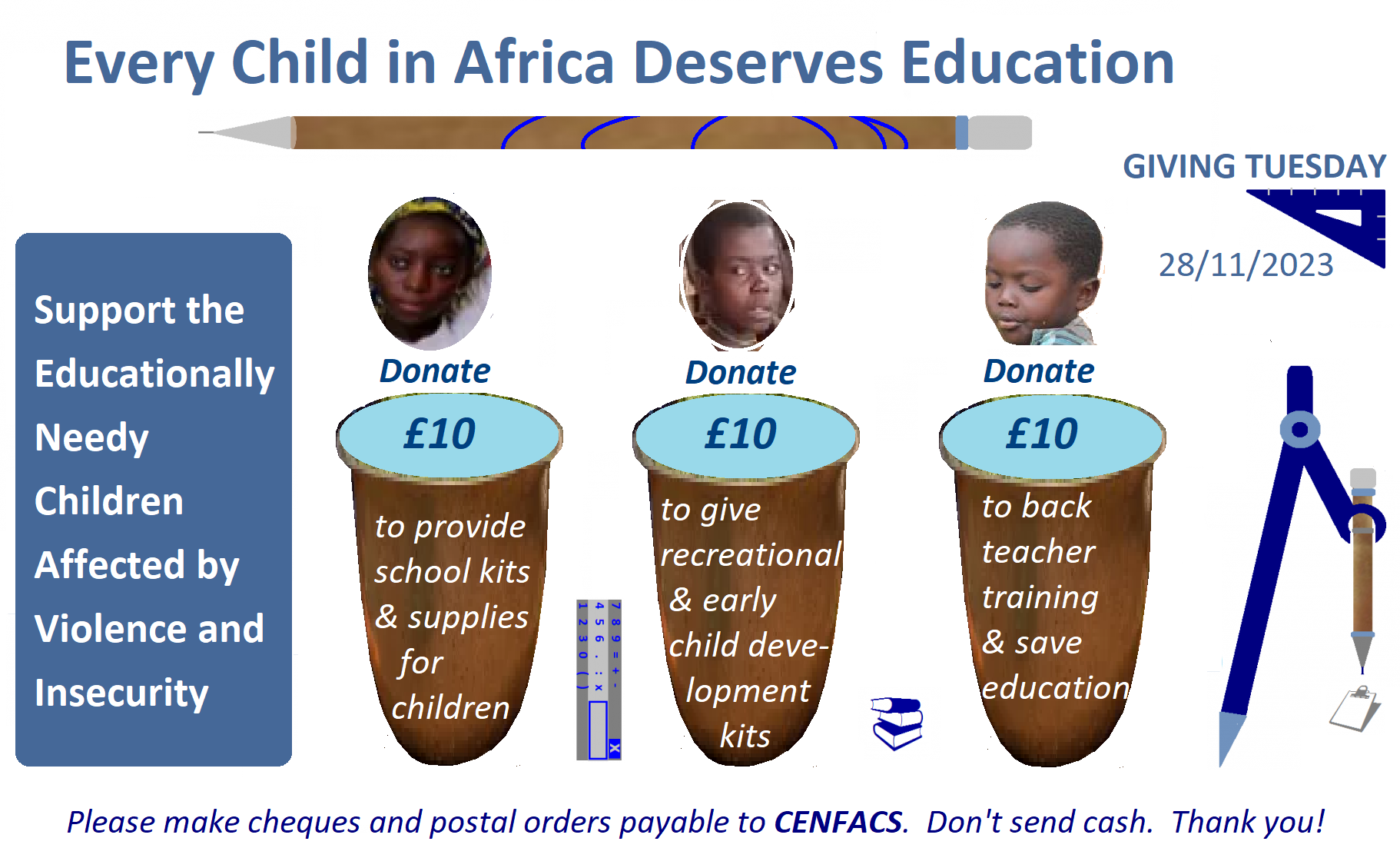

• Support the Educationally Needy Children, Children Impacted by Crises in Africa

• CENFACS’ be.Africa Forum e-discusses Making Carbon Markets Monetise Africa’s Carbon Absorbing Ecosystems and Reduce Poverty Further

• Coming This 19 November 2023: The 14th Edition of the Women & Children FIRST Development Day

This year, our Development Day will still be about skills that can be learnt and developed in order to bounce back from the lingering effects of the coronavirus and the enduring cost-of-living crisis. It will be about Self-efficacy Skills to Refresh Ways of Tackling Crises.

Every day, women and children respond to crises and risks they face. Because the nature of crises and risks is changing, there could be a need to refresh ways of tackling these crises. This can be done through three Self-efficacy skills – resilience, flexibility and agility – which are ranked as the third top skills of 2023 in demand, according to the World Economic Forum (8). The 14th Edition of the Women & Children FIRST Development Day will concentrate on these skills in demand on the job market today.

Indeed, economies are trying to bounce back from the effects of the polycrises. In this process of bouncing back, employment market is also trying to recover. To grab any opportunities that may come with this process, it requires the possession of some skills, mostly skills adapted to the features of the new or recovering market. Amongst these skills are Self-efficacy Skills, which will make our Development Day. Self-efficacy, which belongs to the skill family of attitudes, is made up of three skills: resilience, flexibility and agility skills.

The 14th Development Day will provide an opportunity to exchange ideas and celebrate our resilience, flexibility and agility to get ready to grab new and emerging opportunities of the employment market to further reduce poverty and enhance sustainable development.

What’s more, by dealing with skills, this year’s Development Day will resonate with November month of Skills Development within CENFACS.

For further information and how to engage with the Development Day, please contact CENFACS.

• Support the Educationally Needy Children, Children Impacted by Crises in Africa

The United Nations Educational, Scientific and Cultural Organisation (9) estimates that

“The out-of-school population in Sub-Saharan Africa increased by 12 million over 2015-21” (p. 19)

Likewise, the United Nations Children’s Fund (10) states that

“One of the first day of the new 2023-2024 academic year in Burkina Faso, 1 in 4 schools or 6,149 remain shut due to ongoing violence and insecurity in parts of the country”.

As a way of keeping education alive for these unfortunate children living in those parts of Africa in conflict crisis (like in the 3 borders area composed of Burkina Faso, Mali and Niger), many types of initiatives have been taken to support these children so far.

These initiatives have been carried out by organisations (such as the United Nations Children’s Fund) and people like you to help. Initiatives such as education by radio programme, back-to-school advocacy, delivery of school kits, etc. have been taken.

However, due to the immense educational challenge posed by the legacies of insecurity and violence, there is still a deep, intense and urgent educational need in many of these areas.

This appeal, which is worded as Every Child in Africa Deserves Education, has already started and will make CENFACS‘ fundraising campaign for Giving Tuesday on 28 November 2023.

We would like people who may be interested in our philanthropic mission to join us in this campaign.

We are asking to those who can to support these Educationally Needy Children, through this campaign, not to wait the Giving Tuesday on 28 November 2023.

They can donate now since the needs are urgent and pressing.

To donate, please get in touch with CENFACS.

• CENFACS’ be.Africa Forum e-discusses Making Carbon Markets Monetise Africa’s Carbon Absorbing Ecosystems and Reduce Poverty Further

Carbon markets and credits are fundamental to achieving net-zero greenhouse gas emissions. Investing in these markets and credits can help decarbonisation. Investing in them is also about ensuring that the rise of the price of carbon positively impact actions taken by the poor and poverty reduction.

However, Africa’s carbon ecosystems (like rainforests, mangroves and peatlands) need to be properly monetised. Monetisation of ecosystems can help incentivise environmental behaviour. To clarify this, Anu Wolf (11) explains that

“Ecosystem monetization is giving a value to the ecosystem services in a dollar amount based on the cost of providing the same service from human-built infrastructure. The purpose of monetizing ecosystem services is to incentivize environmental behaviour in municipalities and for corporations”.

In the light of the information, CENFACS’ be.Africa Forum is e-discussing How to Make Carbon Markets to Monetise Africa’s Carbon Absorbing Ecosystems and to Further Reduce Poverty.

Those who may be interested in this discussion can join in and or contribute by contacting CENFACS’ be.Africa, which is a forum for discussion on matters and themes of poverty reduction and sustainable development in Africa and which acts on behalf of its members in making proposals or ideas for actions for a better Africa.

To communicate with CENFACS regarding this discussion, please use our usual contact details on this website.

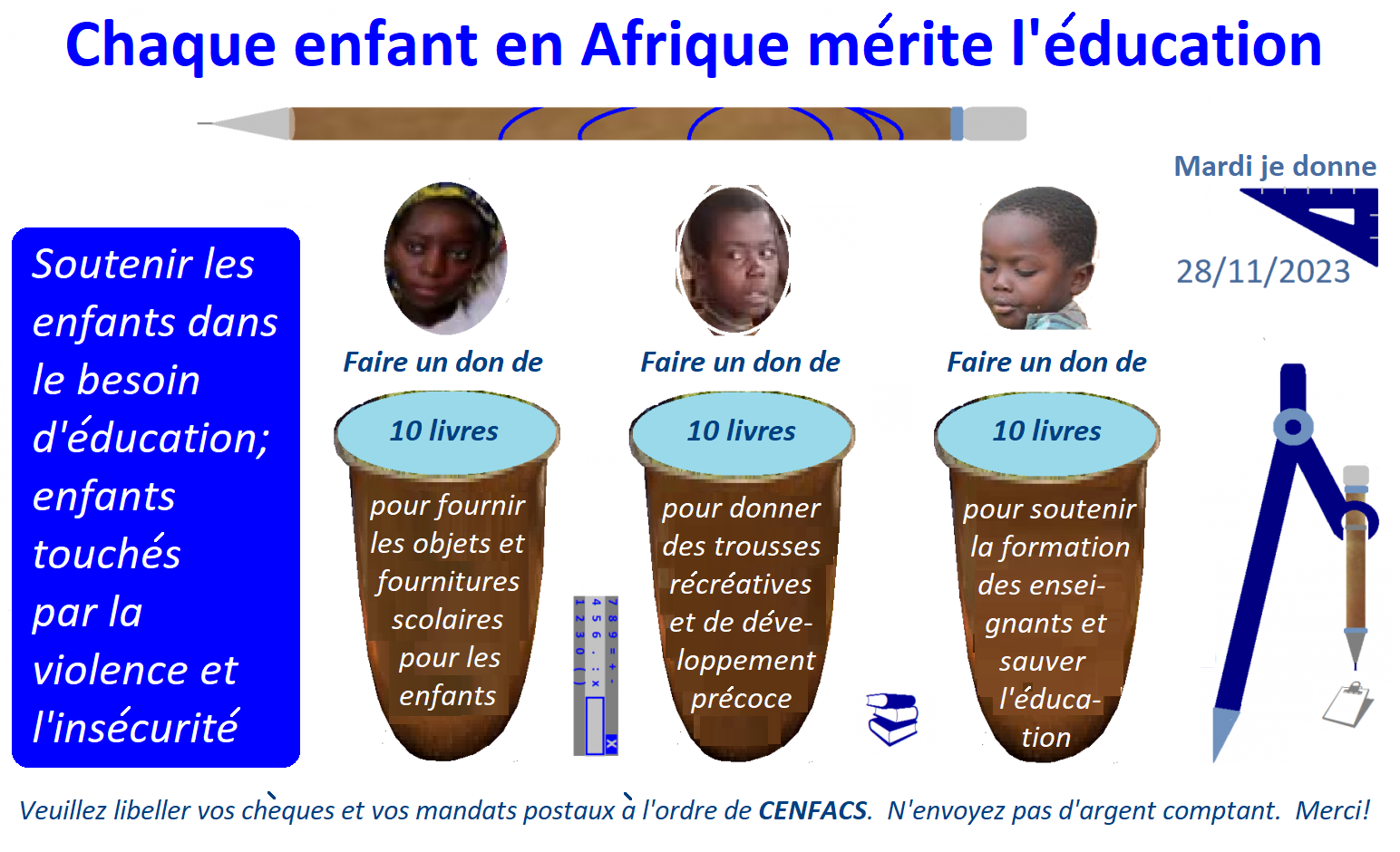

Message in French (Message en français)

• Soutenir les enfants dans le besoin sur le plan éducatif, enfants touchés par les crises en Afrique

L’Organisation des Nations Unies pour l’Education, la Science et la Culture (9) estime que

« La population non scolarisée en Afrique subsaharienne a augmenté de 12 millions entre 2015 et 2021 » (p. 19)

De même, le Fonds des Nations Unies pour l’Enfance (10) affirme que

« En ce premier jour de la nouvelle année scolaire 2023-2024 au Burkina Faso, 1 école sur 4, soit 6 149, reste fermée en raison de la violence et de l’insécurité persistantes dans certaines parties du pays ».

Afin de maintenir l’éducation en vie pour ces enfants malheureux vivant dans les régions d’Afrique en crise et en conflit (comme dans la zone des 3 frontières composée du Burkina Faso, du Mali et du Niger), de nombreux types d’initiatives ont été prises pour soutenir ces enfants jusqu’à présent.

Ces initiatives ont été menées par des organisations (telles que le Fonds des Nations Unies pour l’Enfance) et des personnes comme vous pour aider. Des initiatives telles que l’éducation par programme radiophonique, le plaidoyer pour la rentrée scolaire, la distribution de équipements scolaires, etc. ont été prises.

Cependant, en raison de l’immense défi éducatif posé par les séquelles de l’insécurité et de la violence, il existe toujours un besoin éducatif profond, intense et urgent dans bon nombre de ces régions.

Cet appel, qui s’intitule « Chaque enfant en Afrique mérite l’éducation », a déjà commencé et fera partie de la campagne de collecte de fonds du CENFACS pour le ‘Mardi je donne’ le 28 novembre 2023.

Nous aimerions que les personnes qui pourraient être intéressées par notre mission philanthropique se joignent à nous dans cette campagne.

Nous demandons à ceux ou celles qui le peuvent de soutenir ces enfants dans le besoin d’éducation, à travers cette campagne, de ne pas attendre le ‘Mardi je donne’ du 28 novembre 2023.

Ils/elles peuvent faire un don dès maintenant, car les besoins sont urgents et pressants.

Pour faire un don, veuillez contacter le CENFACS.

Main Development

• Festive Income Booster – In Focus for 2023 Edition: Financial Capacity and Capability – How to manage your financial affairs and make life-saving financial decisions

The following makes the contents for the 2023 Edition of Festive Income Booster (FIB):

∝ What the 2023 FIB resource is about

∝ Who the 2023 FIB resource is for

∝ Key Concepts

∝ Measuring Financial Capacity and Capability

∝ Main Highlights

∝ Resources and services to help the community build or develop financial capacity and capability

∝ What other highlights it covers

∝ What’s more?

∝ How to access this resource.

Let us now highlight these contents.

• • What the 2023 FIB Resource is about

It is about helping beneficiaries to…

√ Get tools to become financially able and capable

√ Access the support they need to better prepare their year-end celebrations

√ Become more resilient to financial stresses

√ Dissipate financial imbalances within household system of managing finances

√ Better manage financial risks and threats

√ Become capable of dealing with economic instability (like rising interest rates, skyrocketing inflation and soaring costs of living)

√ Correct the effects of the increase in the costs of essential spending and of living crisis caused by monetary or price instability

√ Take control of their financial health and well-being

√ Become aware of your financial limits

√ Establish financial capacity and capability report by the end of 2023

√ Understand that financial capacity and capability could be intergenerational

Etc.

• • Who the 2023 FIB Resource is for

Festive Income Boost is for Multi-dimensionally Income Poor Children, Young People and Families (MIPCYPFs) and it is designed to support them throughout the entire festive season and beyond. Amongst them are:

√ Financially incapacitated and incapable MIPCYPFs

√ Those without financial peace of mind and with financial stress levels above average

√ Those failing to well manage their money

√ The unable to plan and save for the future

√ The unprepared for the future and unexpected events

√ The elderly vulnerable to losing financial skills and judgement

√ The unable to detect and prevent financial exploitation

√ Those experiencing deteriorating financial conditions

√ Those without household cohesion and connection because of lack of financial capacity or capability

√ Those looking to improve their financial well-being and happiness

√ Those who need to build or develop their financial capacity and capability

√ Those working with financially incapable (e.g., unable to manage financial resources because mental illness, mental deficiency, physical illness or disability, chronic use of drugs or alcohol, etc.)

Etc.

• • Key Concepts

There are five key concepts or terms to help the users of the 2023 FIB resource.

These key concepts are: Capacity, Capability, Financial Capacity, Financial Capability and Mental Capacity Act.

(a) Capacity and Capability

The words capacity and capability are sometimes used interchangeably. In reality, they are quite not the same. According to Christine Tao (12),

“Capacity, defined in a physical sense, is the maximum amount that something can contain. It is finite in nature”.

The same Christine Tao argues that

“Capability, on the other hand, is defined as a person’s ability or potential to do something. It can be the skills or aptitude a person possesses. These can be learned and developed overtime”.

In real life, humans need both capacity and capability to function.

Knowing what capacity and capability mean, we can now link them to financial matters.

(b) Financial Capacity

The 2023 FIB resource takes its definition of financial capacity from ‘fincap.org.uk’ (13) which explains that

“Financial capacity is the ability to manage money well – both day-to-day and through significant life events like having a baby, getting divorced or moving home”.

According to the same ‘fincap.org.uk’,

“Being financially capable means you have the resilience to handle times when life is financially difficult – like when you lose your job unexpectedly or you can’t work due to illness”.

Marson et al (14) go further in explaining that

“Financial capacity involves not only performance skills (e.g., counting coins/currency accurately, completing a check register accurately, paying bills), but also judgement skills that optimise financial self-interest and promote independence, and values that guide personal financial choices”.

However, when looking at financial capacity between different generations, Monsa S. Botros et al. (15) quote Stiegel who argued in 2012 that

“Financial capacity in the elderly is a fundamental issue given older adults are vulnerable to losing both financial skills and judgement as well as the ability to detect and consequently prevent financial exploitation”.

In the context of the 2023 FIB resource, financial capacity is being viewed both as a specific instrumental activity and a sound value judgement enabling financial decision-making process on the one hand, and on the other one, as the cognitive psychological model in which financial capacity is treated as a set of financial abilities and skills needed for independent functioning.

(c) Financial Capability

In the 2023 FIB resource, the first meaning of financial capability comes from ‘youth.gov’ (16) which states that

“Financial capability is the capacity based on knowledge, skills, and access to manage financial resources effectively”.

The same ‘youth.gov’ adds that

“Financial capability is developed over time and is marked by stepping-stones-milestones – on the path to financial well-being”.

The website ‘responsiblefinance.worldbank.org’ (17), which takes a consumer-led view of financial capability, explains that

“Financial capability encompasses the knowledge, attitudes, skills, and behaviours of consumers with regard to managing their resources and understanding, selecting, and making use of financial service that fit their needs”.

(d) Mental Capacity Act 2005

The Mental Capacity Act 2005 is a UK law that provides a legal framework for acting and making decisions on behalf of adults who lack the capacity to make particular decisions for themselves. The law is thus designed to empower and protect those who may have lost capacity and are not able to make decisions for themselves. This law is up to date with all changes to be in force on or before 06 November 2023, according to ‘legislation.gov.uk’ (18)

The above five key terms or concepts and any others will be considered when one is trying to navigate their way through to build or develop financial capacity and capability.

• • Measuring Financial Capacity and Capability

Financial Capacity and Capability can be measured. Let us look at measures associated to each of these two concepts.

• • • Measures associated with Financial Capacity

Financial capacity can be measured using a variety of metrics.

For example, Angela R. Ghesquiere et al. (19) provides some measures of financial capacity which include financial assessment and capacity test, financial capacity instrument, financial competence inventory, measure for assessing awareness of financial skills, semi-structured clinical interview for financial capacity, etc.

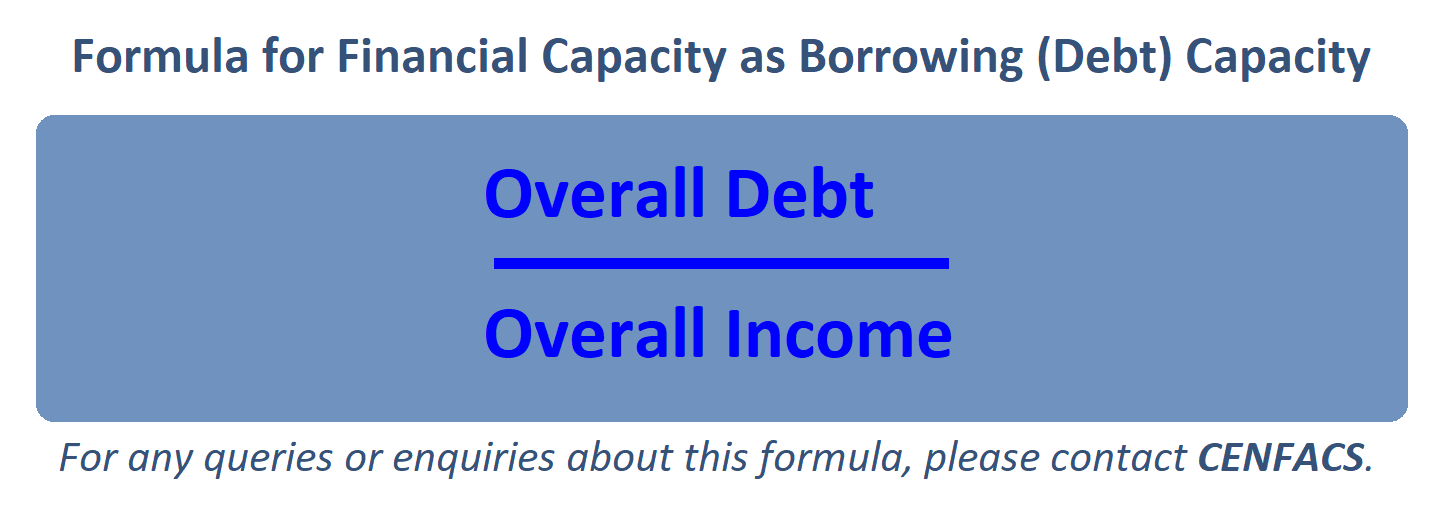

For those who are interested in debt or borrowing capacity, they can use metrics or ratios such as Debt-to-Income Ratio, Overall Debt divided by Overall Gross Income and so on.

For those who are instead focussing on a set of financial skills and tasks as financial capacity measures, they can consider financial skills like skills to budget, to make financial judgement, to make investment decisions, to manage e-money account, etc.

• • • Measures linked to Financial Capability

Financial Capability can also be measured.

For example, in its 2010 to 2012 Wealth and Assets Survey, the ‘ons.gov.uk’ (20) provided six dimensions of financial capability relating to making ends meet, planning ahead, organised money management, controlled spending, staying informed and choosing products.

In both cases of financial capacity and financial capability, it all depends on whether one uses financial measures or other ones (like medical-legal constructed measures).

• • Main Highlights

As the focus for this year’s edition is on Financial Capacity and Capability, the resource includes the following items:

∝ Tools to become financially able and capable

∝ How to take control of your financial well-being through financial capacity and capability programmes or projects or activities or even strategies

∝ How to create enough income to cover basic festive expenses (e.g., by avoiding impulse festive buying)

∝ How to apply the 50 30 20 rule when budgeting and the components of financial capacity

∝ How to enable yourself to pay debts over the festive period (e.g., by carrying out a debt-to-income analysis)

∝ How to build savings for emergencies or emergency funds to cover unexpected festive costs

∝ How to generate enough income while cutting unneeded expenses to cover basic festive costs

∝ How to invest in long-term financial capacity and capability goals

∝ End-of-the-year earning opportunities and openings to build and develop Financial Capacity and Financial Capability

∝ How to earn and save money in times of crises

∝ Online and offline opportunities from both essential and non-essential economic activities

∝ How to successfully remake Financial Capacity and Capability during the festive season

∝ Tips and hints to make savings by exercising your Financial Capacity and Capability.

For example, how can you improve your spending capacity and capability to avoid impulse buying during the festive season?

• • Resources and Services to Help the Community Build or Develop Financial Capacity and Capability

They include

√ Helping our members to make better financial judgement within real-life settings

√ Supporting those who need mental capacity assessment around finances

√ Making our members to understand that the ability to make financial decisions is a life-saving skill

√ Working with the community on the 3 key determinants of financial capability which are knowledge and understanding, skills and confidence and attitudes

√ Bridging Financial Information Gap (service)

√ Summer Financial Updates (resource)

√ Signposting beneficiaries to low-cost and free financial advice services

√ Zero Income Deficit Campaign

√ Financial data and insight advocacy (e.g., discuss a workable debt repayment plan with creditors)

√ Financial advice on how to create emergency or reserve fund, to set realistic financial capacity and capability goals and targets and so on

√ Working with our members to reinforce financial capacity with other types of capacity such as decisional capacity, understanding capacity, appreciation capacity, reasoning capacity, etc.

√ Help and support in terms of financial capacity and capability planning, budgeting, financial statistical literacy

Etc.

• • What Other Highlights It Covers

The resource covers some ways of dealing with the following:

√ Casual job interview questions (online, video calls and distance job interviews)

√ Seasonal job search techniques (for both online and offline searches)

√ Job search engines and leads

√ Guidance on job applications and CV

√ Reference building techniques

√ How to highlight your skills in your job application and or CV

√ Job adverts and alerts

√ Credit history or score

√ Diary of online job fairs and events

√ Job matching to person specification and profile

√ Online job fraud and employment agency scams

√ Details can potential employers ask and not ask as well as how they can ask them

√ What details to provide and not to provide in your job enquiries and when filling job applications

Etc.

It goes further in exploring e-skills as well as stages and steps that poor families can take to skill up themselves.

In addition, the resource covers security and protection matter when trying to develop Financial Capacity/Capability or generate a little extra income to make ends meet. In this respect, it deals again with the general data protection regulations, child protection and safeguarding issues as well as COVID-19 restrictions for jobs where these requirements apply.

The resource does not stop there as it includes online employment agency scams and job advert scams which sometimes has dramatically increased in today’s world and employment market as there are always unscrupulous players (scammers, spammers, hackers and fraudsters) on the market who try to take advantage of the poor and vulnerable people like MIPCYPFs.

• • What’s More?

The resource is packed with insights such as income statement, balance sheet. net worth asset value, etc. It finally reminds us of the areas of law or legal requirements in terms of whatever we do to try to develop Financial Capacity/Capability or raise additional household income to reduce poverty. We should always try to lawfully act and live within our means.

• • How to Access This Resource

The resource will be available as a booklet from CENFACS e-Store. It is normally free of charge, but we will appreciate a donation of £5 to help us help reduce poverty and the cost of renewing and producing this resource on an annual basis. As the side effects of cost-of-living continues and the resilience of voluntary sector is fading, we need financial help like many voluntary and charitable organisations do.

The 2023 FIB resource is a great way to start and set up yourself into 2024.

To order and or find out more about the Autumn ICDP resource, please contact CENFACS with your contact details.

_________

• References

(1) Park, C., (2011), Oxford Dictionary of Environment and Conservation, Oxford University Press, Oxford & New York

(2) www.earthsendangered.com/profile.asp?gr=1&view=c&ID=1&sp=14435 (accessed in November 2023)

(3) https://ukbutterflies.co.uk/webpage.php?mame=law (accessed in November 2023)

(4) https://www.fao.org/sustainable-forest-menagement/toolbox/moduels/forestry-responses-to-natural-and-human-conflict-disasters/tools/en/?type=111 (accessed in November 2023)

(5) https://byjus.com/maths/data-organisation/ (accessed in November 2023)

(6) https://trailhead.salesforce.com/content/learn/modules/einstein-discovery-basics/explore-insights-into-your-data (accessed in November 2023)

(7) Cote, C. (2021), What is Diagnostic Analytics? 4 Examples at https://online.hbs.edu/blog/post/diagnostic-analytics (accessed in November 2023)

(8) World Economic Forum (2023), Future of Jobs Report 2023: Insight Report May 2023 at https://www.weforum.org/reports/the-future-of-jobs-report-2023/ (accessed in September 2023)

(9) UNESCO (2023), Global Education Monitoring Report Summary 2023: Technology in Education: A tool on whose terms? Paris, UNESCO

(10) https://www.unicef.org/burkinafaso/en/press-releases/burkina-faso-new-academic-year-starts-one-million-children-out-school-due-ongoing# (accessed in October 2023)

(11) Wolf, A. at https://medium.com/@anu.garcha12/should-nature-be-monetized-646ff80f1e7b# (accessed in November 2023)

(12) Tao, C. (2022), Capacity Vs Capabilities: Why Organisations Should Invest In Both at https://forbes.com/sites/forbesbusinesscouncil/2022/03/09/capacity-vs-capabilities-why-organisations-should-invest-in-both/ (accessed in November 2023)

(13) https://www.fincap.org.uk/en/articles/what-is-financial-capacity (accessed in November 2023)

(14) Marson, D. C., Triebel, K. & Knight, A. (2012), Financial Capacity, In G. I. Demakis (Ed.), Civil capacities in clinical neuropsychology: Research findings and practical applications (pp. 39-68), OxfordUniversity Press

(15) Botros, M. S., Guzzardi, J. E. & Leong, G. B. (2020), Forensic and ethical issues (Chap. 26) in Handbook of Mental Health and Aging (Third Edition), Hantke, N., Etkin, A. & O’Hara, R. (Editors), pp. 423-436

(16) https://youth.gov/youth.topics/financial-capability-literacy# (accessed in November 2023)

(17) https://responsiblefinance.worldbank.org/en/responsible-finance/financial-capability (accessed in November 2023)

(18) https://www.legislation.gov.uk/ukpga/2005/9/contents (accessed in November 2023)

(19) Ghesquiere, A. R., McAfee, C. & Burnett, J. (2017), Measures of Financial Capacity: A Review, The Gerontological Society of America in Gerontologist, 2019, Vol. 59, No. 2,e109-e129, doi10.1093/geront/gnx045 (accessed in November 2023)

(20) https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomesand wealth/articles/financialcapabilityingreatbritain/2025-06-24 (accessed in November 2023)

_________

• Help CENFACS Keep the Poverty Relief Work Going this Year

We do our work on a very small budget and on a voluntary basis. Making a donation will show us you value our work and support CENFACS’ work, which is currently offered as a free service.

One could also consider a recurring donation to CENFACS in the future.

Additionally, we would like to inform you that planned gifting is always an option for giving at CENFACS. Likewise, CENFACS accepts matching gifts from companies running a gift-matching programme.

Donate to support CENFACS!

FOR ONLY £1, YOU CAN SUPPORT CENFACS AND CENFACS’ NOBLE CAUSES OF POVERTY REDUCTION.

JUST GO TO: Support Causes – (cenfacs.org.uk)

Thank you for visiting CENFACS website and reading this post.

Thank you as well to those who made or make comments about our weekly posts.

We look forward to receiving your regular visits and continuing support throughout 2023 and beyond.

With many thanks.